Abstract

The objective of this research is to investigate the potential moderating role of ISO14001 in the relationship between corporate governance and firm financial performance. Corporate governance is measured using four dimensions, the variable considered in this analysis encompass board size, frequency of board meetings, gender diversity within the board, and the presence of independent non-executive directors. The assessment of financial performance involves both accounting-based and market-based metrics. The results of this study are obtained from annual company reports, and the study employs purposive sampling with a sample size of 70 manufacturing firms from the PXS 100 index. The empirical findings indicate that CG has a positive significant influence on both ROA and Tobin's Q. Additionally, ISO14001 significantly moderates the relationship between CG and FP.

Key Words

Corporate Governance, Financial Performance, Environmental Management Standards, Return on Asset, Tobin’s Q

Introduction

There is a substantial ongoing debate about the relationship between CG and FP in the previous literature. Scant literature has shown that CG enhances a firm's reputation in the market, which helps firms to compete with other companies in the market, and attracts foreign investors (Ehikioya, 2009). The importance of CG was highlighted after the East Asia crises, which were caused by a lack of governance and negligence (Berglöf & Von Thadden, 1999). Corporate governance practices vary across countries, and every country has different challenges to implementing proper governance systems in the corporate sector (Pi & Timme, 1993; Shleifer & Vishny, 1997). CG practices are based on the institutional background, culture, political structure, and norms of the country (North, 1990). There are various codes of CG that exist, and governments try to develop those codes that enhance their business practices at an international level (Prowse, 1994). Corporate governance is defined in multiple ways by researchers at a global level. The two main approaches include the internal corporate governance structure, which describes the behaviour of regulators, stakeholders, and investors within the organization, and the external corporate governance structure, which describes the firm's behaviour under the rules prescribed by the legal system (Black, 2001; Claessens et al., 1999). A weak system of CG emphasizes the importance of a good CG structure in the organization (Berkman et al., 2009). Firms with weak corporate governance structures often face agency problems, as managers only focus on their interests, leading to higher agency conflicts between managers and shareholders (Core et al., 1999; Letza et al., 2004). In contrast, good corporate governance practices assure investors and shareholders about their investment (Shleifer & Vishny, 1997). Resource Dependency theory suggests that boards of directors have access to resources and networks that are not available within the organization, which can enhance the profitability of the firm. This theory emphasizes the importance of the board's role in resource allocation and management (Hillman et al., 2009).

On the other hand, Stewardship theory suggests that directors act as stewards of the firm, working in the best interests of shareholders rather than their own interests (Davis et al., 1997b) This theory suggests that directors are motivated by a sense of responsibility and obligation to their stakeholders, and not just by financial incentives (Muth & Donaldson, 1998)

While Dynamic Capability theory focuses on the benefits of adopting environmental management standards in the organization (Zollo & Winter, 2002). This theory suggests that firms that adopt such standards can gain a competitive advantage in the market, as they are better equipped to respond to changes in the external environment (Concepción López-Fernández & Serrano-Bedia, 2007).

Moreover, the institutional theory stresses the importance of conforming to environmental management standards in the organization, as this can enhance the legitimacy and reputation of the firm (Jennings & Zandbergen, 1995). This theory suggests that firms that comply with these standards are more likely to attract investors and customers who are interested in socially responsible business practices (Christmann & Taylor, 2006; Tourais & Videira, 2016).

A lot of work has been done in developed countries to assess the influence of CG on FP (Gompers et al., 2003; Guest, 2008; Kang & Shivdasani, 1995), but the importance of good corporate governance has also increased in developing nations (Dash & Raithatha, 2019; Kyereboah-Coleman, 2007). However, there is still a need to address this issue in developing countries like Pakistan, where very little work has been done, as previous studies have used small sample sizes (Latif et al., 2013; Riaz et al., 2022). The objective of this research is to examine the influence of CG on FP in Pakistan while considering the moderating effect of ISO 14001. The study utilizes a sample of manufacturing companies that are listed on the KSE 100 index of the PSE. The second part of this study reviews the relevant literature, the third part discusses the sample selection process, the fourth section shows the empirical results, and the final section concludes the study.

Conceptualization

This section explains the past research work in the prescribed manner by explaining the association among all the variables.

Corporate Governance and Financial Performance

Numerous global studies have been conducted to explore the influence of CG on FP. This section contains previous research from different countries. Mashayekhi and Bazaz (2008) examine the impact of CG on FP during the period from 2005 to 2006. There is a positive association between independent directors and FP. Azeez (2015) conducted a study in Sri Lanka to investigate the association between CG and FP. The study obtained data from 100 listed companies on the Colombo Stock Exchange from 2010 to 2012. The results showed a positive association between the CEO of the organization and the FP. Vo and Nguyen (2014) Investigated the correlation between CG and FP, utilizing data from 177 publicly listed firms in Vietnam spanning the period from 2008 to 2012. The findings showed a direct link between CEO duality and FP.

Cremers and Nair (2005) state that internal as well as external CG plays an important role in the performance of the firm. Brickley et al. (1994) examine the association between outside directors and the adaptation of poison pills, and the results show a positive association among these variables. Mashayekhi and Bazaz (2008) show a positive association between the outside board of directors and FP in Iranian companies from 2005 to 2006. Ehikioya (2009) states the association between CG and FP by using the 107 firms from 1998 to 2002 and shows the positive association between the size of the firm, directors, and FP. Another study shows a positive association between firm size and FP by using 174 firms from 2010 in Siri Lanka.

Kapopoulos and Lazaretou (2007) have established a connection between corporate ownership structure and FP. This current study, analyzing 175 listed Greek firms, presents evidence of a positive correlation between ownership structure and firm profitability. Some studies explain there is no association between CG and FP. The association between outside directors and FP is not positive; there is an insignificant association between the firm board and the CEO in China using 60 firms (Wen et al., 2002). Fooladi and Nikzad Chaleshtori (2011) also studied in Malaysia, on the base of this study the results do not show any evidence of an existing relationship among CG and FP. Hermalin and Weisbach (1991) also study the relationship between CG and FP and found no relationship between CG and FP. The above discussion leads to the first hypothesis.

H1: Corporate governance significantly influences the financial performance of firms

Corporate Governance, Environmental Management Standard & Financial Performance

The environmental management standards consist of a family of standards, rather than a single one. These standards are introduced to protect the environment, and ISO14001 is one of them. The climate conference meeting was held in Paris to instruct countries to follow environmental management standards and environmental practices (Palea & Drogo, 2020; Secinaro et al., 2020). All countries agreed to follow environmental management standards as they were aware of the importance of environmental management standards (Birindelli & Chiappini, 2021). All public and private companies agreed to follow these standards as they control environmental issues (Delmas & Toffel, 2008; Erauskin?Tolosa et al., 2020; Li et al., 2018; Melnyk et al., 2003). At that time, investors only wanted to invest in organizations that follow environmental standards (Secinaro et al., 2020). The importance of environmental management standards is also known by stakeholders (Delmas, 2001), and they force organizations to follow these standards to compete in the market (Klassen & Vachon, 2003). Therefore, many organizations started to follow environmental standards (Nakamura et al., 2001) and improve operations with these standards (Kitazawa & Sarkis, 2000). In 1996, organizations started to follow ISO14001 in their business, but now the importance of ISO14001 has increased worldwide, and organizations are aware of its significance (Bazanini, 2020).

According to Delbridge et al. (1998) implementing ISO14001 standards in an organization can enhance its profitability. In a study conducted by Budiharjo (2020), the author examined the association between environmental performance, CG, firm leverage, and firm value. The findings indicate a positive association between environmental performance and its impact on the firm’s performance. (He & Shen, 2019) investigated the effect of ISO14001 certification on corporate technology, specifically in China. The results revealed that ISO certification provides valuable resources and facilitates technological innovation within firms. However limited research exists on the interaction between corporate governance (CG) and ISO14001 as a moderator in relation to financial performance (FP) and how companies incorporate environmental considerations while meeting their financial performance goals. This discussion highlights the significance of CG mechanisms in influencing an FP, supporting the second hypothesis of the present study.

H2: Corporate governance significantly influences the financial performance of firms through the moderating role of ISO 14001

Methodology

Sources of Data & Measurement of Variables

The data of this study is obtained from 70 registered manufacturing companies from Pakistan Stock Exchange. Annual reports are used to collect data from 2017 to 2021 (KSE100 Index). This study uses the quantitative research methodology.

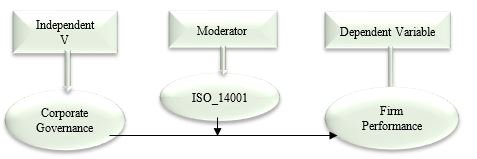

Figure 1

Conceptual Framework

The figure is showing the relationship between independent and dependent variables with the moderator. CG is the independent variable the dependent variable of this study is the Firm Performance and the moderating variable is the ISO14001. This study seeks to explore the influence of CG on FP and to examine the potential moderating effect of ISO 14001 in the relationship between CG and FP.

Table 1

Measurement of Variables

|

Variables |

Measurement |

References |

|

Board size |

The total number of board members |

(Kyereboah-Coleman

& Biekpe, 2006) |

|

Board meeting |

The whole number of board meetings during the year. |

(Narwal &

Jindal, 2015) |

|

Gender diversity |

The proportion of women directors to the total number of board

members |

(Francoeur et

al., 2008) |

|

Independent non-executive directors |

Number of independent non-executive directors on the board |

(Zattoni

& Cuomo, 2010) |

|

ISO-14001 |

A dummy variable was employed in the analysis. Companies registered

under ISO 14001 were assigned a value of 1 While Companies not adhering to

ISO 14001 were assigned a value of 0 for donation purposes. |

(Wu et al.,

2007) |

|

Firm age |

The disparity between the establishment of a company in the past and

the present day. |

(Hansen,

1992) |

|

Firm size |

Log of total assets |

(Embong et

al., 2012) |

|

Asset growth |

The previous value of assets is deducted from the present value and

then divided by the previous value. |

(Cooper et

al., 2008) |

|

Return on asset |

The PBT is divided by the total assets |

(Ghaffar

& Khan, 2014) |

|

Tobin’s Q |

The market value of a

company is divided by its assets |

(Hejazi et

al., 2016) |

Findings

Descriptive Analysis

It provides a summary of the sample data collected and helps to

understand the characteristics of the data. They can be used to identify any

outliers or unusual data points in the sample, as well as to compare the

central tendency and variability of different variables. In this case, the mean

values, standard deviations, and ranges of the variables provide insights into

the level of corporate governance, firm financial performance, control

variables, and ISO14001 in the sample. This information can be used to conduct

further analyses and draw conclusions about the relationships between these

variables. When analyzing descriptive statistics, the mean value serves as a

measure of central tendency. On the other hand, the standard deviation

indicates the extent to which the data is dispersed around the mean.

A low standard deviation indicates that the data points are tightly

grouped around the mean, whereas a high standard implies a greater spread of

data. Corporate governance is the independent variable. From table 2 of

descriptive statistics the total no. of observations of CG 323, the mean value

9.29e-10 and the standard deviation is 1.223. The FP include the ROA and

Tobin's Q. The total of no. of observations of ROA is 349, the mean value

0.0956 and the standard deviation 0.109. Tobin's Q shows the total no. of

observations as 349, with a mean value of 1.883 and a standard deviation of

2.414. Similarly, the distractive statistics of the control variable are given

in the table Firm size has 329 The

moderating variable is ISO 14001, the moderation variable has 350 observations,

the mean value is .031 and the standard deviation is 0.749.

Table 2

Descriptive Statistics

|

Variable |

Mean |

Std. dev. |

Min |

Max |

Observations |

|

ROA |

.0956 |

0.109 |

-0.8844 |

0.4807 |

349 |

|

Tobin’s Q |

1.883 |

2.414 |

-0.1530 |

23.041 |

349 |

|

CG |

9.29e-10 |

1.223 |

-3.4511 |

8.0635 |

323 |

|

Asset Growth |

0.1334 |

0.602 |

-9.5249 |

3.9722 |

350 |

|

Firm Age |

50.294 |

33.07 |

33.077 |

4.000 |

350 |

|

Firm Size |

24.525 |

1.213 |

1.213 |

20.549 |

329 |

|

ISO14001 |

0.031 |

0.74 |

-3.451198 |

7.494 |

350 |

Correlation

Analysis

The correlation matrix is given in Table 3. Correlation is a

statistical method used to examine the association among various variables in a

study. In this particular study, the independent variable is the index of CG

while the measurements of the dependent variable are ROA and Tobin's Q. The

analysis also includes control variables such as asset growth, firm age and

firm size as well as the moderator variable, ISO14001. Correlation analysis

determines the strength and direction of the relationship between these

variables (Allen et al., 2008; Reinard, 2006). Correlation can be positive, negative, or indicate no correlation.

The possible range of correlation values is from +1 to -1. Values ranging from

0 to -1 indicate a negative correlation, suggesting that variables move in the

opposite direction. Conversely, values ranging from 0 to +1 indicate a positive

correlation, indicating that the variables move in the same direction.

A correlation coefficient of zero suggests

that there is no linear relationship between the two variables. It is important

to note that this applies specifically to linear relationships. In the provided

table, all diagonal correlation values are 1.00, indicating perfect correlation

among the variables.

This study highlights the existence of robust inter-relationships

between the dimensions of CG and FP. The correlation analysis reveals

significant and positive associations among the various dimensions of corporate

governance. Each dimension not only positively influences firm performance but

also moderates or interacts with other dimensions, thereby contributing to

overall firm performance. The variance inflation factor (VIF) is employed as a

diagnostic tool to assess multi-collinearity issues in regression analysis. It

measures the level of multi-collinearity within the data. When the VIF value

exceeds 10, it suggests the presence of multicollinearity, which needs to be

addressed (O'Brien, 2007). In the current study, the mean VIF value is determined to be 1.41,

indicating the absence of significant multicollinearity concerns, as the mean

value is below 10 per cent.

Table 3

Correlation Matrix

|

Variables |

VIF |

Tobin’s Q |

ROA |

CG |

MOD |

AG |

FA |

FS |

|

Tobin’s Q |

--- |

1.0000 |

|

|

|

|

|

|

|

ROA |

---- |

0.1468 |

1.0000 |

|

|

|

|

|

|

CG |

2.01 |

-0.0882 |

0.0296 |

1.0000 |

|

|

|

|

|

ISO-14001(MOD) |

1.74 |

-0.0347 |

0.0928 |

0.6516 |

1.0000 |

|

|

|

|

AG |

1.00 |

-0.0196 |

0.0340 |

0.0349 |

0.0183 |

1.0000 |

|

|

|

FA |

1.03 |

0.2168 |

0.0960 |

-0.0609 |

-0.0241 |

0.0247 |

1.0000 |

|

|

FS |

1.26 |

-0.4694 |

-0.1448 |

0.4331 |

0.2703 |

-0.0021 |

0.1129 |

1.0000 |

Regression

Analysis

Table 4 examines the association between CG and FP, firm performance

assessed through Tobin's Q and ROA measurements. Heteroskedasticity arises when

there are varying standard deviations observed across different values of the

independent variable. A significant P-value indicates the presence of

heteroscedasticity. To address the issue of heteroscedasticity, it currently utilizes

robust regression to estimate the relationship among variables. Regression

evaluates all the observations based on their individual behaviour and

characteristics (Khoshravesh et al., 2017).

The

significant relationship between CG and FP is based on a 10% significant level.

In Tobin's Q the P value of CG is 0.079 which is less than 10%. It shows a

positive relationship with corporate governance, by

testing the relationship of CG with ROA has positive relation as the CG value

is 0.018 which is also less than 10%.

Table 4

Relationship of Corporate Governance with

Tobin's Q and ROA

|

Variables |

Tobin’s

Q |

ROA |

||

|

Coefficient |

P-Values |

Coefficient |

P-Values |

|

|

CG |

.07929 |

0.079 |

0.0113 |

0.018 |

|

Asset

Growth |

-.07839 |

0.624 |

-0.0009 |

0.956 |

|

Firm

Age |

.00267 |

0.101 |

0.0003 |

0.059 |

|

Firm

Size |

-.24993 |

0.000 |

-0.024 |

0.000 |

|

Constant |

7.3572 |

0.000 |

0.6708 |

0.000 |

The given below table 5 shows the relationship of CG and FP with the

moderator of ISO 14001. The P value of ISO14001 (moderator variable) is 0.0891

in the case of Tobin's Q & & 0.010 in the case of ROA. These values

express that ISO14001 is significantly moderate between CG and FP.

Table 6

Relationship of Corporate Governance with Tobin's Q and ROA

|

Variables |

Tobin’s

Q |

ROA |

||

|

Coefficient |

P-Values |

Coefficient |

P-Values |

|

|

0.07373 |

0.199 |

.0030887 |

0.608 |

|

|

ISO-14001(MOD) |

0.011221 |

0.0891 |

.0222182 |

0.010 |

|

Asset Growth |

-0.0773 |

0.631 |

.002915 |

0.863 |

|

Firm Age |

0.00268 |

0.101 |

.0003122 |

0.069 |

|

Firm Size |

-0.2511 |

0 |

-.0236806 |

0.000 |

|

Constant |

7.38623 |

0 |

.6584111 |

0.000 |

Discussion

This study investigates the association between CG and FP. CG is treated as the independent variable, with proxies such as board size, board meetings, gender diversity, and independent non-executive directors used to measure it. Firm performance (FP) serves as the dependent variable and is assessed through metrics such as ROA and TQ. Additionally, ISO14001 is considered a moderator variable. According to the result, there is a significant positive impact of CG on TQ in the manufacturing sector of Pakistan. This finding aligns with the results reported by (Singh et al., 2018) who also find the impact of GC on firm performance is positive with TQ as a measure. Moreover, when evaluating the impact of CG on FP using ROA, our study indicates a positive influence. This outcome is consistent with the findings of (Vo & Nguyen, 2014), Conducted the study found a noteworthy positive influence of CG on FP, as assessed through the measurement of return on asset (ROA). As a result, the first hypothesis (H1) is supported. The acceptance of the second hypothesis is supported by the results, demonstrating a significant moderating effect of ISO14001 on the association between CG and FP. In a study by Oyewale and Johl (2021), they found that ISO14001 plays a significant moderating role between green growth and sustainability. However, limited prior research is available regarding the relationship between CG and ISO1400.

Conclusion

In general, this research added to the current body of knowledge by presenting practical proof of the association between CG and FP within a developing country context with the moderating role of ISO14001. The findings indicate that CG positively impacts FP, and ISO14001 can strengthen this relationship. The study highlights the position of CG practices, such as board size, board meetings, gender diversity, and independent non-executive directors, in improving firm performance and protecting shareholders' interests. However, there are some limitations to the study, including its focus on only manufacturing industries in Pakistan and the exclusion of some years of data. There is also a possibility of other control variables that could be used to strengthen the analysis. Additionally, the study did not examine the relationship between CG and non-financial measures of performance. Future studies could consider these limitations and explore other factors that may influence the association of CG and FP in different industries and economies. Nonetheless, this study contributes to the literature on agency theory, and stewardship theory in Pakistan and provides practical implications for firms and policymakers looking to improve corporate governance practices.

References

- Aarts, F. M., & Vos, E. (2001). The impact of ISO registration on New Zealand firms’ performance: a financial perspective. The TQM Magazine, 13(3), 180–191.

- Ahmed, E., & Hamdan, A. (2015). The impact of corporate governance on firm performance: Evidence from Bahrain Bourse. International Management Review, 11(2), 21-37.

- Azeez, A. A. (2015). Corporate Governance and Firm Performance: Evidence from Sri Lanka. Journal of Finance and Bank Management, 3(1), 180–189.

- Berglof, E., & von Thadden, E.-L. (1999). The Changing Corporate Governance Paradigm: Implications for Transition and Developing Countries. SSRN Electronic Journal.

- Berkman, H., Zou, L., & Geng, S. (2009). Corporate governance, profit manipulation and stock return. Journal of International Business and Economics, 9(2), 132-145.

- Bhagat, S., & Bolton, B. (2008). Corporate governance and firm performance. Journal of Corporate Finance, 14(3), 257–273.

- Birindelli, G., & Chiappini, H. (2020). Climate change policies: Good news or bad news for firms in the European Union? Corporate Social Responsibility and Environmental Management, 28(2), 831–848.

- Black, B. (2001). The corporate governance behavior and market value of Russian firms. Emerging Markets Review, 2(2), 89– 108.

- Block, P. (1993). Stewardship: Choosing service over self-interest. Berrett-Koehler Publishers.

- Brickley, J. A., Coles, J. L., & Terry, R. L. (1994). Outside directors and the adoption of poison pills. Journal of Financial Economics, 35(3), 371–390.

- Budiharjo, R. (2020). Effect of environmental performance, good corporate governance and leverage on firm value. American Journal of Humanities and Social Sciences Research (AJHSSR), 4(8), 455-464.

- Chen, F., Ngniatedema, T., & Li, S. (2018). A cross-country comparison of green initiatives, green performance and financial performance. Management Decision, 56(5), 1008–1032.

- Claessens, S., Djankov, S., & Lang, L. H. (1999). Who controls East Asian corporations, and the implications for legal reform. World Bank.

- Core, J. E., Holthausen, R. W., & Larcker, D. F. (1999). Corporate governance, chief executive officer compensation, and firm performance. Journal of Financial Economics, 51(3), 371–406.

- CREMERS, K. J. M., & NAIR, V. B. (2005). Governance Mechanisms and Equity Prices. The Journal of Finance, 60(6), 2859– 2894.

- Dash, S. R., & Raithatha, M. (2019). Corporate governance and firm performance relationship: Implications for riskâ€adjusted return behavior. Managerial and Decision Economics, 40(8), 923–940.

- Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Davis, Schoorman, and Donaldson Reply: The Distinctiveness of Agency Theory and Stewardship Theory. The Academy of Management Review, 22(3), 611–613.

- Delbridge, T. R., Bailey, B., Chew, J. L., Conn, A. K. T., Krakeel, J. J., Manz, D., Miller, D. R., O’Malley, P. J., Ryan, S. D., Spaite, D. W., Stewart, R. D., Suter, R. E., & Wilson, E. M. (1998). Ems agenda for the future: Where we are … where we want to be. Prehospital Emergency Care, 2(1), 1–12.

- Delmas, M. A., & Toffel, M. W. (2008). Organizational responses to environmental demands: opening the black box. Strategic Management Journal, 29(10), 1027–1055.

- Doidge, C., Andrewkarolyi, G., & Stulz, R. (2007). Why do countries matter so much for corporate governance?. Journal of Financial Economics, 86(1), 1–39.

- Dowell, G., Hart, S., & Yeung, B. (2000). Do Corporate Global Environmental Standards Create or Destroy Market Value? Management Science, 46(8), 1059– 1074.

- Ehikioya, B. I. (2009). Corporate governance structure and firm performance in developing economies: evidence from Nigeria. Corporate Governance: The International Journal of Business in Society, 9(3), 231–243.

- Erauskinâ€Tolosa, A., Zubeltzuâ€Jaka, E., Heras†Saizarbitoria, I., & Boiral, O. (2019). ISO 14001, EMAS and environmental performance: A metaâ€analysis. Business Strategy and the Environment, 29(3), 1145– 1159.

- Gompers, P. A., Ishii, J. L., & Metrick, A. (2003). Corporate Governance and Equity Prices. SSRN Electronic Journal, 118(1), 107–156.

- Grotta, R. C., Machado Júnior, C., Souza, M. T. S. de, Ribeiro, D. M. N. M., & Bazanini, R. (2020). Analysis of the affinity of the principles of corporate governance to the ISO 14001 environmental management system standard. Gestão & Produção, 27(2).

- Guest, P. M. (2008). The determinants of board size and composition: Evidence from the UK. Journal of Corporate Finance, 14(1), 51– 72.

- He, W., & Shen, R. (2017). ISO 14001 Certification and Corporate Technological Innovation: Evidence from Chinese Firms. Journal of Business Ethics, 158(1), 97–117.

- Hillman, A. J., Cannella, A. A., & Paetzold, R. L. (2000). The Resource Dependence Role of Corporate Directors: Strategic Adaptation of Board Composition in Response to Environmental Change. Journal of Management Studies, 37(2), 235–256.

- Hillman, A. J., Withers, M. C., & Collins, B. J. (2019). Resource Dependence Theory: A Review. Journal of Management, 35(6), 1404–1427.

Cite this article

-

APA : Rasool, N., & Zulfiqar, Z. (2023). Relationship between Corporate Governance and Financial Performance of Manufacturing Firms through Moderating Role of ISO-14001. Global Social Sciences Review, VIII(II), 581-591. https://doi.org/10.31703/gssr.2023(VIII-II).52

-

CHICAGO : Rasool, Nosheen, and Zunaira Zulfiqar. 2023. "Relationship between Corporate Governance and Financial Performance of Manufacturing Firms through Moderating Role of ISO-14001." Global Social Sciences Review, VIII (II): 581-591 doi: 10.31703/gssr.2023(VIII-II).52

-

HARVARD : RASOOL, N. & ZULFIQAR, Z. 2023. Relationship between Corporate Governance and Financial Performance of Manufacturing Firms through Moderating Role of ISO-14001. Global Social Sciences Review, VIII, 581-591.

-

MHRA : Rasool, Nosheen, and Zunaira Zulfiqar. 2023. "Relationship between Corporate Governance and Financial Performance of Manufacturing Firms through Moderating Role of ISO-14001." Global Social Sciences Review, VIII: 581-591

-

MLA : Rasool, Nosheen, and Zunaira Zulfiqar. "Relationship between Corporate Governance and Financial Performance of Manufacturing Firms through Moderating Role of ISO-14001." Global Social Sciences Review, VIII.II (2023): 581-591 Print.

-

OXFORD : Rasool, Nosheen and Zulfiqar, Zunaira (2023), "Relationship between Corporate Governance and Financial Performance of Manufacturing Firms through Moderating Role of ISO-14001", Global Social Sciences Review, VIII (II), 581-591

-

TURABIAN : Rasool, Nosheen, and Zunaira Zulfiqar. "Relationship between Corporate Governance and Financial Performance of Manufacturing Firms through Moderating Role of ISO-14001." Global Social Sciences Review VIII, no. II (2023): 581-591. https://doi.org/10.31703/gssr.2023(VIII-II).52