Abstract

The aim of the current study is to inspect the intervention of customer satisfaction in the association between service quality and corporate image to customer loyalty in the Pakistan banking sector. The population of this research is banking customers and a sample size of 210 respondents. This study uses the SPSS, Correlation, ANOVA and regression analysis techniques along with AMOS methods. The results of the study show that service quality and corporate image of the banks are not associated with customer loyalty, but this association is possible due to customer loyalty. This study shows that banks must focus on customer satisfaction to engage customer loyalty. CL is only achieved through customer satisfaction. The Pakistani banking sector, therefore, improves customer satisfaction, so the association between service quality, corporate image and customer loyalty must be enhanced.

Key Words

Customer Loyalty, Customer Satisfaction, Corporate Image, Service Quality

Introduction

Achieving CL has long been an issue for organizations and brands. To learn about the benefits, we need to comprehend the idea of customer loyalty first. The second is to figure out the context through which we will see customer loyalty. Finally, some questions regarding the antecedents that may or may not affect customer loyalty and the mediating variable. Can we enhance customer loyalty through the mediating variable, or is it feasible to enhance customer loyalty without the mediating variable? Minimizing the cost of the organization and maximizing the profits through customer retention is the goal we will discuss through the variables and antecedents selected for the thesis.

After years of extensive research to improve customer loyalty, customer satisfaction remains the top driver out of all other variables being tested (Chandrashekaran et al., 2007). Service plays an important role in creating customer loyalty by bestowing quality service to its customers and promoting Customer Relationship Management (Juanamasta, I.G., et al., 2019). Satisfied customers feast helpful WOM (word of mouth), endorse the services to others and are highly prone to repurchase these services (Cronin Jr & Taylor, 1992). Any complications faced by a company can create a bad image as well as fewer levels of customer loyalty (Amanto, Umanailo, Wulandari, Taufik, & Susiati, 2019). According to (Kristensen, Martensen, & Gronholdt, 2000). CI (corporate image) is the strongest precursor to CL (customer loyalty) and the second most powerful precursor that affects CS (customer satisfaction). Research has revealed that service quality is also one of the significant factors when it comes to CS and CL.

In our research, we choose the banking sector of Pakistan. We will test what effects the SQ (service quality) and CI have on the CL directly and through a mediating variable of CS as well. The question is whether to satisfy the customer in order to make him/her loyal or directly apply the determinants of SQ and CI to achieve CL.

Banks are monetary organization that allows for deposits and uses those deposits for loaning exercises, a way to pump blood to the economy. A bank is an institution where customers with a deficit are met with customers with a surplus. Banks have a great impact mainly due to the credit facility given to organizations and the government. This requires productive management of these accounts can benefit the financial development of the country.

Extensive research has been done due to the significance of the banking sector overall, and this brings us to a point where research in the Pakistan banking sector is necessary. The recent recession and the COVID-19 have affected organizations and individual investors as well. In turn, the banks need to come up with a way to provide excellent service to boost business again. Hence we look into the service quality and CI of the banks to boost CL with and without CS from a Pakistani perspective.

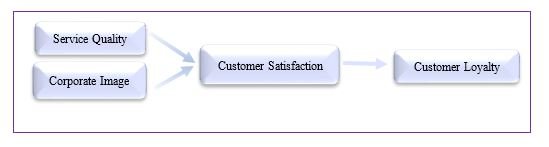

Figure 1

Source: Elaborated by the authors based on Sumartik et al., Aslam et al., 2022; Eshghi et al., 2007; Gan, Clemes, Wei, & Kao, 2011.

The research is analytical and co-relational in the countryside, and its determination is to trial the hypothesis relating to the connections among CI, SQ, CS and CL. The investigator is also interested in checking the influence of variables with CL on mediating effect of CS. The time perspective of this research is cross-sectional.

This is a field study in which the extent of researcher interferences is minimal, and study settings are non-contrived (the study is invariably conducted in natural settings). The survey is passed out complete the circulation of a self-administered survey to consumers of particular banks. Assurance is given to the respondents that their information will be kept confidential. The respondents of the survey complete the survey questionnaire and hand it over to the conductor after completion.

To help the researcher accomplish this study, the following research questions will help:

1. What are the factors that influence CL in Pakistan's banking sectors?

2. What is an association among factors that affect CL in Pakistan banking?

3. How to shape the CL in Pakistan banks?

The analyst needs to discover the impact of elements on the behaviour of customers in the banking sectors of Pakistan. The researcher will find the relationship among various components that influence customer awareness, that is, CS, CI, SQ and CL.

Moreover, this research examination identifies the impact of components on each other. The researcher will find the relationship among various components that influence customer loyalty, that is, customer satisfaction. Hence, the authentic research study to find these kinds of relationships is the casual research study(Anantharanthan et al., 1991).

Literature Review

Customer Loyalty

"CL is when customers have the impression of reliable trust also, an inordinate impression of the store's workers, products, or services" (T. Jones, 1995). CL can be grouped into two categories: Long term loyalty and short-term loyalty. Long-term loyalty means that the customer will go back to repurchase the product or services from the first service provider and will not change for a longer period of time. At the same time, short-term loyalty is the repurchasing of the services from the service provider until the customer finds a better option and the opinion changes. Long-term CL will bring greater benefits to the organization. (T. Jones, 1995)

CL is the customer’s relationship to a product, facility, image or organization (Morgan & Hunt, 1994). Loyalty is an idea of a relationship duty, which is then communicated through an association with the organization (Morgan & Hunt, 1994). To increase competitive advantage, service providers utilize CL (Woodruff, 1997). The connection between a customer's opinion of value, CS and CL has been discussed in various sectors of the service industry (Cronin, 2002; Choi, 2003; Chen, 2010)

CL is immensely important for both customers and the organization. A loyal customer that repurchases the services adds to the organization's worth, and from the customers' perspective, it saves a lot of time and effort in decision-making choices (Kleinaltenkamp, Ehret, Hunt, Arnett, & Madhavaram, 2006). A loyal customer costs much less than acquiring a customer base through advertisement (Rowley, 2005).

Managing a reliable customer base is very troublesome as the customers are always looking for substitutes (Kleinaltenkamp et al., 2006). The research to date only considers CL as an antecedent related to customers only whereas, leaving behind the mental importance of dependability. CL is usually shaped by the social network such as family members, friends and so forth for a specific brand. Loyalty includes some mental procedures that a customer makes given the alternative services available and checking the criteria before making a purchase (Beerli, Martin, & Quintana, 2004).

The best definition of CL is to stay committed to repurchasing a favoured product/service, in spite of the situational impacts and marketing efforts that have the capacity to change behaviours (Oliver, 1999). Loyalty should have a positive impact both on the organizational level and at the customer level as well (Park & Bai, 2006; Yeung & Ennew, 2000). The most basic assumption of loyalty marketing is that a little increment in regular customers can increase critical gainfulness for the organization. ( Reichheld, 1992; Reichheld & Sasser, 1990).

Customer Satisfaction and Loyalty

CS refers to the condition of a consumer when he receives the desired performance from that product (Gustafsson, Johnson, & Roos, 2005). CS is the feeling of happiness or unhappiness deriving from the expectation he or she has set regarding the product or service received ( Kotler Philip & Kevin Lane Keller, 2006). If the product/service provides a satisfactory result as per the customers' expectations, then he/she is considered to be happy, and if a product provides more than expected results, the customer is said to be in an overjoyed or delightful condition (Muturi, Jackline Sagwe, Kipkirong Tarus, & Rabach, 2013). CS is said to be an assessment regarding the product/service that is purchased or consumed, and it leads towards CL that creates a long-lasting relationship until or unless something bad happens (Kaura, 2013).

Investigator has established that customer satisfaction is a strong antecedent of CL (Hoq & Muslim, 2010). A satisfied customer spreads the positive WOM and recommends the service to others as well as keeps repurchasing the identical service from the same service provider (Reichheld & Schefter, 2000). Literature has shown that in the service industry, CS is the key indicator of CL (Eshghi, Haughton, & Topi, 2007). "It is recommended that banking system framework has been exchanged from conventional banking to propel keeping money (propel saving money mean electronic saving money). Banks are attempting to get the upper hand and consumer satisfaction as we realize that the most usual utilization of portable is correspondence. Bankers utilize the M-keeping money to complete the banking money exchange on portable(Saleem & Rashid, 2011)”.

It is proposed that the upgradation of customer experience can lead to CS (Klaus, Gorgoglione, Buonamassa, Panniello, & Nguyen, 2013). CS is to keep in mind the customer's desire with the facilities as long as by the bank. If the association with the group is adaptable and can change with changing conditions, then the organization with its adaptable leadership style can provide CS. In different words, we can state that the hierarchical component enormously influences customer satisfaction ( Saleem & Rashid, 2011).

It is said that innovative products/services influence the CS level. If a bank representative fails to communicate these innovative features to the customer, then the CS level will diminish. Financial stability is the most imperative variable that customers pick in the Pakistani banking system framework, yet the most important thing that pulls back customers is the SQ and not the financial stability (Javed, 2005). Hence we can assume that consumer satisfaction urges the bank to enhance its SQ through its effective administration (Gan, Clemes, Wei, & Kao, 2011). In the Pakistani banking system, customers are grouped by nature and area (Javed, 2005). Looking at the above arguments, we can say that CL can be achieved in the banking sector of Pakistan through CS by giving high value to customers.

H1: CS has a positive association with CL

SQ, CS and Loyalty

From the very beginning, the concept of SQ (SQ) is attached to product value. The standing of preserving and ornamental the product and services according to customers' demand is undeniable for industries (Leventhal & Zineldin, 2006). From the customer's perspective, the term SQ is used for an assessment (Oliver & Bearden, 1985). The standard of quality according to the customers' expectations is what they receive about the product against what they receive (A Parasuraman et al., 1985). If the product/service exceeds their expectations, it is a superior product, and the customer is satisfied, and if it doesn't meet the expectations, the customer is not satisfied, and the product is deemed inferior (A Parasuraman et al., 1985). So to satisfy the customer, the manager needs to understand and provide superior quality and value as per the customers' expectations which in turn will affect the SQ (A Parasuraman et al., 1985). Factors such as SQ, BI and PV has a positive influence on outpatient loyalty in China's private dental clinic (Lin W, Yin W, 2022)

Factors which affect the SQ are included access, reliability, supplier attitude and behaviour and consumers' characteristics etc. (Wall & Berry, 2007). SQ plays a vital role when it comes to service-oriented organizations (Leventhal & Zineldin, 2006). Studies have shown that SQ has a positive effect on CL (Lewis & Soureli, 2006; Lin & Sun, 2009). Previous studies have also shown that several factors that impact CS and CL in the banking sector are satisfaction, market conditions, willingness to respond and more value in a particular product (Pont & McQuilken, 2005).

“SQ explains practices displayed by forefront representatives when interfacing with customers to address their needs and interests, for example, giving versatile and innovative administration and being benevolent, useful, and mindful to customers(Liao & Chuang, 2004). Literature suggests that to measure SQ, there are two key issues to tend to, first is the operationalization of the SQ build (Abdullah, 2006; Brady, Cronin, & Brand, 2002) and secondly, the distinguishing proof of suitable service measurement scales (G.-D. Kang & James, 2004).

The SERVQUAL scale and its adjustments have been generally utilized as a part of different services, for example, "banking, retail, wholesale, health and education" (Narang, 2012). It is depicted that benefit quality "as a type of demeanour, related however not proportional to satisfaction, and results from the correlation of desires with the impression of execution" (Parasuraman et al., 1988). Connected to the higher instructive context, SQ can accordingly be characterized as "the contrast between what an understudy hopes to get and his/her view of real conveyance" (O’Neill & Palmer, 2004). From the above-mentioned arguments, CL and CS can be achieved through SQ, so the following hypothesis is proposed:

H2: SQ has a significant positive relationship with CL.

H3: Loyalty CS mediates the relationship between SQ and CL.

CI, CS and Loyalty

CI is a positive or negative feeling which brought up in the mind of the customer, stored as a memory accounting for experience, behaviours and feelings regarding that particular organization when he/she heard the name of that organization (Jo Hatch & Schultz, 2003). CI is an image which leaves its impression in the shape of "gestalt" in the mind of the customer (Golden & Zimmer, 1988). CI can vary in the customers' mindset from organization to organization (Kotler & Fox, 1995). Organizations have different images in different customer perceptions (Dowling, 1988) as the SQ is referred to as a physical, corporate and interactive quality (Lehtinen & Lehtinen, 1982) that is set in the customers' minds as an image.

CI is described in two components, functional and emotional, which are tangible & feelings, beliefs and attitudes respectively towards an organization (Kandampully & Hu, 2007). CI is considered to be as company activities, company name, brand name, building structure, size of company and location etc. (Mohd Suki, 2016). Research has shown that CL and CS are highly positively impacted by CI (Chen, 2010). CI is an important antecedent of CL (Martensen et al, 2000). Furthermore, Aslam et al. (2022) stated that CI is the most important factor for CL in the Islamic banking sector.

CI is the general impression in the minds of the customer about the organization (Barich & Kotler, 1991). CI are the emotions and beliefs about the organization in the customers' mindset as conceptualized by (Shee & Abratt, 1989). CI also impacts customers' decision-making process and practices through alternative mental routes when preparing purchase information (Kotler & Gertner, 2002). The above information is identified with the business name, the assortment of products/services, traditions, company culture, and belief system, which all contribute to the quality conveyed by every employee interaction with the company's customers. (Nguyen & Leblanc, 2002).

As shown by the friendly personality hypothesis, individuals relate to associations that they recognize as predominant, believing that they will, in this way, show up more viable to others (Hogg and Terry, 2000). associations with a common picture can assemble clients' assumptions to use the service(Wu, Yeh, and Woodside, 2014) and draw in clients than associations with a more unfortunate image (Gatewood, Gowan & Lautenschlager, 1993; Turban & Cable, 2003). From the previously mentioned contentions, CL and CS can be accomplished in financial areas through CI, so the following hypotheses are proposed:

H4: CI has a significant positive association with CL

H5: CS mediates the relationship between CI and CL

Research Methodology

The researcher used a questionnaire survey method for this research study, and the research is based on CL enhancement in banking sectors of Pakistan; that is why the researcher collected data from different banks like Allied Bank Ltd. (ABL) and Bank of Punjab (BOP), and Faysal Bank Ltd. And United Bank Ltd. (UBL) according to sampling criteria.

The researcher chose the poll questionnaire technique because of the reasons introduced by (Aaker, Kumar, & Day, 2008); the determination of a questionnaire survey technique relies upon the nature of a research study and its motivation. The choice of the questionnaire study in the manner is determined by the kind of questions from the customers. Questionnaires are the best way to collect data from the customers (Athar, Butt, Abid & Arshad, 2021).

The questionnaires were personally distributed to respondents. A total of 300 questionnaires were distributed, out of which 240 questionnaires were returned safely. Two hundred ten usable questionnaires out of 240 questionnaires make the response rate 55%, which is fine.

This study use correlation and regression analysis method for results and conclusion. This study uses SPSS for implementing applicable tests to study variables to quantify their relationships. The researcher put every information from the current research study considered in SPSS 21 programming and AMOS 21 for data analysis of every construct of variables Atiq et al. (2022). This study uses SPSS because it is the most common and widely used software by social sciences researchers (Athar, Abid, Rafiq & Sial, 2022).

Finally, the t-test, standardized coefficients Beta, and significance of factors have measured. Correlation analysis has been done to explore the relationship of research study factors that could help to understand them.

Hence, the researcher has given a descriptive analysis of each item of this research study's factors.

Results and Discussion

Reliability scales are measured in this study by Cronbach's Alpha, the most reasonable test to check the consistency of items. The Cronbach Alpha is figured for each construct which incorporates perfect self-consistency, actual self-consistency, advancement and earnestness. The reliability coefficient of approximately 0.90 can be taken as "brilliant", though values near Alpha 0.80 are "great" and esteem pretty much Alpha 0.70 are "sufficient" (Kline & Santor, 1999). In this study, the reliability of the CS scale is over 0.8 and can be viewed as great. Similarly, the reliability of the rest of the scales is over 0.70, which is sufficient.

Table 1.

Table 2.

|

Sr. No |

Scales |

Items |

Alpha |

|

1 |

SQ |

05 |

0.792 |

|

2 |

CS |

05 |

0.820 |

|

3 |

CI |

05 |

0.750 |

|

4 |

CL |

06 |

0.812 |

Table 2 above tested the First model with a direct and indirect relationship of CI and SQ with CL. And with mediating effect of the CS and results show that in a direct relationship with CL, the variables CI and SQ were significant, and with an indirect relationship, all two variables were significant, which shows the mediating effect of CS in the relationship.Table 3.

|

First

Model |

||

|

|

CI |

SQ |

|

CS To |

0.003 |

0.001 |

|

CL |

0.001 |

0.001 |

In the given Table 3, the relationship of CS to CL was tested, and the results show that this path was significant.

|

|

CS |

|

CL |

0.002 |

Table 4.

Following table 5, correlation indicates the significance, strength and directions of relationships between variables. The correlation value could range from ?1.0 to +1.0, and a value of p = 0.05 suggests that 95 out of 100 times, there is a significant correlation between variables with only a 5% chance of no relationship among variables. Also recommended that p = 0.05 is an acceptable value to consider the correlation significance. Table 5.

|

|

Mean |

Std. Deviation |

N |

|

18.9427 |

2.94000 |

210 |

|

|

SQ |

17.2625 |

2.93972 |

210 |

|

CI |

14.7975 |

2.85270 |

210 |

|

CS |

18.9000 |

4.93355 |

210 |

Table 5 discusses the correlation analysis of studied variables, and the results show the significant correlation between all observed variables, providing initial support to our study. The correlation between SQ and CL (0.61) shows a positively moderate association. The correlation between CI and CL (0.81) and CI and SQ (0.693) shows a positively moderate association. The correlation between CS and CL (0.61), CS and SQ (0.604), and CS and CI (0.593).

Table 6.

|

|

CL |

SQ |

CI |

CS |

|

|

Pearson Correlation |

CL |

1.000 |

|

|

|

|

SQ |

0.61 |

1.000 |

|

|

|

|

CI |

0.81 |

0.693 |

1.000 |

|

|

|

CS |

0.61 |

0.604 |

0.593 |

1.000 |

|

In table 6, the value of R Square is 0.446 and 0.465, Significance F change is 0.000 and 0.023, and Durbin-Watson is 2.291, which should be between 1.5 to 2.5. As the standard value for significance is p <0.05 so that this shows there is a statistically significant difference between these variables.Table 7.

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Change Statistics |

Durbin-Watson |

||||

|

R Square Change |

F Change |

Df1 |

Df2 |

Sig. F Change |

||||||

|

1 |

0.66 |

0.446 |

0.428 |

2.22267 |

0.446 |

24.838 |

5 |

204 |

0.000 |

|

|

2 |

0.68 |

0.465 |

0.444 |

2.19229 |

0.019 |

5.297 |

1 |

203 |

0.023 |

2.291 |

|

Model |

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

613.539 |

5 |

122.708 |

24.838 |

0.000b |

|

Residual |

760.797 |

205 |

4.940 |

|

|

|

|

Total |

1374.336 |

209 |

|

|

|

|

|

2 |

Regression |

638.997 |

6 |

106.500 |

22.159 |

0.000c |

|

Residual |

735.339 |

203 |

4.806 |

|

|

|

|

Total |

1374.336 |

209 |

|

|

|

|

Conclusion

Banks recognize and observe the drivers of CL, CS, SQ and CI, as this current study found that these factors affect each other and have a strong impact on building CL.

This research study has contributed to finding and calculating the effects of CS, CI and SQ on CL in the Pakistan banking sector. The researcher has calculated the effect of these factors on CL that vary from bank to bank in his CL model.

Therefore, with the help of the CL model, banks can understand the effects of these variations. The fact is that CS leads to CL, as this research study has shown. Research analyses also show that the association among the factor are also different for the different banks. The current study also concluded that factors to the existing loyalty model which was proved (Beerli et al., 2004). Building and strengthening relationships with customers are essential (Dar & Hu, 2005). More grounded relations of the banks with customers, higher odds of their prosperity. If the banks assemble and keep up solid associations with customers, it is troublesome for contenders to back them (Gilbert & Choi, 2003). In this way, building and keeping up close relations with customers is of high significance for any organization.

CL is the assurance of acquisition and redemption of a particular invention offered by a retail bank. It is basically a repetition of purchasing a service or product offered by a service provider (Lam et al., 2004). CL eventually proved profitable for a retail bank that attracted customers by receiving data from researchers and marketers (Keisidou et al., 2013). As research is conducted in rural and urban areas were in rural areas, the banking options are limited, so banking management has to hold their consumers in order to sustain their profit because if customers switch to another bank, they will lose their limited share.

Hence, this study proved that customers and banks are interconnected and dependent on each other to make this industry more beneficial and fruitful for customers. This research study is being conducted.

After this clear discussion and analysis, we come to the conclusion that each bank has a different relationship with its customer from another bank and the loyalty of fate varies among them. Finally, the researcher answered the questions and hypothesis of the current research study and made the CL model effective for the Pakistani banking system to benefit both the customer and the bank.

In the recent research conducted by the researcher, this was to be found that the indirect path of CI to CS P=0.003 and the direct path of CI to CL P= 0.001 both the paths are significant. A previous study explored that CI to CS was P= 0.033, which is significant, and CI to CL was P=0.170, which is insignificant (Mohd Suki, 2017). Research originate that CI has a significant positive effect on CS with P=0.000 (Sallam, 2016). The study depicts that the effect of CI on CS is moderately powerless. Together the antecedent builds clarified 96.5% of the changeability in CS (Erjavec, Dmitrovi?, & Povalej Bržan, 2016).

The current study organized by the researcher proves that the course of CS towards CL is positively significant as a previously conducted study proves that CS towards CL is positively significant with P=0.000 (1). Another research study has shown the after-effects of consumer satisfaction which is emphatically connected with CL and is predictable with prior research.

The model was run, and the results show that the CL and CI have a significant relationship of 0.001, as existing literature shows this relationship is supported and tested (Erjavec et al., 2016; Mohd Suki, 2017; Sallam, 2016) with significance. SQ to CL has a significant relationship of 0.001, as previous literature has shown its significance (Grönroos, 1982). The indirect effect with CS shows CI to CL is significant with 0.003 as tested in existing literature (Mohd Suki, 2017). SQ to CL has a significant relationship of 0.001, as a previous research study depicts (M. A. Saleem et al., 2016).

Table 8

|

|

Mean |

Std. Deviation |

N |

|

CL |

18.9427 |

2.94000 |

210 |

|

SQ |

15.8625 |

2.63972 |

210 |

|

CI |

15.6975 |

2.73270 |

210 |

Table 9.

|

|

CL |

SQ |

CI |

|

CL |

1.000 |

|

|

|

SQ |

0.561 |

1.000 |

|

|

CI |

0.615 |

0.613 |

1.000 |

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Change Statistics |

Durbin-Watson |

||||

|

R Square Change |

F Change |

df1 |

df2 |

Sig. F Change |

|

|||||

|

1 |

0.65 |

0.425 |

0.414 |

2.25070 |

0.425 |

38.435 |

3 |

206 |

0.000 |

2.249 |

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

584.098 |

3 |

194.699 |

38.435 |

0.000b |

|

Residual |

790.238 |

206 |

5.066 |

|

|

|

|

Total |

1374.336 |

209 |

|

|

|

|

References

- Aaker, D. A., Kumar, V., & Day, G. S. (2008). Marketing research: John Wiley & Sons.

- Abdullah, F. (2006). The development of HEdPERF: a new measuring instrument of service quality for the higher education sector. International Journal of Consumer Studies, 30(6), 569-581.

- Amanto, B. S., Umanailo, M. C. B., Wulandari, R. S., Taufik, T., & Susiati, S. (2019). Local consumption diversification. Int. J. Sci. Technol. Res, 8(8), 1865-1869.

- Anderson, E. W., & Sullivan, M. W. (1993). The Antecedents and Consequences of Customer Satisfaction for Firms. Marketing Science, 12(2), 125–143.

- Andreassen, T. W., & Lindestad, B. (1998). The Effect of Corporate Image in the Formation of Customer Loyalty. Journal of Service Research, 1(1), 82–92.

- Aslam, E., Ashraf, M. S., & Iqbal, A. (2022). Impact of corporate image on customer loyalty of Islamic banks: the role of religiosity, collectivism, sight cues and CSR. Journal of Islamic Marketing.

- Athar, M. A., Butt, M., Abid, G., & Arshad, M. (2021). Impact of influential attributes on purchase intention during covid-19: Theoretical base sequential mediation of image and memories. Int. J. Manag, 12, 454- 467.

- Athar, M. A., Abid, G., Rafiq, Z., & Sial, M. A. (2022). Impact of leadership aspiration on organizational citizenship behavior: sequential mediation of leader member exchange and communal orientation. Bulletin of business and economics (BBE), 11(2), 292- 301.

- Atiq, M., Abid, G., Anwar, A., & Ijaz, M. F. (2022). Influencer Marketing on Instagram: A Sequential Mediation Model of StorytellingContent and Audience Engagement via Relatability and Trust. Information, 13(7), 345.

- Barich, H., & Kotler, P. (1991). A framework for marketing image management. MIT Sloan Management Review, 32(2), 94-104.

- Beerli, A., Martin, J. D., & Quintana, A. (2004). A model of customer loyalty in the retail banking market. European Journal of marketing, 38(1/2), 253-275.

- Bitner, M. J. (1990). Evaluating Service Encounters: The Effects of Physical Surroundings and Employee Responses. Journal of Marketing, 54(2), 69.

- Bose, R. (2002). Customer relationship management: key components for IT success. Industrial Management & Data Systems, 102(2), 89-97.

- Brady, M. K., Cronin, J. J., & Brand, R. R. (2002). Performance-only measurement of service quality: a replication and extension. Journal of Business Research, 55(1), 17-31.

- Chandrashekaran, M., Rotte, K., Tax, S. S., & Grewal, R. (2007). Satisfaction strength and customer loyalty. Journal of Marketing Research, 44(1), 153-163.

- Chen, Y.-S. (2010). The drivers of green brand equity: Green brand image, green satisfaction, and green trust. Journal of Business Ethics, 93(2), 307-319.

- Colgate, M. (1996). The use of personal bankers in New Zealand: an exploratory study. New Zealand Journal of Business, 18(2), 103-113.

- Cronin, J. J., & Taylor, S. A. (1992). Measuring Service Quality: A Reexamination and Extension. Journal of Marketing, 56(3), 55.

- Dar, R. I., & Hu, Y. (2005). How banks manage CRM: A B2B perspective.

- Dick, A. S., & Basu, K. (1994). Customer loyalty: toward an integrated conceptual framework. Journal of the academy of marketing science, 22(2), 99-113.Dick, A. S., & Basu, K. (1994). Customer loyalty: toward an integrated conceptual framework. Journal of the academy of marketing science, 22(2), 99-113.

- Dowling, G. R. (1988). Measuring corporate images: A review of alternative approaches. Journal of Business Research, 17(1), 27-34.

- Erjavec, H. Š., Dmitrović, T., & Povalej Bržan, P. (2016). Drivers of customer satisfaction and loyalty in service industries. Journal of Business Economics and Management, 17(5), 810-823.

- Eshghi, A., Haughton, D., & Topi, H. (2007). Determinants of customer loyalty in the wireless telecommunications industry. Telecommunications policy, 31(2), 93-106.

- Fornell, C. (1992). A National Customer Satisfaction Barometer: The Swedish Experience. Journal of Marketing, 56(1), 6.

- Fornell, C., & Wernerfelt, B. (1987). Defensive Marketing Strategy by Customer Complaint Management: A Theoretical Analysis. Journal of Marketing Research, 24(4), 337.

- Fornell, C., Johnson, M. D., Anderson, E. W., Cha, J., & Bryant, B. E. (1996). The American Customer Satisfaction Index: Nature, Purpose, and Findings. Journal of Marketing, 60(4), 7.

- Gan, C., Clemes, M., Wei, J., & Kao, B. (2011). An empirical analysis of New Zealand bank customers' satisfaction. Banks and Bank Systems, 6(3), 63-77.

- Gatewood, R. D., Gowan, M. A., & Lautenschlager, G. J. (1993). Corporate image, recruitment image and initial job choice decisions. Academy of management Journal, 36(2), 414-427.

- Gilbert, D. C., & Choi, K. C. (2003). Relationship marketing practice in relation to different bank ownerships: a study of banks in Hong Kong. International Journal of Bank Marketing, 21(3), 137-146.

- Golden, L., & Zimmer, M. (1988). Impressions of retail stores: a content analysis of consumer images. Journal of retailing, 64(3), 265-289.

- Grönroos, C. (1982). An applied service marketing theory. European Journal of marketing, 16(7), 30-41.

- Gustafsson, A., Johnson, M. D., & Roos, I. (2005). The effects of customer satisfaction, relationship commitment dimensions, and triggers on customer retention. Journal of marketing, 69(4), 210-218.

- Hogg, M. A., & Terry, D. I. (2000). Social identity and self-categorization processes in organizational contexts. Academy of management review, 25(1), 121-140.

- Hoq, M. Z., & Muslim, A. (2010). The role of customer satisfaction to enhance customer loyalty. African Journal of Business Management, 2(4), 139-154.

- Javed, F. (2005). Customer Satisfaction at a Public Sector Bank, Karachi. Market Forces, 1(2).

- Jo Hatch, M., & Schultz, M. (2003). Bringing the corporation into corporate branding. European Journal of marketing, 37(7/8), 1041-1064.

- Jones, T. 0., & Sasser, W. E .(1995). " Why Satisfied Customers Defect", Harvard.

- Kandampully, J., & Hu, H.-H. (2007). Do hoteliers need to manage image to retain loyal customers? International Journal of Contemporary Hospitality Management, 19(6), 435-443.

- Kang, G.-D., & James, J. (2004). Service quality dimensions: an examination of Grönroos's service quality model. Managing Service Quality: An International Journal, 14(4), 266-277.

- Kang, S., & Hur, W. M. (2012). Investigating the antecedents of green brand equity: a sustainable development perspective. Corporate Social Responsibility and Environmental Management, 19(5), 306-316.

- Kaura, V. (2013). Antecedents of customer satisfaction: a study of Indian public and private sector banks. International Journal of Bank Marketing, 31(3), 167-186.

- Keisidou, E., Sarigiannidis, L., Maditinos, D. I., & Thalassinos, E. I. (2013). Customer satisfaction, loyalty and financial performance. International Journal of Bank Marketing, 31(4), 259–288.

- Kennedy, S. H. (1977). Nurturing corporate images. European Journal of marketing, 11(3), 119-164.

- Klaus, P., Gorgoglione, M., Buonamassa, D., Panniello, U., & Nguyen, B. (2013). Are you providing the "right" customer experience? The case of Banca Popolare di Bari. International Journal of Bank Marketing, 31(7), 506-528.

- Kleinaltenkamp, M., Ehret, M., Hunt, S. D., Arnett, D. B., & Madhavaram, S. (2006). The explanatory foundations of relationship marketing theory. Journal of Business & Industrial Marketing, 21(2), 72-87.

- Kline, R. B., & Santor, D. A. (1999). Principles & practice of structural equation modelling. Canadian Psychology, 40(4), 381-383.

- Kotler, P., & Gertner, D. (2002). Country as brand, product, and beyond: A place marketing and brand management perspective. The Journal of brand management, 9(4), 249-261.

Cite this article

-

APA : Ali, R., Aslam, T., & Zafar, H. (2022). Determinants of Customer Loyalty in the Banking Sector of Pakistan. Global Social Sciences Review, VII(I), 356-370. https://doi.org/10.31703/gssr.2022(VII-I).34

-

CHICAGO : Ali, Rizwan, Tanveer Aslam, and Hammad Zafar. 2022. "Determinants of Customer Loyalty in the Banking Sector of Pakistan." Global Social Sciences Review, VII (I): 356-370 doi: 10.31703/gssr.2022(VII-I).34

-

HARVARD : ALI, R., ASLAM, T. & ZAFAR, H. 2022. Determinants of Customer Loyalty in the Banking Sector of Pakistan. Global Social Sciences Review, VII, 356-370.

-

MHRA : Ali, Rizwan, Tanveer Aslam, and Hammad Zafar. 2022. "Determinants of Customer Loyalty in the Banking Sector of Pakistan." Global Social Sciences Review, VII: 356-370

-

MLA : Ali, Rizwan, Tanveer Aslam, and Hammad Zafar. "Determinants of Customer Loyalty in the Banking Sector of Pakistan." Global Social Sciences Review, VII.I (2022): 356-370 Print.

-

OXFORD : Ali, Rizwan, Aslam, Tanveer, and Zafar, Hammad (2022), "Determinants of Customer Loyalty in the Banking Sector of Pakistan", Global Social Sciences Review, VII (I), 356-370

-

TURABIAN : Ali, Rizwan, Tanveer Aslam, and Hammad Zafar. "Determinants of Customer Loyalty in the Banking Sector of Pakistan." Global Social Sciences Review VII, no. I (2022): 356-370. https://doi.org/10.31703/gssr.2022(VII-I).34