Abstract

Theory of overconfidence states that investors are highly overconfident when valuing the stocks. Self-attribution has been found by the researchers as the root cause for overconfidence bias in investors. Investors attribute the high stock prices and returns with their own art of picking up the stocks, and thus they trade more frequently. In order to test overconfidence and self-attribution Vector Autoregressive (VAR) model has been employed to find out the long-term relationship between endogenous variables: market return and market turnover and exogenous variables: volatility and dispersion. Results revealed that there exists a strong positive relationship between market returns and trading turnover. Also, the cross-sectional standard deviation in market prices i-e volatility and the cross-sectional variation in stock returns i-e dispersion has a very strong impact on trading pattern and returns. Since investment decisions made by Pakistani investor largely depend upon psychological factors, giving less weightage to all the fundamentals, the trading pattern exhibited may collectively tend the market behave in an irrational manner.

Key Words

Stock Returns, Volatility, Overconfidence, Self-Attribution, Vector Auto-Regressive Model

Introduction

Debondt and Thaler (1995) found the people tend to be overconfident and considered the finding a vital contribution of the psychology of judgment. The theory of overconfidence held the investors overconfident while valuing the stocks by heavily relying upon their own judgment instead of taking into account the publically available information and while doing so the chances of error of judgment are completely overlooked. Investors can be segregated into two categories: rationalists and behaviorists (Wouters, 2006). Rationalists totally oppose the occurrence of abnormal returns, whereas behaviorists support the sentiment-based decision making causing the mispricing in the market which results in anomalies.

“Heads I win tails its chance” (Langer and Roth, 1975) is a common tendency of assuming oneself better than the other average people. Alicke et al. (2001) has found it as a staple finding of Social Psychology. Wide literature in the field of Psychology advocates the idea that people wrongly attribute the success period with their own strategies by overestimating their capabilities. Precisely, investors have a tendency to praise themselves for successful trading and consider others responsible for failures (Taylor and Brown, 1988). Self-attribution has been attributed as the root cause of overconfidence bias in investors, the two being static and dynamic counterparts of each other (Hirshliefer, 2001).

Existence of overconfidence bias among investors has been investigated by Cesarini et al. (2006) as a function of response format of the investors. The overconfidence of investor depicted by his responses directly affects the trading pattern and ultimately, the stock returns. Analysis of trading pattern, trading volume and stock returns has been considered as a most robust technique to find evidence of overconfidence bias (Odean, 1998; Gervais and Odean, 2001). Market trading volume has also been implied by Statmanet’al (2004) as an indicator of investor overconfidence and found increased market turnover for the positive lagged returns in the long run.

Realizing high returns makes the investors overconfident even same state is being enjoyed by the rest of the market (Gervias and Odean, 2001).

Since overconfidence is strongly associated with the illusion of own success and illusion of control, even high risks are assumed by investors in terms of excessive trading (De long et al, 1990) and simultaneously available trading opportunities are exploited to reap the maximum benefit (Taylor and Brown, 1988).

This excessive trading based on irrational decisions may lead to excess volatility in the market (Odean, 1998). Pakistani stock market has been highly volatile in the past few years, which have paved

the ways to investigate the forces behind this excessive volatility. The importance of humans, being the lifeblood of the stock market, has been increased in this scenario for further analysis that how the irrational decisions at the individual’s level may have affected the whole market. Examination of trading pattern of investors to find out whether Pakistani investors are prone to overconfidence bias creating excess volatility in the market is a step forward in this regard.

Methodology

In order to test the underlying relationship between turnover and returns, the study has implied an unrestricted vector autoregressive (VAR) model formulated by Statman et’al (2004). The model utilizes two endogenous variables, i.e., market return and market turnover. Monthly data of Market returns (Return) calculated from month end index values and Market turnover (Turn) calculated from cumulated daily market trading volume divided by total market capitalization has been gathered for the period 2000 to 2014 for the purpose.

Market Volatility (Mvol) and Dispersion (Disp) are the two exogenous variables, and they have been defined as monthly temporal volatility of market returns and monthly cross-sectional standard deviation among the returns, respectively. Dispersion is to see the effect of portfolio rebalancing on the potential trading activity (Statman, 2004).

The VAR model treats all the variables as endogenous variables. It develops an individual equation for each variable, considering it as the dependent variable. Each equation contains lagged values of the variables under study. VAR model formulated for this study is as follows:

[?(?Turn?_t@?Return?_t )]= [?(?_Turn@?_Return )]+ ?_(k=1)^3?A_k [?(?Turn?_(t-k)@?Return?_(t-k) )]+ ?_(l=0)^2?B_(l ) [?(?Mvol?_(t-l)@?Disp?_(t-l) )]+ [?(e_(Turn,t)@e_(Return,t) )]

Where:

Turnt= Market Turnover for month t

Returnt = Market Returns for month t

Mvolt = cross-sectional standard deviation of daily returns for month t

Dispt = dispersion of returns from the mean for month t

k= lag length for endogenous variables

l = lag length for exogenous variables

The significantly positive association between market turnover and lagged market returns are required to have evidence for overconfidence bias among investors. The covariance structure present in the residual vector, et, of VAR system allows the current as well as future values of the variables to change according to the movement in residual vector due to the fact that lagged values appear in both the equations through the coefficient matrix Ak. Based on AIC, lag lengths for the purpose of study have been determined as k=3 for endogenous variables and l = 2 for exogenous variables.

Data Analysis

The

high trading activity followed by high observed market returns depicted by the

positive correlation between past returns and current turnover is the basic

testable implication for the overconfidence bias. Also, the impact of

aggressive trading by overconfident traders may be assessed in terms of

observed excessive returns volatility.

Unit Root Test

Results for the Unit root test

applied to the variables under study are presented below in Table -I. The null

hypothesis for unit root has been tested as H0:

series has a unit root.

Table 1. Unit Root Analysis of Variables

|

Variables |

ADF

I (0) |

PP

I (0) |

|

Turnover |

-6.011 |

-4.725 |

|

Market Returns |

-12.101 |

-11.31 |

|

Market volatility |

-8.923 |

-9.013 |

|

Dispersion |

-7.985 |

-8.493 |

|

Critical

Value |

||

|

1% |

-4.002 |

-3.472 |

|

5% |

-3.000 |

-2.880 |

|

10% |

-3.000 |

-2.576 |

Significantly

higher values of variables as compared to the critical values establish that

the variables discussed above have no unit root. Therefore, a null hypothesis

on the basis of these results is rejected at 1% level of significance and

series is found stationary at I (0), good enough to test for the relationship

between lagged returns and turnover.

Descriptive

Statistics

Table 2. Descriptive Statistics of Variables for Testing Overconfidence Bias

|

|

Turn |

Ret |

Mvol |

Disp |

|

Mean |

20.89 |

1.014 |

0.063 |

0.002 |

|

Maximum |

24.46 |

1.241 |

0.220 |

0.001 |

|

Minimum |

15.01 |

-1.448 |

0.001 |

0.021 |

|

Std. Dev. |

0.81 |

0.084 |

0.039 |

0.00 |

|

Skewness |

-4.11 |

-2.152 |

1.677 |

2.189 |

|

Kurtosis |

23.68 |

9.541 |

6.444 |

7.854 |

|

Observations |

156 |

156 |

156 |

156 |

The above Table Shows the

Descriptive Statistics of the Variables.

Table –II depicts that turnover for 100 indexes

has the highest mean value of 20.89 with a standard deviation of around 81%

which again is considerably high and marks the series as highly volatile moving

between the minimum and maximum values mentioned in the table. Value of

skewness as a measure of normality of distribution is<0 i-e -4.11 showing

the series has a long tail at left side with maximum values at the left side of

the mean. Value of Kurtosis being greater than 3 makes the data peaked from

center with heavy tails. This means that most of the values of turnover series

are concentrated around mean.

Mean value of returns is 1.0144 with a standard

deviation of around 8.45%, which sufficiently declares the market volatile.

Series has been found as negatively skewed with a value of skewness less than

zero. Value of Kurtosis, being greater than 3, shows peakness of data and

concentrated values around mean value.

Correlation Analysis

Correlation

analysis is to be conducted to check for the multi-collinearity and mutual

relationship among variables. Table-III below presents the results for

correlation analysis.

Table 3. Correlation

|

|

Turnover |

Returns |

Market volatility |

Dispersion |

|

Turnover |

1 |

|||

|

Returns |

0.239 |

1 |

||

|

Market volatility |

0.207 |

-0.356 |

1 |

|

|

Dispersion |

0.174 |

-0.293 |

0.869 |

1 |

The matrix above shows that market turnover is weakly correlated to the market returns; however, the relationship remains positive. Also, the volatility and dispersion have been found positively correlated to market turnover; however, the values remain lower than 0.50 marking the correlation week enough. Strongest correlation in the whole matrix has been observed for market volatility and dispersion i-e 0.869. In order to test for the chances of multi-collinearity between two variables, auxiliary regression has been implied. The value of Variance Inflation Factor (VIF) calculated with the value of R2 as 0.7552 has been obtained as 4.08 i-e > 10 rulings out the chances of multi-collinearity between the two variables in the model.

Vector Auto Regression (VAR) Model

A VAR model is applied to assess the relationship between the variables under study, particularly market volatility and market returns. Volatility and dispersion have been added to the model as exogenous variables.

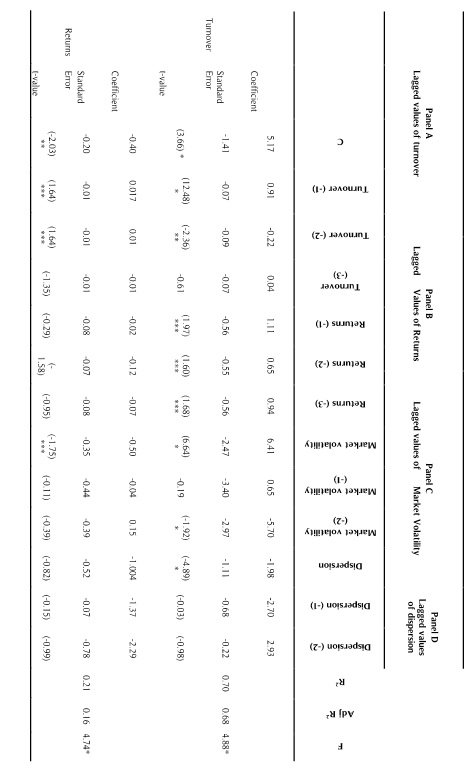

Panel A of Table IV shows a significantly positive relationship between turnover and lagged turnover. The relationship found for the first lag is strong enough with a confidence interval of 99% however, as the number of lags is increased, the relationship has found weaken and ultimately disappear at last lag. Investigation of the relationship between Return and lagged values of turnover has revealed a significantly positive association between two. Again, as the number of lags is increased, the relationship starts weakening and finally disappear at last lag depicting that lagged turnover does not impact market returns beyond this point. The results imply that trading volume or turnover can be used to predict future returns as found by Lee and Swaminathan (2000) for individual stocks.

Panel B of Table IV with lagged values of market returns establishes a significantly positive relationship with market turnover. The relationship holds for all the three lags in the system as evidenced by the significantly positive coefficients. The results hold that the continuously positive or high returns earned by the market increase the future turnover by increasing the trading volume. These findings are in accordance with the overconfidence bias theory that investor tends to associate positive returns to its own stock-picking ability and starts trading aggressively, which results in increased trading volume and turnover.

Relationship between returns and lagged returns has been found insignificant for the specified lag length and thus cannot be used to predict future returns. This result found is surprising in a way that various studies in the literature have found this relationship significant enough.

Panel C of Table-IV depicts test statistics for the first exogenous variable i-e market volatility. There exists a strong positive relationship between trading turnover and volatility. Since trading turnover largely depends upon trading volume, the results confirm the volume-volatility relationship of Karpoff (1987) and French, Schwert, Stambaugh (1987). The relationship disappears when it comes to the first lag of market volatility; however, the relationship again turns significant in second lag. Analysis with an increased number of lags may provide more robust results regarding the nature of the relationship between lagged volatility and market turnover.

When coming to returns, Mvol has been found negatively associated with returns. Inverse nature of the relationship between these two variables implies that as the market volatility tends to increase, market returns fall. Volatility in the market creates uncertainty for the future and makes the investor trade less to avoid any probable losses. Decreased trading activity reduces market turnover. Relationship between dispersion (Disp) and turnover in Panel D has been found significantly negative, but no evidence of this relationship has been found for lagged values of dispersion. Market turnover and stock returns dispersion have a negative relationship.

VAR Granger Causality

Granger causality test has been applied to test the null hypothesis. It tests whether variable B is being granger caused by variable A. it also tests the relationship of lagged values of one variable with the other one. VAR Granger causality results are mentioned below in Table IV and Table V.

Table 4. Vector Auto

Regressive Estimates for Endogenous and Exogenous Variables

*significant

at 99% confidence interval

**significant at 95% confidence

interval

***Significant at 90%

confidence interval t-values in parenthesis

Table 5. VAR Granger Causality/Block Exogeneity

Wald Test

|

DV: TURNOVER |

|||

|

Excluded |

Chi-sq |

df |

Probability |

|

RETURNS |

7.29 |

3 |

0.003* |

|

All |

7.29 |

3 |

0.003 |

|

DV: RETURNS |

|||

|

Excluded |

Chi-sq |

df |

Probability |

|

TURNOVER |

12.41 |

3 |

0.006* |

|

All |

12.41 |

3 |

0.006 |

*Significant at 95% confidence

interval

Having turnover as dependent variable p-value

obtained is 0.003, which is lesser than the critical value 0.05, which provides

us with the sufficient base to reject the null hypothesis and determine that

market returns granger cause market turnover. Same results were obtained by

implying a VAR system which also exhibited that there is a positive and

significant relationship between returns and turnover for one day, two days,

and three days lags under study. In the

VAR model, with returns as the dependent variable, p-value obtained is 0.006,

which is significant at a 95% confidence interval. This makes the null

hypothesis rejected and establishes that market turnover granger causes market

returns. VAR also establishes the same results.

Conclusion

Theory of overconfidence states that investors tend to rely heavily on their personal judgment and information more than any outside information and thus are prone to error of precision. In order to test whether the Pakistani investors are prone to the same tendency, the Vector Autoregressive (VAR) model has been applied by assessing the long-term relationship between market return and market turnover. Data for the period 2000 to 2014 has been gathered. VAR test revealed a positive relationship between trading turnover and market returns. The variation in market prices and stock returns both impact trading turnover and returns. The results confirm the existence of overconfidence bias among Pakistani investors establishing that they tend to credit themselves for each positive outcome and makes them trade more aggressively.

Evidence of overconfidence and self-attribution bias found in Pakistani market implies that investors are prone to bounded rationality supported as a natural phenomenon by the psychology literature. Investment decisions made by Pakistani investors depending upon psychological factors like hopes, perceptions and self-attribution, ignoring fundamentals, affects the trading pattern of the market in an irrational manner. The individual investor finds increased trading turnover confirming his market speculations making the effect of overconfidence bias denser which not only further transforms into overreaction of investors to the private information but also significantly increases trading volume and market turnover, directly effecting the market volatility.

Table 4

Vector Auto Regressive estimates for Endogenous and exogenous variables

References

- Abbes, M. B., Boujelbene, Y., Bouri, A. (2009). Overconfidence bias: Explanation of Market Anomalies French Market Case.Journal of Applied Economic Sciences, 4(1(7)), 12-25

- Alicke, M. D., Debbie S. V., Matthew, H., & Olesya, G. (2001). The Better Than Myself Effect. Motivation and Emotion, 25(2001), 7-22.

- Barber, B., & Odean, T. (2001). Boys will be Boys: Gender, Overconfidence and Common Stock Investment.Quarterly Journal of Economics, 116, 261-292.

- Bem, D. J. (1965). An Experimental Analysis of Self-Persuasion. Journal of Experimental Social Psychology,1(3), 199-218

- Benos, A. (1998). Aggressiveness and Survival of Overconfident Traders.Journal of Financial Markets, 1(3-4), 353- 383

- Bessembinder, H., Chan, K., & Seguin, P.J. (1996). An Empirical Examination of Information, Differences of Opinion and Trading Activity. Journal of Financial Economics, 40(1), 105-134.

- Cesarini, D., Sandewall, Ã. R., & Johannesson, M. (2006). Confidence Interval Estimation Tasks and the Economics of Overconfidence.Journal of Economic Behavior & Organization, 61, 453-470.

- Chordia, T., Roll, R., & Subrahmanyam, A. (2000). Market Liquidity and Trading Activity.working paper, UCLA

- Cremers, M., & Pareek, A. (2011). Can Overconfidence and Biased Self-Attribution Explain the Momentum, Reversal and Share Issuance Anomalies? Evidence from Short-Term Institutional Investors. Working Paper, October 2011

- Daniel, K., David H., & Avanidhar, S. (1998). Investor Psychology and Security Market Under- and Overreactions. Journal of Finance, 53 (6), 1839-1885.

- De Bondt, W., & Thaler, R. (1995). Financial Decision Making in Markets and Firms: A behavioral Perspective. Working Paper, No: 4777, The National Bureau of Economic Research, June 1994.

- DeLong, J. B., Shleifer, A., Summers, L., & Waldman, R. (1990). Noise Trader Risk in Financial Markets.Journal of Political Econ, 98(4), 703-738

- French, K. R., Schwert, G. W., & Stambaugh, R. F. (1987). Expected Stock Returns and Volatility. Journal of Financial Economics, 19, 3-29

- Gervais, S., & Odean, T. (2001). Learning to be Overconfident.The Review of Financial Studies, 14 (1), 1-27

Cite this article

-

APA : Urooj, S. F., Zafar, N., & Sindhu, M. I. (2019). Overconfidence Bias: Empirical Examination of Trading Turnover and Market Returns. Global Social Sciences Review, IV(II), 384-390. https://doi.org/10.31703/gssr.2019(IV-II).50

-

CHICAGO : Urooj, Syeda Faiza, Nosheen Zafar, and Muzammal Ilyas Sindhu. 2019. "Overconfidence Bias: Empirical Examination of Trading Turnover and Market Returns." Global Social Sciences Review, IV (II): 384-390 doi: 10.31703/gssr.2019(IV-II).50

-

HARVARD : UROOJ, S. F., ZAFAR, N. & SINDHU, M. I. 2019. Overconfidence Bias: Empirical Examination of Trading Turnover and Market Returns. Global Social Sciences Review, IV, 384-390.

-

MHRA : Urooj, Syeda Faiza, Nosheen Zafar, and Muzammal Ilyas Sindhu. 2019. "Overconfidence Bias: Empirical Examination of Trading Turnover and Market Returns." Global Social Sciences Review, IV: 384-390

-

MLA : Urooj, Syeda Faiza, Nosheen Zafar, and Muzammal Ilyas Sindhu. "Overconfidence Bias: Empirical Examination of Trading Turnover and Market Returns." Global Social Sciences Review, IV.II (2019): 384-390 Print.

-

OXFORD : Urooj, Syeda Faiza, Zafar, Nosheen, and Sindhu, Muzammal Ilyas (2019), "Overconfidence Bias: Empirical Examination of Trading Turnover and Market Returns", Global Social Sciences Review, IV (II), 384-390

-

TURABIAN : Urooj, Syeda Faiza, Nosheen Zafar, and Muzammal Ilyas Sindhu. "Overconfidence Bias: Empirical Examination of Trading Turnover and Market Returns." Global Social Sciences Review IV, no. II (2019): 384-390. https://doi.org/10.31703/gssr.2019(IV-II).50