Abstract

Responsiveness activities and intelligence are two categories in which export market orientation has been classified. Even though previous studies have greatly focused on the intelligence and responsiveness of international channel partners that help these activities improve export venture performance. The study explores the advantages that are influenced by choosing international partners through direct contacts or word-of-mouth. The advantages of responsiveness activities and intelligence are also explored in this study. Data is gathered from 246 Japanese manufacturers of exporting firms. For hypotheses testing, regression analysis and post hoc analysis are used. Our findings show international channel partner chosen by word-of-mouth has a moderating effect on export-focused strategies. The study enhances the understanding of export market orientation by breaking it into two key aspects; gathering market insights, and taking actions based on those insights and giving factual proof of how these activities interact differently with partner selection.

Keywords

Export Venture Performance, Agency Theory, B2B WOM, Paper Type – Conceptual Paper

Introduction

Literature Review

Venture Performance on export is a major target to analyze the degree to which the foreign market achievements regarding exporting a product depict the Firm's main purpose. There are two levels for capturing the Performance on export in one of the ventures and function of the export. An outdoor indicator is used in this context for export venture Performance and the export venture level is captured by the WOM referral for the purpose of channel partner selection.

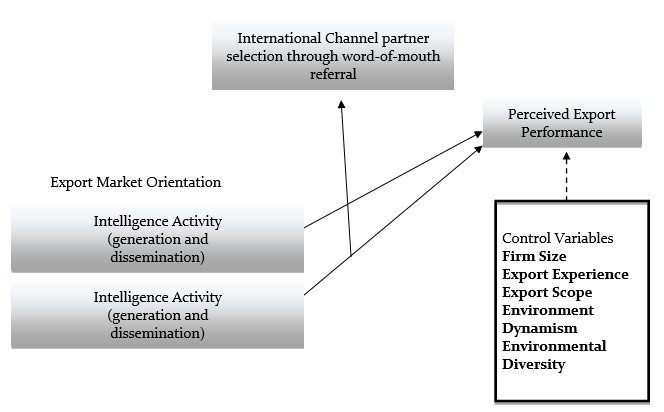

The purpose of this model is to highlight the intelligence and responsiveness activities based on the inner and outside information that shows the impact of export Venture Performance. This Theoretical model is based on capabilities-based theory. Additionally, the relationship of these two activities is directly compared with the WOM Referrals (Foreign associates). Particularly the impact of responsiveness activities shows the dissembling condition and intelligence activities show the impact on enabling conditions. So this Theoretical background was also analyzed by agency theory in which we viewed the activities associated with export manufacturing firms as the base of market-oriented activities (B?çakc?oglu-Peynirci & Morgan, 2023).

Table 1

|

Author |

Research context |

Approach to the EMO concept |

International channel partners' role |

International channel partner role |

Key finding |

|

Murray et al 2011 |

491 foreign progress founded in China |

Commulative |

- |

- |

International market orientation by improving product development, pricing, and communication abilities: Influences positively export venture performance |

|

Chung 2012 |

100 up to date New Zealand foreign progress |

Non-commulative |

- |

- |

The key aspects of intellectual generation and distribution have a positive effect on the key factor of responsiveness which results in high strategic export performance. Also, having strong business and political connections can influence how well these efforts work together |

|

Katiskea et al 2019 |

168 Greek assembling progress of foreign countries |

Noncommulative |

- |

- |

Collecting and sharing market information helps businesses create better export sales strategies, which in turn boosts their success in international markets. |

|

Ipek and Tanyeri, 2021 |

221 Turkish International Market project |

commulative |

- |

- |

The economic, legal, and cultural conditions in a company’s home country shape how much it focuses on international markets, and this focus helps improve its success in exporting |

|

He et al 2003 |

195 Chinese assembling international market entry |

Commulative |

- |

- |

When a company’s focus on international markets matches well with its home country’s conditions and the way it sells internationally, it tends to perform better in exports. |

|

He et al 2018 |

214 Chinese manufacturing export ventures |

Non-commulative |

- |

- |

The way a company sells its products globally affects how much it benefits from focusing on international markets |

|

Coming study |

246 Japanese Non-commulative Manufacturing |

|

|

Choosing international channel affiliates based on word-of-mouth referrals can influence export success, it helps companies gather useful market information but may make it harder for them to |

It usually sees better export performance when it sells directly (without affiliates) compared to when it works through channel associates. |

Research Model

Figure 1

Export Market Orientation

The Relationship Between the External Trade Market and the Export Business was a Close one.

External trade market defines the statement "the ability to access information to implement the strong effects on the significant logic of market-driven activities to gain the business success "It differentiates the domestic factors of market orientation as in the degree of intelligence activity that are categorized in distribution structure differences, sociocultural, competitive, geographical and political differences. (Cadogan et al., 2016, p. 5046) More precisely

It indicates the comprehensive statement regarding the customer preferences response, Foreign market pressures on institutions, and the behavior of competitors. It constitutes three dimensions with respect to export market orientation: The first one is the generation of international market insights, responsiveness, and distribution. Most researchers capture this comprehensive approach as the addition of these three components to provide clarification of the findings of the study (Ciszewska-Mlinaric, Siemieniako & Wojcik, 2024). These dimensions create different impacts on business results. The misleading results and incomplete information can lead to the aggregated approach and the dis-aggregated approach states the proper information about findings on export market orientation (Boso, Cadogan, & Story, 2012). This study basically used the segmented approach for proper analysis. The research majorly focuses on internal knowledge that plays a crucial role in the data collection by the use of explicit knowledge. The distinction between these categories shows the relationship between external knowledge the internal knowledge (Cadogan, 2012). The RBV theory relates the Association between the independent variables and dependent variables (Cavusgil & Zou, 1994). It interprets the demonstration of business results and persistence in the context of the firm's Reputation and unique abilities and resources. The producers of exporting should have unique intelligence activities for sustaining the knowledge about the foreign target buyers and rivals as well as the awareness gaining of the changes that occur in trade-related, valid, and cultural perspectives around their goods for export. Researchers in export marketing highlight export market significance. The company's focus on exporting is a vital factor for successful export results and business success. Market export orientation is often broken down into distinct aspects. Further, those aspects are inspected to view the effect on export performance (Cadogan, Cui, Morgan, and Story, V.M. (2006). Export marketing researchers analyze export market orientation in different portions and in detail in order to understand its benefits. The common way is to split market orientation into two parts: creating new data, distributing information (intelligence), and reacting according to the information (responsiveness). Intelligence activities are focused on analyzing and gathering data to understand present consumer actions and export opportunities. Responsive activities enable exporters to instantly cater to the demands of consumers and be competitive against opponents. Despite providing a profound understanding of export market orientation, many studies still disregard the importance of global platform partners (Cadogan, Kuivalainen, & Sundqvist, 2009). However, some extraordinary studies exhibit that exporters who handle distribution themselves (without the use of international channel partners) obtain more benefits than those who depend on international channel affiliates. Simultaneously, numerous exporters count on foreign affiliates-such as international buyers, domestic sales representatives, and international wholesalers- to reduce territorial, commercial, communication, and community-based obstacles while carrying out and using market-oriented activities. It is important to study exporters that use non-hierarchical channels (depending on global associates) and determine what type of foreign partners most effectively facilitate intelligence and responsiveness activities. A widely accepted theoretical foundation for analyzing the connections through activities focused on export markets (such as gathering intelligence and the resource-based approach (Barney, 1991), connects activities focused on responsiveness with performance outcomes. It makes the case that a company's worth and Its existence and financial results are determined by its unique resources and competencies. Superior intelligence operations enable exporting companies to better gather and preserve data on overseas clients and rivals, as well as understand the cultural, legal, and economic shifts pertaining to the export of their goods. A company may obtain valuable insights and forecast future long-term patterns, dormant client demands, and new prospects by using intelligence activities to understand the state of the export industry as a whole (Chung, 2012). Additionally, internal information sharing establishes a platform for information exchange, which leads to departmental or individual partnerships between top management and staff and may even foster unity among individuals and the settling of disputes between departments (Katsikea et al., 2019). The ability to give business partners, like importers and local agencies, relevant information is improved by the collection of data about users and the export surroundings. This strengthens these partners' cooperation and commitment to the export firm and improves business results (Ju et al., 2011). Therefore, the capacity to support intellectual operations might be seen as a useful asset. Furthermore, this capacity cannot be learned by reading textbooks or operational guidelines; because of its implicit and socially complicated character, it is a unique resource, Consequently, we put up the following theory:

H1a.Intelligence activity and export venture performance are positively correlated.

Another important and unique resource is the capacity to carry out responsiveness initiatives.

Achieving venture success is greatly aided by this reactivity to rivals, the export environment,

and international clients. Additionally, the capacity to carry out responsiveness exercises is not

readily created only by reading textbooks; as a result, and significant method

Consequently, we put up the following theory:

H1b. The performance of export ventures and response activities are positively correlated.

Moderating Role of International Channel Partner Type

Different export environments affect how well intellectual and responsiveness efforts perform in international markets. One such export environment is the host nation's foreign channel partners. For instance, an exporter who actively participates in intelligence operations If its overseas channel partners give inaccurate or skewed information regarding the host nation, ultimately makes judgments based on subpar information and receives subpar export results (Ishii, 2021). Similarly, if an exporter's foreign channel partners do not market The new products or brands from the seller in the foreign country may not lead to better customer satisfaction or a larger market presence if the seller does not take part in activities to understand and respond to customer needs (B?çakc?oglu-Peynirci, & Ipek, 2020). This inflexibility or relaxed behavior on the side of the foreign platform affiliates is known as a moral hazard or "hidden action" from the standpoint of agency theory. Exporting manufacturers are essential for effective intelligence and response operations and must stop their foreign channel partners' covert activities. On this front, agency theory (Bergen et al., 1992; Eisenhardt, 1989) offers a great deal of information. Agency theory states that by giving a job to someone else (such as an overseas platform associate), a principal (such as a manufacturing exporter) encounters agency issues. When there are knowledge asymmetries and aim incongruence between the two parties, issues occur. Moral hazard, sometimes known as the "hidden action" problem, is one agency issue (Bergen et al., 1992); In other words, while the agent is conversant with the principal's objectives. They strive to enhance their own benefit while undermining those objectives (e.g., by giving incorrect detail or performing improper advertising) work specifics and keep the principal in the dark about the objectives.

We believe that the way the foreign channel partner is chosen. According to Kikumori and Ishii (2023), the referrer makes it simple to share knowledge about their foreign affiliates, and it is comparatively simple for manufacturers to keep an eye on these channel partners' actions.

Because of this, behavior-based contracts regulate the interactions between exporting manufacturers and these channel partners, giving the manufacturers direct control over the actions of their channel partners. In particular, the manufacturer seeks close cooperation by offering material and financial assistance to partners introduced through word-of-mouth referrals, and it places stringent limits on how its products are advertised and on the introduction of new items (Cavusgil, Yeoh, & Mitri, 1995). However, because it is very expensive for manufacturers to keep an eye on the actions of these partners and there is a considerable degree of risk involved, connections formed by personal interactions with manufacturers are controlled by result-based contracts and goal inconsistency with these companies. Exporting manufacturers IMR 41,7 122 have no coordination with their channel partners, little financial or physical assistance, and manage them only on the basis of quantifiable results under the outcome-based contract (Lassar & Kerr, 1996). What are the task features of global market-driven strategies from the standpoint of

agency theory? Low outcome uncertainty and strong outcome measurability define the intelligence activity task. For the former, data on client sales and reports on shifts in the local market may be used to gather knowledge on export markets. Export environment, which facilitates the measurement of intelligence operations' results (Dong, Hinsch, Zou, & Fu, 2013).

Furthermore, the uncertainty of the results is also seen to be minimal because such data and reports may be produced by the careful gathering and arrangement of information. Channel partners under outcome-based contracts are more able to complete tasks with these features (Bergen et al., 1992; Eisenhardt, 1989). These associates, whose objectives coincide with exporting producers', aim to collect a multitude of information, are prepared to provide sales reports and offer comprehensive consumer data. However, because their objectives do not coincide with those of the exporters in the same manner as those regulated by result-based agreements, channel partners recommended by word-of-mouth and subject to behavior-based contracts are unable to offer detailed and valuable information (Homburg, Krohmer, & Workman, 2004).

Consequently, we put up the following theory [2]:

H2a. The favorable correlation between intellectual activities and international venture performance decreases as the number of foreign channel associates chosen through customer referrals increases. On the other hand, poor result traceability and high output variability are characteristics of response activities. For instance, addressing client complaints and marketing new items that cater to their demands are tasks that call on tacit knowledge and abilities; There are no precise assessment standards. There is also a great deal of uncertainty surrounding results; even if a new product is launched to satisfy consumer demands, its success will mostly depend on International channel partners recommended by word-of-mouth (WOM) and subject to behavior-based contracts are more suited to do such activities (Bergen et al., 1992; Eisenhardt, 1989). Manufacturers are able to customize their sales efforts by means of careful coordination and oversight to reach international clients and market their goods in a way that is suitable for their attributes. On the other hand, channel partners under performance-based contracts are inefficient in carrying out these duties (Bergen et al., 1992; Eisenhardt, 1989). They avoid several customer service initiatives that are unlikely to produce positive results or they avoid them altogether, citing the difficulty in quantifying the results.

As a result, they might, for instance, improperly address consumer concerns or ineffectively market new items. Consequently, we put up the following theory [3]:

H2b. The higher the favorable correlation between export and response activity, the more foreign channel partners are chosen via word-of-mouth recommendations on venture performance.

Methodology:

Research Context

We gathered data in Japan because of two key standards. The first is that Japanese businesses heavily rely on word-of-mouth (WOM) referrals due to strong collectivism, risk avoidance, long-term focus, and close social networks. As compared to Western countries firms, Japanese companies are more likely to use WOM referrals for the selection of partners. This made it possible to collect information from exporters who select foreign platforms based on suggestions as well as direct connections. International channel partners are the subject of the second. Manufacturing exporters in Japan's collectivist culture strive to establish solid bonds with foreign channel partners; they frequently choose exclusive agreements and collaborate with just one partner per nation (Ipek & B?çakc?oglu-Peynirci, 2020). This was a great fit with the study's goal, which was to investigate the function of foreign platforms in a certain nation.

Data Collection

To test the idea, data was gathered from Japanese exporting companies. We selected 911 Japanese exporting enterprises with more than 10 employees from a database of exporting businesses kept up to date by the Japan External Trade Organization.

Firstly, They communicated with each company by phone for their willingness to take part in the survey and to determine key information. Many firms were eliminated from 911 because of different purposes, for instance, unwillingness to incorporate or no further being involved in the market overseas, 555 firms were identified as eligible for our survey. We sent a survey to participants through email and followed up with a phone call to those companies that did not respond within two weeks. In sum, we got completed questionnaires from 281 companies. However, 35 responses were unworkable because of many missing values and the unuse of international channel partners, leaving us with 246 valid responses. In general, 246 companies employed 107 people and managed markets in 12 international sectors, such as China, the US, South Korea, Taiwan, and Hong Kong. These businesses worked in the food and beverage, electronics, manufacturing, and chemical industries. We included inquiries concerning respondents' engagement, expertise, and understanding of export sales in order to evaluate the key informant competency. The average knowledge, experience, and participation scores of the respondents were 5.0 (SD=2.5),

5.2 (SD=2.5), and 5.9 (SD=1.3), in that order. The respondents had been in their departments for

12.9 years (SD=10.4) and 19.7 years (SD=11.5). The majority of respondents held high positions such as section manager, department head, managing director, or president. This suggests that they have the necessary expertise and experience to make decisions for their companies.

Common Method Bias

While designing the survey work, we minimized the variance of common methods by following steps: We started by reviewing questions that were unclear and confusing, and then we made revisions

based on input from academic researchers and corporate managers. Second, we included questions about independent and dependent factors. Finally, we guaranteed secrecy to reduce respondents' assessment worries and social desirability bias. The marker variable (MV) approach developed by Lindell and Whitney (2001) was applied to examine common technique bias. The statement "Your company plans to create a product that has a limited number of possible buyers" (1=to no extent) to (7=to a very large extent) was used to weight the MV in this study. Comparing partial correlation coefficients (control for MV) versus uncontrolled correlation coefficients revealed a little variation in magnitude and significance. This implies that the study's typical method bias was not a major problem.

Measures

Export venture performance was assessed by four units that are based on He et al. (2013 and 2018). The two categories of intelligence activities were export intelligence creation and distribution. Each was measured with three items. In addition, responsiveness activity was assessed using three units Three items from Yang et al. (2017) were used to assess international channel partner selection through the word of mouth integration. Key control variables were included in the questionnaire. The count of employees working full-time in each factory that exports was used to control the size of the company. The length of time the company had been exporting goods was counted in order to control for export experience. The number of export markets that the company has entered was also counted in order to restrict the export scope. Furthermore, three questions from Eyuboglu et al. (2017) were used to evaluate diversity and management of environmental changes. Twelve questions from Sousa and Lages (2011) were also used to evaluate psychological distance. To ensure that all of the questionnaire questions in the model were valid, a confirmatory factor analysis was performed. The results show a decent match to the data. The other fit indices, including ?²/d.f. = 1.94, the chi-square test was significant (?² = 93.17, d.f. = 48, p < 0.01), and the non-normed fit index (NNFI = 0.95), comparative fit index (CFI = 0.97), incremental fit index (IFI = 0.97), and root mean square error of approximation (RMSEA = 0.062) were all within acceptable bounds.

These findings suggest a well-fitting model. Composite reliability (CR) exceeded 0.70 and average extracted variances (AVE) exceeded 0.50. The correlation between every conceivable pair of variables was less than the square roots of AVE. This indicates that the study's measuring items showed good discriminant and convergent validity.

Table 2

|

1 2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

||

|

Export venture (0.84) 0.22* |

0.28* |

0.22* |

0,18* |

0.08 |

0.14* |

0.17 |

0.02 |

0.02 |

_0.09 |

0.01 |

||

|

performance Export firm |

0.22* |

- |

0.30* |

0.12 |

0.35* |

0.14* |

0.18* |

0.28* |

0.22* |

0.01 |

0.06 |

0.06 |

|

performance Export |

0.28* |

0.29* |

(0.84) |

0.25* |

0.51* |

0.14 |

0.04 |

0.15* |

0.07 |

0.18 |

0.16* |

0.14 |

|

intelligence generation export |

0.22* |

0.12 |

0.25* |

(0.79) |

0.12 |

-0.12 |

-0.05 |

0.08 |

0.04 |

- |

-0.08 |

-0.09 |

|

intelligence dissemination Export |

0.18* |

0.35* |

0.50* |

0.12 |

(0.78) |

0.15 |

0.14* |

_0.16* |

0.13* |

0.16

0.05 |

0.02 |

0.16* |

|

intelligence responsiveness partner |

0.08 |

0.14* |

0.14 |

-0.12 |

0.15 |

(0.73) |

0.00 |

0.11 |

0.06 |

0.14 |

0.14 |

0.09 |

|

selection through WOM referral Firm size log |

0.14* |

0.18* |

0.03 |

-0.06 |

0.14 |

0.00 |

- |

0.23 |

0.23* |

0.02 |

-0.10 |

0.01 |

|

Export experience log Export scope |

0.17* |

0.28*

0.21 |

0,15

0.07 |

0.08

0.04 |

0.16*

0.13 |

0.11

0.66 |

0.23*

0.23 |

-

0.49* |

0.49*

- |

- 0.07 - |

0.03

-0.02 |

-0.02

0.02 |

|

log Environmental |

0.02 |

0.00 |

0.18* |

-0.16 |

0.05 |

0.14* |

0.02 |

-0.07 |

-0.10 |

0.10 - |

0.46* |

0.25* |

|

dynamism Environmental |

-0.09 |

0.06 |

0.16** |

-0.07 |

0.02 |

0.14* |

-0.10 |

0.03 |

-0.02 |

0.44 |

- |

0.15* |

|

diversity Psychic |

0.01 |

0.05 |

0.14 |

-0.09 |

0.16 |

0.09 |

0.01 |

-0.02 |

0.02 |

0.25 |

0.15 |

- |

|

distance Mean |

3.44 |

28.00 |

4.06 |

4.64 |

4.62 |

3.72 |

4.19 |

11.16 |

16.15 |

3.43 |

4.47 |

4.59 |

|

Standard |

1.46 |

31.74 |

1.27 |

1.12 |

1.34 |

1.45 |

1.47 |

15.68 |

13.10 |

1.30 |

1.23 |

1.05 |

|

deviation Max |

7.00 |

100.00 |

7.00 |

7.00 |

7.00 |

7.00 |

10.09 |

120.00 |

80.00 |

7.00 |

7.00 |

7.00 |

|

Min |

1.00 |

0.10 |

1.00 |

2.00 |

1.00 |

1.00 |

1.10 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

Endogeneity

Since reverse casualty may have an impact on two categories, we took into account the likelihood that a company with better export performance may have greater resources. This was addressed by checking for endogeneity bias Ipek, I. and Tanyeri, M. (2021). For this, instrumental variable regression using two-stage least squares (2SLS) was employed. This approach necessitates identifying a variable that influences an independent variable but is unrelated to the model's error term. For instruments, three variables related to premium product offerings are used. Exporting manufacturers that provide premium quality products with high prices are often market-oriented but it does not guarantee high export outcomes Jean, R.-J.B., Deng, Z., Kim, D. and Yuan, X. (2016).

All instruments met the exogenetic condition, as evidenced by the Sargan test's failure to reject the null hypothesis (p > 0.10). All of the F statistics from the first stage were significant (p < 0.01). The components linked to intelligence and reaction activities may be considered exogenous, as shown by Wu-Hausman's failure to reject the null hypothesis (p > 0.10).

Analysis

For testing theory. They used the ordinary least squares approach to do hierarchical regression analysis (Ishii, 2022). Three models were used in this investigation. Only control variables were included in Analysis 1. All factors were included in Analysis 2, with the exception of the interaction term between intelligence and responsiveness activities and the choice of channel partner based on word-of-mouth recommendations. These interaction terms were used in Analysis 3. Mean calculated scores are utilized prior to the inclusion of interaction variables in the study.

The adjusted sum of the squares for modes 1, 2, and 3 were 0.02, 0.11, and 0.14 respectively. F-tests for change in R2 indicated the difference between Analysis 1 and 2 (?0.09, p < 0.01), and from Analysis 2 and 3 (?0.03, p < 0.01) was analytically accurate. Hence, Analysis 3 was used in theory. One-tailed tests were used for hypothesis testing because our hypotheses were all directional.

Discussion

While earlier studies on marketing have focused on the advantages of being aware and quick to react, there is limited understanding of how the type of foreign channel partner may influence these factors (Ishii, 2024). To address this gap, we examine if word-of-mouth (WOM) recommendations assist in choosing partners by analyzing how intelligence and responsiveness operations affect the success of export activities. Notably, at the function level (firm level) the effect of responsiveness activities is positive and strong but not necessarily at the venture level. This could be due to Japanese firms' culture that is strong clan culture (Desphande & Farley, 2004). This culture highlights forming long-term and comprehensive vision by generating and sharing information that helps to minimize conflicts within departments. One market product in a company's extensive portfolio is called a venture (Jean, Deng, Kim, & Yuan, 2016). Japanese businesses place a strong emphasis on long-term, comprehensive vision, which means that market-oriented responsiveness is more concerned with firm-level goals rather than venture-related matters in the short term. We could have gotten results on the long-term impact of responsiveness if we had followed Japanese companies for a longer time.

Interestingly, the fact that responsiveness activity has no significant influence, implies that it does not have a strong impact on task progress, It suggests that, on average, it has no effect on venture success across all channel partner selections. Simply put, there is no meaningful correlation between responsiveness and performance whether channel partners are chosen through direct contact or word-of-mouth referrals (Lengler, Sousa, & Marques, 2013). However, the association between responsiveness activity and venture is positive and substantial when WOM referrals are significantly dependent upon, confirming hypothesis H1b. These results are consistent with earlier research on channel difficulties. Export-driven benefits from the use of readily guarded and coordinated routes, according to He et al. (2018). According to our results, export market-oriented responsiveness necessitates an easy-to-communicate route created by word-of-mouth referrals in order to drive venture success.

Our analysis offers important insights for researchers studying export performance theory. We present actual evidence that illustrates the distinct impacts of intelligence and resp Our findings indicate that responsiveness initiatives have a major impact on export function performance.

However, intelligence activities pertaining to inputs have a greater effect on venture-level performance.

Moreover, our survey identifies a new facilitating factor for export market orientation that makes it valuable to researchers (Li, M., He, X. & Sousa, 2017). According to earlier research, environmental variables (market competition, institutional distance) and business characteristics (organizational structure, strategy orientation) may facilitate or impede export market orientation. As a result, the significance of foreign channel partner features is ignored in current studies. On the other hand, our research investigates how the kind of foreign channel partners may either help or hurt export market orientation efforts in terms of performance outcomes.

Although both intelligence and responsiveness play a part in export market orientation, we propose that they differ in terms of result measurability and certainty.

Furthermore, our research suggests that behavior-based contracts apply to partners chosen through word-of-mouth recommendations, whereas outcome-based contracts govern partners picked through direct interactions. Our research shows that although direct connections are better suitable for intelligence operations, WOM-referred partners are more suited for responsiveness activities. Overall, our work presents the explanation of agency theory by using it in the context of export marketing and presenting empirical evidence that aligning task features with contract qualities can better results.

Managerial Implications

Our research provides business managers with useful information on export manufacturing companies. Export manufacturing firms can choose four different patterns, that differ in intelligence activity and way of selection of international channel partners. Firms that have low levels of intelligence activity should work on increasing it. Doing so will help them to predict future trends and improve internal relationships, ultimately leading to better outcomes. Exporters who focus heavily on intelligence activities and prefer a selection of partners through WOM referrals should also consider selection through direct contacts if they want to maximize the advantages of intelligence activities. Exporters who actively participate in high-intelligence activities choose partners through direct contacts and continue with this strategy is more likely to yield higher results. Likewise, exporting manufacturing firms can choose four points, that differ in intelligence activity and selection method of international channel partners. Exporters that choose WOM referrals for partner selection but have low responsive activity should quickly enhance their level. This will help them to improve performance in export ventures. Firms that choose partners through direct contacts and have high responsiveness activity may struggle to get an advantage from their efforts. To maximize the benefit, they should select partners through WOM referrals and focus on their responsiveness activities on strong and close relationships. Exporters who have low responsiveness activities and select partners through direct contacts will find it hard to obtain the benefits of responsiveness. For this, they would need to enhance both responsiveness efforts and change selection methods. Since they are already seeing good results, exporters who participate in sensitive tasks with WOM referrals should continue with their existing approach.

Limitations and future research directions

There are four limitations to the study, all of which present chances for further investigation. The first is that one individual per business is surveyed using cross-sectional data. Despite its widespread usage in export marketing research, this approach carries the danger of common technique bias. It is crucial to employ longitudinal data or gather information from several respondents inside the same company in order to get around these methodological issues.

Furthermore, employing longitudinal data provides a chance to investigate the ways in which export market orientation affects venture success over the short and long terms. Therefore, in order to obtain deeper and more precise insights, researchers need to work on future studies.

Second, the contract forms utilized to manage foreign channel partners that are obtained by word-of-mouth and direct contact are not examined in this study. Future research should look into how different types of contracts are connected. (behavior-based and outcome-based contracts) and the methods of choosing foreign channel partners (WOM referrals and direct contact).

However, because they improve export performance in various ways, According to Katsikea et al. (2019, p. 2096), it is necessary to view the creation and sharing of export market information as separate concepts. As a result, scholars ought to investigate the distinctions between the creation and distribution of intelligence. Furthermore, future studies can investigate the relationships between the three market orientation dimensions, examine how the three dimensions affect performance results, and identify the elements that promote or impede effectiveness. These initiatives would contribute to the development of a thorough comprehension of export market orientation.

Finally, the study demonstrates a moderation of international channel partner types on export market-oriented performance and activities. It remains uncertain, however, how various channel-related factors contribute to or detract from the advantages of intelligence and responsiveness initiatives.

For a deeper understanding, further studies should examine how channel problems and multinational marketing tactics interact.

References

Cite this article

-

APA : Tariq, M., & Khan, Z. U. (2024). Export Market Orientation and Performance: Comparing Partner Selection Via Referrals and Direct Contact. Global Social Sciences Review, IX(IV), 277-290. https://doi.org/10.31703/gssr.2024(IX-IV).25

-

CHICAGO : Tariq, Maham, and Zargham Ullah Khan. 2024. "Export Market Orientation and Performance: Comparing Partner Selection Via Referrals and Direct Contact." Global Social Sciences Review, IX (IV): 277-290 doi: 10.31703/gssr.2024(IX-IV).25

-

HARVARD : TARIQ, M. & KHAN, Z. U. 2024. Export Market Orientation and Performance: Comparing Partner Selection Via Referrals and Direct Contact. Global Social Sciences Review, IX, 277-290.

-

MHRA : Tariq, Maham, and Zargham Ullah Khan. 2024. "Export Market Orientation and Performance: Comparing Partner Selection Via Referrals and Direct Contact." Global Social Sciences Review, IX: 277-290

-

MLA : Tariq, Maham, and Zargham Ullah Khan. "Export Market Orientation and Performance: Comparing Partner Selection Via Referrals and Direct Contact." Global Social Sciences Review, IX.IV (2024): 277-290 Print.

-

OXFORD : Tariq, Maham and Khan, Zargham Ullah (2024), "Export Market Orientation and Performance: Comparing Partner Selection Via Referrals and Direct Contact", Global Social Sciences Review, IX (IV), 277-290

-

TURABIAN : Tariq, Maham, and Zargham Ullah Khan. "Export Market Orientation and Performance: Comparing Partner Selection Via Referrals and Direct Contact." Global Social Sciences Review IX, no. IV (2024): 277-290. https://doi.org/10.31703/gssr.2024(IX-IV).25