Abstract

This research empirically examines the factors affecting the intention to use FinTech applications during the pandemic situation. The convenient sampling of the research comprised 546 individual respondents from different cities in Pakistan. The research results indicate that perceived benefits and social influence have significantly affected the customer's intentions to use FinTech applications during the covid-19 pandemic. Customers' intentions to utilize FinTech apps are unaffected by perceived technology risks. Furthermore, the findings show that attitude influences the relationship between social influence and perceived consumer trust. To ensure confidence, FinTech service providers should make sure their solutions are simple to use, meet demands, and protect clients' data. This will favourably influence consumers' adoption

Key Words

FinTech Use, Perceived Risk, Social Influence, Perceived Benefits, Perceived Trust etc.

Introduction

Financial innovation enabled by technology could lead to new products. Intention to use is a word used in the innovation adoption terms of clarifying a participant's intention to apply future technology. This study depends on the consumer’s intentions to use financial technology apps during the pandemic. People are using mobile wallets and financial technology apps during the covid-19 pandemic situation. How does financial technology help people during this situation, and how many consumers' attract by the facility of FinTech adoption during this virus. This study finds how many people like to use financial technology in pandemic situations, applies the test to people, and collects their responses for analysis. Furthermore, UTAUT will one day be able to explain why so many people embrace or reject certain advances, as well as how emerging technologies may enhance acceptance and usage. We describe the impacts of mediation and moderation on consumers' intentions to utilize FinTech during Covid-19 in this study. The rise of OFDO services in Pakistan has been fuelled by the demographics and hunger of the youthful people. Despite the great potential, just 15% of Pakistanis chose to order meals via the internet. (Venkatesh et al., 2011) established UTAUT as a technology acceptance paradigm. The goal of the UTAUT is to explain how users want to use information systems, as well as how they use them. It is predicted that the coronavirus pandemic will destroy small businesses more than people. Given the importance of Enterprises, it is becoming increasingly important to assess the impact of Covid 19 on them and determine what steps may be taken to assist them in surviving. To investigate consumer behaviour toward OFDO services, researchers have used various theories. According to experts, a person's technological preparedness influences their buying inclinations. Technology readiness is defined as "people's willingness to adopt and employ new technologies to achieve goals in their personal lives and at work. Despite the crucial relevance of technological readiness in consumer behaviour research, there is currently a gap in the literature on this topic. The majority of firms in the United Kingdom may be classified as small based on the number of employees. Ninety-five per cent of businesses employ fewer than ten people, which is skewed in the opposite direction when compared to revenue and turnover. Entrepreneurs are the foundation of every business, whether that is the industry of a single state or the economy as a whole. When it comes to definitions, financial technology and Islamic FinTech have the same meaning. Banking institutions are the backbone of any financial system. This is accomplished by financial institutions providing loans, regulating markets, and sharing risk among individuals.

As a result of the covid-19 pandemic, people are suffering a wide range of concerns, including stick lockdown, social distances, market closures, and the closure of government and private services. Since as a result of the circumstance, GDP has been continuously dropping, as the task has become physically difficult owing to covid-19. The world's economy is still in disarray & becoming lesser healthier as businesses shut down, stores shut down, crossings closed, and individuals are being urged to remain at home. Employers, civic society organizations, The COVID-19 problem demonstrates how important digital money has become for low-income individuals and families in difficult socioeconomic situations. Many families and people throughout the world rely on money sent home from migrant workers overseas via international digital payment networks, and these transnational companies are addressing the requirements of the unbanked globally, and government agencies must work together to assist the impacted and save costs. Financial technology development remains difficult, and even more time and effort are required for main contributions and market acceptability, especially in retail financial institutions. In Financial technology breakthroughs, the problem of assessing potential advantages and dangers is exacerbated in developing economies. People with lower socioeconomic positions are less knowledgeable about management and profitability and are less inclined to seek financial advice. Wireless services, in particular, play a significant role in delivering financial institutions to the financially excluded in developing nations. However, just a few empirical pieces of research on the adoption and spread of Financial Technology have been undertaken. Fintech enables consumers to send money to every financial institution, pay bills, and get services from merchants and companies in any area of the country and across the country. While resources are restricted or have been used before the pandemic, it is necessary to study how financial technology has impacted the human lifestyle of Pakistani people during the covid-19 epidemic. Even though the number of people killed and infected with COVID-19 is largely from the world's largest and most industrialized nations, such as the United States, Germany, France, Poland, India, China, and the United Kingdom, the number of targeted people is growing by every minute. The COVID-19 outbreak turned into a truly global calamity, affecting practically every country on the planet. The world economy was ultimately wrought havoc by the COVID-19 crisis. The link between regulatory quality and financial inclusion outcomes is examined, and it is discovered that nations with good regulatory quality have a large proportion of account owners in some form. FinTech can give the safest means to transmit money to loved ones straight from smartphones, while COVID-19 is driving several countries to fall into lockdown. It is likely the safest, cheapest, and most expedient option to send money to loved ones during a health crisis. FinTech allows consumers to send money to any bank account, pay bills, and get services from merchants and companies in any area of the country or across borders. Financial technology may also be used to provide a framework for embracing and utilizing technological potential to increase transaction, account access, and utilization. Individuals in urban areas can pay bills once such a structure is in place. During the crisis, poor people and families must have faith in FinTech platforms. Along with security, FinTech companies should emphasize increased openness and, as a result, there will be confidence in their operations. Increasing openness by itself will not result in increased trust. Trust cannot be built only based on communication. Contextual variables play a big role in a customer's decision to buy anything online.

Our study checks the customer's intention to use financial technology during the pandemic of covid-19 means that our study explores the understanding of financial technologies in our life, and it will also defend the usages and advantages of financial technology applications in life. On the other hand, our study or research is limited to online concerns, which are done through applications on your own. Financial technology focuses on the use of technology from a financial perspective to help make easy transactions or, in other words, make easy payments and receipts. It comes with a change in growing acceptance and requirements. It also is aimed and how much time will be saved for people after using it. Following are the research objectives of the study:

Research Objectives

I. To investigate the social influences, perceived risk, and perceived benefit of Use intention through the mediation of perceived trust.

II. To investigate the moderating influences of attitude on the relationships between social influences, perceived risk, perceived benefit, and perceived trust.

Literature

FinTech is a type of knowledge innovation that

compete with outdated financial methods after it derives from the supply of monetary facilities. It was a new industry with a $127.66 billion market size in 2018; the worldwide financial technology marketplace was estimated at $127.66 billion. With a forecast for an annual growth degree of 25% till 2022, the market is expected to reach $309.98 billion. In comparison to the worldwide financial services market, it is still quite modest. The substantial speculation in technology-based answers by banks and industries is a key element in the financial technology marketplace's growth. Pakistani FinTech startups Pakistan's Most Prominent FinTech Companies TPS With customers in Europe, South Asia, Africa, and the Middle East. TPS is a global provider of cards and payment solutions. AutoSoft Dynamics is a company that specializes in software development. Tez. Avanza Solutions. Mawazna. Finja. CreditFix. JazzCash. Tez. Avanza Solutions. Mawazna. Finja. CreditFix is also of the same nature.

Intention of usage

According to the literature on technology acceptance, an intention to use displays a consumer's desire to employ skills know the future. Because an intention to use technology ensures stayed demonstration to a reliable forecaster of real equipment custom, it was used as the outcome variable in this learning. The TAM & UTAUT both strive to improve understanding of why consumers admit or discard certain technologies, as well as in what way consumers' approval can enhance determined skill projects (Jackson et al., 1997).

Social influences

The procedure by which the occurrence or action of others impacts a personality's assertiveness, outlooks, or action is referred to as social influences. Conventionally, obedience and compliance and underground inspiration are the four regions of social influence. Persons adapt their comportment to contest the requirements of a social context, which is stated as social influences. Conformity, aristocrat pressure, compliance, socialization, management, encouragement, deals, and promotions were all examples conventionally. People consent to influence their thinking for a variety of reasons. The single reason on behalf of this is that we commonly familiarize ourselves with groups and norms in demand to attain agreement from its memberships. Moreover, group conformism leads to a civilization's sense of belonging(Fulk et al., 1990).

Perceived Risk

Popular individual decisions regarding the features and then the harshness of a hazard are mentioned as risk acuity. Because they stay unfair via a wide range of affective, mental, conservational, and specific reasons, danger perceptions fluctuate for real hazards. Perceived risk refers to a buyer's uncertainty while acquiring items, particularly that one that is highly expensive, such as cars, homes, and processers. Each customer contemplates procurement of something; he or she has suspicions, especially if the item is costly. In the situation of material arrangements, the adoption of material technology (IT) or information system services is hampered by a poor perception of risk. When it comes to FinTech, consumers' perceptions of risk are crucial. Popularly the use and invention of espousal schoolwork, this term mentions the professed perils allied with products or services (Im et al., 2008). The subjective uncertainty of "winning" or "losing" all or part of the stake amount is known as perceived risk. As a result, perceived risk is definite, for example, "purchasers' perception of susceptibility and then the potentially damaging effects of FinTech."

Perceived Benefits

FinTech (financial technology) stands for the usage of slashing skills towards offering a wide choice of economic products and amenities. Its goal is to make multichannel, easy, quick, and more accessible to consumers. FinTech has the potential to impact the finance sector in several ways, including enhancing competition, empowering customers, democratizing admittance to monetary facilities, particularly in emerging nations, and, as a result, spurring more innovation(Manrai & Gupta, 2020).

Perceived Trust

Since the intrinsic decision and risk in financial technology transactions, trust is rather more important than today's traditional E-commerce and E-banking dealings. According to previous studies, trust plays two roles in financial connections. First and foremost, confidence is essential for tracking consumers' behaviour. Users with high expectations for successful transactions, according to Kim et al., will use services with high satisfaction rates are all examples of digital services. Trust can favourably modify consumer intentions (Liu & Tu, 2021). FinTech companies can retain all current users while meeting customers' expectations only when they provide a secure environment where users feel safe and confident in their transactions. Secondly, in an unstable context, trust can help to reduce uncertainty and risk. Past studies have shown trust can help alleviate hazards in E-commerce, online banking, mobile shopping, mobile finances, and mobile disbursements (Ituma et al., 2021). Financial transaction trust, in specific, contains reduced discretion and safety issues, as growing as per the risks linked through FinTech suppliers' adaptable activity.

Attitude (ATT)

Together Perceived utility and Perceived simplicity of Uses are considered by the general population. A person's, thing's, or scenario's attitude is a manner of feeling acting toward them. It stands essential to motivate potential users that the new technology is easy to use and that they will gain profit from utilizing it. In financial services, an attitude is a method of feeling or acting by a Person, a Thing before a condition (Tan, 2013). An Attitude is defined as enthusiasm for a sport, distaste for a particular performer, or pessimism toward life in general.

Relationship of social influence and intention to usage

Social Influence is The Process through which

Individuals alter their behaviour to fit the expectations of a cultural setting. It manifests itself in a variety of ways, including Conformity, Socialization, Peer Pressure, Obedience, Leadership, Persuasion, Sales, and Marketing. In the Technology Acceptance Literature, intent to use is described as a seer's desire to utilize technology in the Future(Shen et al., 2011). The Intention to Use Technology stood selected as the concluded variable now. Since its’ devours stood shown toward unswerving forecaster of definite knowledge tradition.

Relationship of perceived risk and intention to usage

However, there is no statistical significance in the relationship between perceived risk and usage intention. It takes a detrimental effect on the approval of info skills (IT) or information system utilities. When it comes to FinTech, consumers' perceptions are important. In The utilization and Innovation Adoption Study, this terminology refers to the perceived risks associated with products or services. The intention to use tools be stricter to use as the study conclusions' variable since it's been shown to be a dependable interpreter of real technology uses (Lu et al., 2005).

Relationship of Perceived Benefits and intention to usage

H2 is reinforced by the fact that the Perceived Benefits have an affirmative and substantial relation to usage intention (= 0.605; p0.05). The usage of new technology to Deliver a Wide Range of Financial Products And Services is known as financial technology (also known as FinTech). Fintech does have the potential to affect the financial industry in various ways, including increasing competition, empowering customers, democratizing contact with financial facilities, particularly in emerging nations, and encouraging further innovation. Intention to use supports an operator's desire to utilize technology (Liu et al., 2012).

Relationship of Perceived Trust and intention to usage

Since of the inherent indecision besides danger in

Fintech communications, trust is more important in Fintech transactions (= 0.21; p 0.05) than trendy outmoded E-commerce and E-banking communications. According to prior studies, trust serves two objectives in financial transactions. According to Hwang and Kim (2007), operators with High Expectations for Successful Transactions will Use Services with High Satisfaction Rates. Belief may stimulate consumer intents in the variability of numerical facility Situations, including E-commerce, Internet Banking, Online Social Networks, Mobile Shopping, Mobile Banking, and Mobile Payments. Intention to use, according to the literature on technology acceptance, reflects a user's intention to use technology in the future (Pai et al., 2018).

Relationship of Attitudes and intention to usage

The together perceived utility, then perceived simplicity of use inspire attitudes. An outlook stands method Of feeling or behaving towards a Person, Thing, or circumstance. It is important to persuade Potential Users that The New Technology remains simple near use and that they would profit from adopting it. In finance, an Attitude is a manner of Feeling or Acting toward a person, thing, and situation. An attitude can be defined as enthusiasm for a sport, hatred for a particular performer, or pessimism toward life in general. An intention to use is a term used in the technology acceptance literature to describe a user's desire to utilize technology in the future. The intention to use technology was chosen as the study's outcome variable since its returns have been proven to be a good predictor of real skill use (Liu et al., 2012).

Many consumer products and services have laid great emphasis here on adoption rate and adoption. As a response, technological improvements have led consumers to utilize an increase in the number of portable devices. Since the advent of credit and debit cards, consumers have relied on non-cash payment options such as withdrawal cards.

The mobile wallet has been one of the methods employed. As a function, mobile payment methods have given a flexible network of easy and practical services. Mobile payment refers to a type of payment that occurs on a smartphone. Users' smartphones must also be connected with a mobile wallet that enables individuals to store money and achieve virtual connections automatically.

Methodology

The study was quantitative. Individuals with an understanding and knowledge of FinTech were our respondents. An online survey was built based on a thorough review of the literature. The survey comprised two parts: demographics and measurement items, which were assessed on a five-point Likert scale ranging from "strongly disagree" to "strongly agree" on a five-point Likert scale. The survey was completed in English. Because of the lockdown constraints, the poll was delivered over six months in several Pakistani cities using various social media sites like Emails, WhatsApp groups, Facebook groups, and some other ways to use the circulation of the questionnaire in the different cities for the collection of responses.

A total of 546 responses with the help of convenience sampling were received, all of which were engaged and judged complete. Microsoft Excel 2010 and SPSS 26 were used to analyze the survey data. Using Excel and SPSS, the data was initially coded and inspected for probable outliers. Any study's research design establishes a framework for data collecting and analysis, as well as revealing the nature of the study and the researcher's goals. It's a comprehensive framework that lays out the methods and procedures for gathering and analyzing data for a particular study. As a result, determining whether a research design is appropriate is a crucial step toward achieving a research goal. (Venkatesh et al., 2011) provided the scales for the UTAUT components (performance expectancy, effort expectancy, social influence, enabling conditions, and behavioural intention).

Hypothesis

? Social Influence has a significant positive Relationship with User intentions, and perceived trust mediates the relationship.

? Perceived benefits have a significant positive Relationship with User intentions, and perceived trust mediates the relationship.

? Perceived risks have positive Relations with User intentions, and perceived trust mediates the relationship.

? Attitude moderates the relation between social intention and perceived trust.

? Attitude moderates the relation between perceived benefits and perceived trust

Results

The first demographic is gender, which

means that in total, 546 responses, the male is 383 responses (70.1 per cent)

and females 163 responses (29.9 per cent) recorded. Age is another demographic

title which responses divided into age categories first one the age

between18-25 year peoples 267 responses recorded (48.9 per cent) and other one

26-35 aged 242 (44.3 per cent), 36-45 are 32 response it comes (5.9) per cent

and carry on that same. Academic qualification is divided into 7 categories,

the first one being primary to the last one PhD, so every respondent your

education end then answering. Respondent has a bank account holder or not its

important information on behalf of financial technology researchers, in which

answer yes or no.

Table 1. Construct

Reliability and Validity

|

Cronbach's Alpha |

rho_A |

Composite Reliability |

Average Variance Extracted (AVE) |

|

|

Attitude |

0.865 |

0.866 |

0.918 |

0.788 |

|

PB*AT |

1.000 |

1.000 |

1.000 |

1.000 |

|

PR*AT |

1.000 |

1.000 |

1.000 |

1.000 |

|

Perceived Benefits |

0.900 |

0.901 |

0.926 |

0.715 |

|

Perceived Risk |

0.842 |

0.847 |

0.894 |

0.678 |

|

Perceived Trust |

0.892 |

0.892 |

0.920 |

0.698 |

|

SI*AT |

1.000 |

1.000 |

1.000 |

1.000 |

|

Social Influence |

0.880 |

0.880 |

0.926 |

0.806 |

|

Usage Intention |

0.894 |

0.894 |

0.926 |

0.759 |

Source: SmartPLS 3.3.3

Reliability for all the variables is above the threshold, and the Average variance extracted is also above the required value. This shows that the data is ready for further analysis.

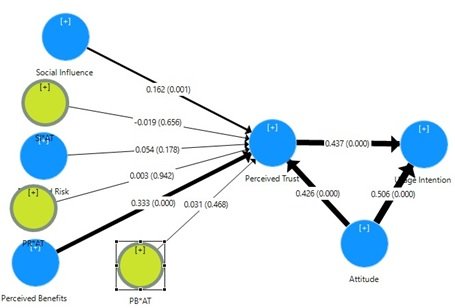

Figure 1

Table 2

Mean, STDEV, T-Values, P-Values

|

|

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

T Statistics (|O/STDEV|) |

P Values |

|

Attitude -> Perceived Trust |

0.426 |

0.426 |

0.048 |

8.802 |

0.000 |

|

Attitude -> Usage Intention |

0.506 |

0.506 |

0.046 |

11.087 |

0.000 |

|

PB*AT -> Perceived Trust |

0.031 |

0.032 |

0.043 |

0.727 |

0.468 |

|

PR*AT -> Perceived Trust |

0.003 |

0.008 |

0.038 |

0.073 |

0.942 |

|

Perceived Benefits

-> Perceived Trust |

0.333 |

0.333 |

0.058 |

5.730 |

0.000 |

|

Perceived Risk -> Perceived Trust |

0.054 |

0.053 |

0.040 |

1.349 |

0.178 |

|

Perceived Trust -> Usage Intention |

0.437 |

0.438 |

0.043 |

10.214 |

0.000 |

|

SI*AT -> Perceived Trust |

-0.019 |

-0.025 |

0.044 |

0.446 |

0.656 |

|

Social Influence

-> Perceived Trust |

0.162 |

0.162 |

0.046 |

3.497 |

0.001 |

Conclusion

The intention to use FinTech applications was investigated using a modified version of the UTAUT theory. The findings of the study emphasize the importance of consumer trust in FinTech applications for crisis resilience. The survey collected 546 valid forms from users, which were utilized to test the research model and hypotheses. The important characteristics that influence customers' willingness to adopt FinTech applications have been discovered and scientifically tested.

This research also looked into whether or not the perceived customers' trust and intentions to use with moderation affect attitude. In this research, a collection of a bundle of financial technology users like Jazz cash users, Omni users, Standard charted, auto soft, Meezan bank, Ufone, connect, fonepay, Telenor, creditFIX etc., all of the responses collected by google form online because physically responses collection not possible during the pandemic situation and it's also be made by the help of moderate variables attitude.

In this research, a collection of this chapter presents the study's findings and debates to respond to the study's research questions. The present study investigated the moderation effects on the dependent variable customer's intentions to use fintech application, which means that the moderated variable effect the customer’s intention to use. Our evaluation and synthesis show that some work has been done to advance UT AUT. Despite these contributions, the majority of published research has only looked at a subset of the UT AUT components. The expansions, especially the incorporation of new constructions, have helped to broaden UT AUT's theoretical boundaries. However, constructs have been added on an ad hoc basis without a thorough theoretical analysis of the context being investigated, and the works have not necessarily sought to pick conceptually complementary processes to what is already recorded in UT AUT on a progressing premise. It did not adhere to or prolong UT AUT on adoption. Our evaluation and synthesis show that some work has been done to advance UT AUT. Despite these contributions, the majority of published research has only looked at a subset of the UT AUT components. The whole first three are provided with the necessary user intent and behaviour, whereas the fourth is a predictor of user behaviour. The study's statistical findings revealed that the perceived benefits had been positively affecting the perceived customer's trust and intention to use. On the other hand, the perceived risks have been negatively affecting the relationship between customers' trust and usage intention of customers with the help of supposed variable attitude, and the social influence is a positive impact on the relationship between usage intentions and the perceived customer's trust. Most of the respondents to my questionnaire are younger aged are 67percent in aged between 18 to 30 years of responses. The findings also demonstrated that the respondents' gender and age significantly and positively impacted their intention to use (Hwang & Kim, 2007). It is predicted that the coronavirus pandemic will destroy more small businesses than people. Given the importance of Enterprises, it is becoming increasingly important to assess the impact of Covid 19 on them and determine what steps may be taken to assist them in surviving. To investigate consumer behaviour toward OFDO services, researchers have used various theories.

References

- Fulk, J., SChmitz, J., & Steinfield, C. (1990). A Social Influence Model of Technology use. Organizations and Communication Technology, 117–140.

- Hwang, Y., & Kim, D. J. (2007). Customer self- service systems: The effects of perceived Web quality with service contents on enjoyment, anxiety, and e-trust. Decision Support Systems, 43(3), 746–760.

- Im, I., Kim, Y., & Han, H. J. (2008). The effects of perceived risk and technology type on users’ acceptance of technologies. Information & Management, 45(1), 1–9.

- Ituma, A. I., Riaz, A., & Ali, M. H. (2021). EXAMINATION OF DIGITAL AND NON-DIGITAL FACTORS ON PERCEPTION OF MOBILE BANKING CUSTOMERS: A CASE OF DEVELOPING ECONOMY. DECEMBER, 37(04), 388– 399.

- Jackson, C. M., Chow, S., & Leitch, R. A. (1997). Toward an Understanding of the Behavioral Intention to Use an Information System. Decision Sciences, 28(2), 357–389.

- Liu, D., & Tu, W. (2021). Factors influencing consumers’ adoptions of biometric recognition payment devices: combination of initial trust and UTAUT model. International Journal of Mobile Communications, 19(3), 345.

- Liu, M., Chu, R., Wong, I. A., Angel Zúñiga, M., Meng, Y., & Pang, C. (2012). Exploring the relationship among affective loyalty, perceived benefits, attitude, and intention touse coâ€branded products. Asia Pacific Journal of Marketing and Logistics, 24(4), 561–582.

Cite this article

-

APA : Ashfaq, K., Riaz, A., & Haider, U. (2022). Is FinTech a Savior in COVID-19? Evidence from an Emerging Economy. Global Social Sciences Review, VII(II), 285-294. https://doi.org/10.31703/gssr.2022(VII-II).29

-

CHICAGO : Ashfaq, Khurram, Adil Riaz, and Usman Haider. 2022. "Is FinTech a Savior in COVID-19? Evidence from an Emerging Economy." Global Social Sciences Review, VII (II): 285-294 doi: 10.31703/gssr.2022(VII-II).29

-

HARVARD : ASHFAQ, K., RIAZ, A. & HAIDER, U. 2022. Is FinTech a Savior in COVID-19? Evidence from an Emerging Economy. Global Social Sciences Review, VII, 285-294.

-

MHRA : Ashfaq, Khurram, Adil Riaz, and Usman Haider. 2022. "Is FinTech a Savior in COVID-19? Evidence from an Emerging Economy." Global Social Sciences Review, VII: 285-294

-

MLA : Ashfaq, Khurram, Adil Riaz, and Usman Haider. "Is FinTech a Savior in COVID-19? Evidence from an Emerging Economy." Global Social Sciences Review, VII.II (2022): 285-294 Print.

-

OXFORD : Ashfaq, Khurram, Riaz, Adil, and Haider, Usman (2022), "Is FinTech a Savior in COVID-19? Evidence from an Emerging Economy", Global Social Sciences Review, VII (II), 285-294

-

TURABIAN : Ashfaq, Khurram, Adil Riaz, and Usman Haider. "Is FinTech a Savior in COVID-19? Evidence from an Emerging Economy." Global Social Sciences Review VII, no. II (2022): 285-294. https://doi.org/10.31703/gssr.2022(VII-II).29