Abstract

The study examines the volatility spillover between selected emerging Asian and developed stock markets. Moreover, the study analyzes the impact of the financial crisis on volatility spillover between the stock markets. This study used monthly observations for the period 2001-01 to 2017-12 on three emerging markets of Pakistan, China, India and three developed markets of Hong Kong, Japan and the US. First, the asymmetric volatility transmission between the stocks is analyzed by extended EGARCH representation. The study found the existence of asymmetric volatility spillovers throughout the financial crisis. The researcher estimated the VECM granger causality test in the next step. The outcomes revealed existence of bidirectional spillover between Pakistan and India, the US to Japan and Hong Kong. Unidirectional relationship was found from Pakistan and the US to Hong Kong, India to the US and Hong Kong to China. Overall, the results suggest a significant relationship between emerging and developed markets due to integration.

Key Words

EGARCH, Eurozone Crisis, Emerging Economies, Developed Economies, Volatility Spillover, VECM.

Introduction

The stock market is an organization where the trade of shares of public listed companies takes place. The companies propose shares to the general public in the primary market to elevate capital. The stock exchanges offer a place for financiers to deal with their stock plus and an important basis to raise finances. Stock exchange builds rules for soft practice to do business and protect the investors. The job of stock markets is extremely important to every country. Stock markets provide an opportunity for economies to assemble resources inside and outside. The market offers a medium to move funds from businessmen across the world in various economies. Association between stock markets is rising clearly from the previous decade with the integration of economies through global trade, a stream of resources and industrial progress (Kayani et al., 2019).

The volatility factor swamps foremost pecuniary tools and does a crucial job in several financial fields. Volatility in stocks means variations in stock prices vary all over time (Zafar et al., 2008). When volatility of a market triggers the volatility in further markets, this process is known as volatility spillovers (Yarovaya et al., 2015). This upshot can exist mainly observable during stages of disorder which decreases the advantages of global assortment variegation for financiers. The "leverage effect" adverts to the affinity for volatility to increase more follow to price decrease than subsequent price increase of the identical scale.

To estimate the integration level between international markets and the level of the association among them over time has studied by the traditional approach. The level of association of stock prices is usually taken, as their subsisted time variable properties, such as small-time noises along with long time primary interactions that are not confined through the usual correlation method. By investigating the spillover of volatilities among stock markets, the studies have calculated the mutuality’s among them.

The idea of volatility’s spillover could be drained from the influential effort of Engle et al., (1990). The authors place the hypothetical fundamentals “own” and “cross” form spillover by using the meteorological lexicon. Engle et al., (1990) firstly introduced Heat waves as well as Meteor shower hypotheses. The “heat wave” hypothesis says that the existing market’s volatility is task of ancient times the same market volatility, representing own-spillover or volatility clustering (Mitra et al., 2015). The postulate of “heat wave” hypothesis says that the volatility of a single market proceeds in the same one in next day. While the “meteor shower” hypothesis says that the current market’s volatility is a task of equally ancient time volatility in the similar market and ancient times volatility of another market, representing cross-spillover or volatility transmission.

Therefore, the “meteor shower” gives the meaning of volatility in both “own” as well as “cross” ways. On instability shocks transversely stock market, literature may divide among two wide strings. One is crisis-specific, and the other is country-specific research.

Particular crises research primarily considers assessment to volatility spillover mainly in four foremost economic crises: Black Monday, Oct 1987, the Asian crisis in 1997, crisis of 2008 and the Eurozone crisis in 2009-12. During the 1987 crises, many authors studied in detail the transmission of volatility among dissimilar stock markets. The crises of 1997 and 2008 are analyzed by researchers like Shamiri and Isa (2009) and Issam et al., (2013).

The volatility transmission between selected countries or regions is examined by the geography-specific studies. Mostly country-associated studies (like the US, Japan and the UK) focus on developed economies. Behind the Asian’s crisis in 1997, progressively studies started to concentrate on developing markets. The regional studies primarily concentrate on financial zones like the ASEAN countries, European Union, and the Asia-Pacific region. Generally, by having a large sample, these studies are characterized in terms of both the span of study and the number of countries. Among some main stock markets, volatility transmissions examined by Eun and Shim (1989), Hamao and Ng (1990) and Lin et al., 1994. Santis and Imrohoroglu (1997); Bekaert and Harvey (1997) considered the emerging markets amongst others. Baele (2005); Issam et al., (2013) and Tiwari et al., (2015) examined the European region. Among the four main continents, the instability process of eighteen foremost worldwide stock markets analyzed by Engle and Susmel (1993). The document is arranged as the subsequent section of precise literature evaluation. Section three and four describe methodologies and data representation. Section five explicates empirical outcomes and last regarding conclusion and suggestions.

Literature Review

The literature review is relatively supportive to familiarize with studies originated in the earlier period concerning volatility of stock markets in Pakistan and different characteristics of volatility at the worldwide and national levels. The empirical study reviews on the stock market join various features that affect the volatility of stock markets. The analysis of volatility diffusion with monetary markets has acquired an enormous concern in the latest years.

Bangash et al., (2018) studied liquidity patterns and the size in stock market of Pakistan from 2001-2012 using different asset pricing models. Though, it was observed that the incidence of liquidity and size did not affect the coefficients’ results but the normal value of force premium was lower in size than liquidity.

Rahman et al., (2018) found the relationship between political measures and Pakistan's stock exchange in the period of 2012-2017. The study utilized moving average technique for calculating predictable and unusual returns and investigated that Government strategies have linkage with PSX. Investors react positively when government association looks strong and free from following pressure.

Bhunia and Yaman (2017) analyzed the causal association between some preferred stock markets in the US and Asia. Based on stock values by using a sample of nine Asian markets, this study finds out a positive relationship with US stocks prices in majority cases as compared to Vietnam. The sample period for study was 2 Jan 1991 to 31 March 2016 for the nine US and Asian stock markets. Johansen Cointegration analyses were used for the estimation process in this study. The result shows important short-run and long-run causality in the US and Asian markets.

Jebran and Iqbal (2016) investigated the instability spillovers amid the different stock exchanges of Asian nations. The data was collected on a daily basis from 4 Jan 1999 to 1 Jan 2014. The GARCH model was used for determining the spillover among different stock markets. The outcomes indicate considerable bi-directional transmission among the markets of the under-mentioned countries like Sri Lanka and Hong Kong; Sri Lanka and China. The unidirectional spread of stocks volatilities was examined flowing from Sri Lanka toward Japan, India to China, Hong Kong to India and Pakistan to Sri Lanka

Yarovaya et al., (2016) studied Inter and intra-regional volatility and return spillovers involving advanced and emerging markets. This study contains 11 emerging and 10 developed markets from 2005 to 2014 in Asia, Europe, America and Africa. By employing widespread VAR framework the determinations revealed that markets were more vulnerable to intra-regional and domestic volatility shocks as compare to the worldwide contagion.

Mohammadi and Tan (2015) analyzed volatility Spillovers and return involving the China, United States and Hong Kong’s Equity Markets. This study analyzed unidirectional returns flow from the US to the other markets, facts of unidirectional GARCH and ARCH effects from the US to further three markets.

(Oluseyi, 2015) analyzed correlation among macroeconomic variables volatility and stock market volatility by using monthly data ranges from January 1990 to December 2014 in Nigeria. The investigation was carried out by using bivariate and multivariate VAR models, GARCH (1, 1), Granger causality tests and also through regression analysis.

Qayyum and Khan (2014) analyzed the volatility spillover and dynamic relationship by using the VAR-EGARCH framework, among the foreign exchange market and stock market of Pakistan. The data accumulated on a weekly basis starting 02 July 1997 to 04 July 2012 by using exchange rates and stock prices. The EGARCH models show bidirectional volatility spillovers results. In general, the results reveal a robust linkage among the instability of the foreign exchange market plus volatility of stock prices in Pakistan.

Jebran (2014) investigated dynamic association among some Asian stock markets. Closing stock price indices were taken on a monthly basis from 2003:11 to 2013:11. The Johansen cointegration procedure was applied for examining the long-run relationship. Results revealed that stock exchange of Srilanka was granger caused via Indonesia, India and the Malaysian stock market. This study examines no long-run association of Pakistan stock market among any other stock market.

Hassan et al., (2006) analyzed the “heat waves and meteor shower” effects in some Asian developed and emerging stock markets. The SURE model and the GMM method on the base of the VAR technique were used in the present study to test the existence of meteor shower and heat waves hypotheses. Data was collected for the period 1st Jan 1991 to 31 Dec 2000. During high growth period (1991-1996), the results give facts of strong and noteworthy heat wave effect between the emerging as well inside Asian developed nations. Whereas, throughout and after the crisis the outcomes suggested the meteor shower effects amongst emerging stock markets.

Research Methodology

Perfect statistical procedure and appropriate data organization are the strength of any investigation. Improper model choice and assessment procedure direct toward unfair consequences.

Modeling Uncertainty

Engle introduced Autoregressive Conditional Hetroscedasticity (ARCH) approach which used a mean

inflation equation with unchanging parameters, however, consents the conditional variances to the variable with time.

The broad structure of ARCH (1) model is

…………… (1)

……….…… (2)

………………………… (3)

………………….. (4)

Bollerslev (1986) projected a different generalized procedure and permitted the restricted variance to conditional on its preceding lags plus the interval square residual term. The general structure of GARCH method is

………… (5)

……………… (6)

Extended Egarch Model

The study intends to explore the asymmetric instability spillovers among markets by employing extended EGARCH model. Asymmetric volatility argues that negative shocks produce high volatility contrast to positive shocks of a similar magnitude. Before the estimation of the EGARCH form data is checked for its time-varying properties. If data is stationary at level EGARCH framework might be functional. Additionally, another hypothesis of EGARCH representation is that statistics must contain ARCH effect or incidence of autocorrelation and heteroskedasticity

the phenomenon in the data.

….. (7)

……(8)

Data Description

Monthly data taken from yahoo finance for the period 2001:01 to 2017:12 is used to study the relationship between the variables. Table 1 shows stock exchanges and their indices used in this research. The phase 2009:10-2012:12 is considered as a turbulent phase. This era discovers the volatility transmission during abnormal conditions.

Stock returns are calculated as

………………………. (9)

Here,

? ---- Stock returns

? ln ---- Natural logarithm

? pt ---- Current time index value

? pt-1 ----Value of the preceding period

Results and Explanations

Table 1. Countries, Stock Markets and Indices

|

Countries

|

Stock Exchanges |

Indices |

|

Pakistan |

PSX |

KSE 100 |

|

India |

BSE |

S

& P BSE SENSEX |

|

China |

SSE |

SSEC |

|

HongKong |

SEHK |

HIS |

|

Japan |

TSE/TYO |

Nikkei 225 |

|

United States |

NYSEA |

S & P 500 |

The first the

descriptive statistics for all the series are checked. The results are

presented in the table 2. The kurtosis values greater than 3 shows that data is

leptokurtic for all the series. Value of skewness is positive for Pakistan

while for all other series it is negatively skewed. There is a high value of the

Jarque Bera test which also confirms abnormality in data. Overall, all the

indices show abnormality in series and suggest some different measures instead

of simple regression procedures. It leads toward uncertainty in series which is

the prime focus in the current analysis.

Table 2. Descriptive Statistics of Data

|

Pakistan |

India |

China |

Hong Kong |

Japan |

US |

|

Mean

0.003 |

0.017 |

0.011 |

0.003 |

0.003 |

0.003 |

|

Med.

0.009 |

0.022 |

0.011 |

0.007 |

0.010 |

0.006 |

|

Max.

0.102 |

6.961 |

0.248 |

0.243 |

0.157 |

0.121 |

|

Min.

-0.185 |

-6.888 |

-0.273 |

-0.283 |

-0.254 |

-0.272 |

|

Std.

Dv. 0.042 |

0.984 |

0.066 |

0.079 |

0.059 |

0.055 |

|

Skew.

-0.867 |

0.043 |

-0.544 |

-0.543 |

-0.687 |

-0.848 |

|

Kurt.

4.936 |

48.241 |

5.187 |

4.663 |

4.764 |

5.091 |

|

Jarq.Bera

57.163 |

173.43 |

50.496 |

33.373 |

42.308 |

61.307 |

|

Probability

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Sum

0.671 |

3.487 |

2.136 |

0.575 |

0.704 |

0.584 |

|

Sum

Sq.Dev. 0.628 |

195.541 0.356 |

0.878 |

1.292 |

0.724 |

|

|

Observations

203 |

203 |

203 |

203 |

203 |

203 |

In the next step, the

researcher has examined the stationarity of data sets by employing ADF in

addition to PP tests. The outcomes of ADF and PP tests in table 3 explain that the

entire series are stationary at first difference.

Table 3. Unit Root Tests

|

Regressors |

ADF Test Statistics |

PP Test Statistics |

||

|

|

level |

1st diff |

level |

1st diff |

|

PSX |

-1.018 |

-8.791* |

-3.261 |

-30.319* |

|

BSE |

-2.464 |

-14.053* |

-2.894 |

-14.093* |

|

SSE |

-2.925 |

-7.984* |

-2.869 |

-13.405* |

|

SEHK |

-2.768 |

-13.012* |

-3.128 |

-13.036* |

|

TSE |

-0.024 |

-11.833* |

-0.476 |

-11.833* |

|

NYSEA |

-1.242 |

-13.262* |

-1.336 |

-13.245* |

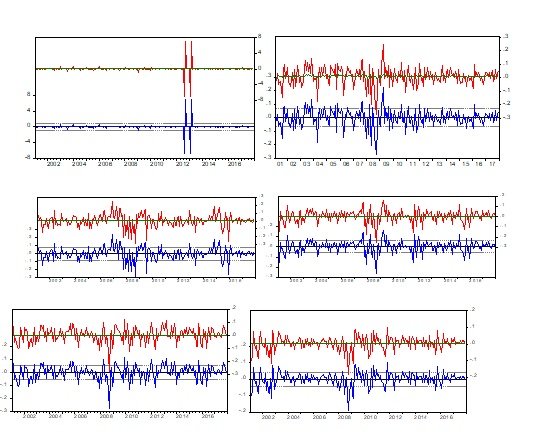

Further, to study ARCH

consequences, the investigator describes the residuals obtained from the mean

equation. Figure1 illustrates that incidents of higher instabilities are

pursued by synchronization periods. The graphical presentation also suggests

applying ARCH family models for modeling the heteroskedasticity in data.

Figure 1

Residuals of AR models of stock returns

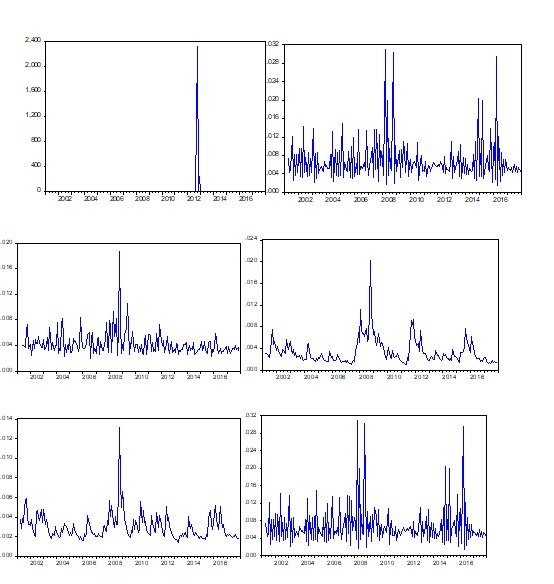

Further, the study has used EGARCH representation to capture the instability in the stock indices data. These series have been used as proxies for shocks to each stock index. The researcher has used the GARCH variances series to represent volatility is stock returns. The graph of variances series is shown in figure 2. The series is showing the phenomenon of variances clustering

Figure 2

Trends in Volatility Series of Stock Returns

Volatility Spillover

The study has used extended EGARCH

representation to model the asymmetric volatilities in the stock markets.

Returns spillover is calculated through the mean equation and shown in upper

part of table 4. Volatilities spillovers are estimated through the variance

equation as shown in the lower part of table 4. The mean equation shows

significant return spillover during financial in Asian emerging markets. The

outcomes prove an indication of individual lag return spillover in all stock

markets except India. Bidirectional return spillover also found between

Pakistan to Japan and Hong Kong.

Table 4. Volatility Spillovers Among the Financial Markets

|

Coefficients |

Pakistan |

India |

China |

Hong Kong |

Japan |

US |

|

Mean Equation |

||||||

|

? |

0.234*(0.003) |

0.003*(1.01) |

0.06*(0.03) |

0.002*(0.001) |

0.0008*(6.16) |

-0.003*(7.26) |

|

? |

0.403*(0.075 |

0.024(0.05) |

-0.32*(0.037) |

0.871*(0.061) |

0.592*(1.9) |

0.682*(0.026) |

|

?-Pakistan |

|

2.98(1.83) |

4.291(2.591) |

-0.212*(0.045) |

-0.04*(0.02) |

-0.002(0.11) |

|

?-India |

-103.3*(0.26) |

0.064(0.06) |

0.083(0.074) |

-2.47(1.42) |

0.011(0.022) |

0.092*(0.015) |

|

?-China |

24.23*(1.71) |

0.196*(0.001) |

|

0.001(0.01) |

0.009(0.007) |

0.116*(0.025) |

|

?-Hong Kong |

80.68*(2.36) |

0.019(0.07) |

0.236*(0.092) |

|

0.036(0.027) |

0.014*(0.002) |

|

?-Japan |

-2.992*(0.54) |

0.019(0.07) |

0.206*(0.124) |

-0.127(0.11) |

|

-4.69(1.42) |

|

?-USA |

2.073**(0.98) |

0.007(0.02) |

-0.203(0.142) |

0.074(0.082) |

2.19(6.84) |

|

|

? |

0.348*(0.035) |

-0.003*(0.00) |

-0.01*(0.01) |

-0.002(0.02) |

-2.06(3.03) |

2.25(7.27) |

|

? denotes return spillover from other stock markets. ? shows return from own previous lag. ? indicates crisis

period. () represents standard errors |

||||||

|

Variance

Equation |

||||||

|

? |

6.513*(0.29) |

-13.44*(2.47) |

-12.4*(2.27) |

-14.02*(3.21) |

-15.91*(1.89) |

-7.068*(1.26) |

|

? |

5.871*(0.51) |

-0.22(0.16) |

1.075*(0.28) |

0.28(0.24) |

-0.43(0.23) |

1.006*(0.21) |

|

? |

-2.185*(0.43) |

0.50*(0.14) |

-1.071*(0.19) |

0.28*(0.116) |

-0.19(0.18) |

-0.319**(0.13) |

|

? |

0.945*(0.02) |

0.08(0.17) |

0.057(0.169) |

0.09(0.21) |

0.112(0.104) |

0.74*(0.06) |

|

?-Pakistan |

|

-0.009(0.17) |

-0.05*(0.008) |

97.97(86.72) |

961.7*(133.5) |

30.21(77.44) |

|

?-India |

-266.72*(46.7) |

|

62.21(79.39) |

-0.01(0.37) |

-94.55(96.9) |

-11.28(60.16) |

|

?-China |

-465.43*(38.5) |

29.48(88.63) |

|

7.37(42.32) |

-146.47*(60.7) |

511.45*(111.3) |

|

?-Hong Kong |

112.93*(43.7) |

210.12*(81.4) |

102.39(69.48) |

|

208.25*(102.27) |

85.04*(27.7) |

|

?-Japan |

-36.65(92.05) |

47.87(149.9) |

-89.82(119.22) |

244.84*(107.22) |

|

-0.001(0.04) |

|

?-USA |

203.02*(148.7) |

57.23(36.41) |

68.81(116.04) |

71.17(93.37) |

-0.008(0.22) |

|

|

? |

6.007*(0.32) |

-0.18(0.29) |

-0.211(0.399) |

0.26(0.32) |

-59.58*(31.72) |

0.104(0.24) |

|

Note: *, **, *** shows 1%, 5% and 10%significance

level. ? denotes volatility spillovers from other stock markets. ? shows volatility

spillovers during crisis. The term ? represents effect of asymmetric volatility. |

||||||

The results of variance

equation confirm the presence of asymmetric volatility in stock markets. The

negative sign of ? affirms that volatility

is more due to bearish trend. For the case of Pakistan volatility transmission

is significant from all the stock exchanges except Japan. However, there exists relationship from

Pakistan to Japan.

Moreover, bidirectional

volatility transmission between Pakistan and China was found. The coefficient

of volatility spillover during the crisis is also significant for the case of

Pakistan and Japan.

Johansen Cointegration Results

Analyses of Johansen test in table

5 enclose two lags for the endogenous variables preferred through the Schwarz

criterion. Eigen and Trace tests signify five cointegrating equations.

Table 5. Johansen Cointegration Results

|

Hypothesized No. of CEs |

Eigen values |

Trace Statistics |

Critical Values |

Probability |

|

r ? 0* |

0.433 |

391.756 |

95.754 |

0.001 |

|

r ? 1* |

0.403 |

279.097 |

69.818 |

0.000 |

|

r ? 2* |

0.341 |

176.972 |

47.856 |

0.000 |

|

r ? 3* |

0.241 |

94.514 |

29.797 |

0.000 |

|

r ? 4* |

0.134 |

40.045 |

15.494 |

0.000 |

|

r ? 5 |

0.016 |

68.921 |

69.812 |

0.051 |

|

Maximum

Eigenvalue |

||||

|

Hypothesized No. of CEs |

Eigen values |

Max-Eigen Statistics |

Critical Values |

Probability |

|

r ? 0* |

0.434 |

112.658 |

40.077 |

0.000 |

|

r ? 0*

|

0.403 |

102.126 |

33.887 |

0.000 |

|

r ? 2* |

0.341 |

82.457 |

27.584 |

0.000 |

|

r ? 3* |

0.241 |

54.468 |

21.132 |

0.000 |

|

r ? 4* |

0.134 |

54.468 |

14.265 |

0.000 |

|

r ? 5 |

0.016 |

22.454 |

33.871 |

0.571 |

|

Note: * Rejection of hypothesis at 0.05 levels.

Probability = MacKinnon–Haug–Michelis prob- values. |

||||

The negative sign of the error correction

representation in table 6 indicates convergence toward equilibrium. Therefore,

if long-run causality survives, the short-run causality must be experienced (Joshi, 2013). The next short-run relationship

among the stock markets is estimated by using the coefficients of the lagged

difference terms and Wald test.

The outcomes of short-run

causality test are presented in table 7. The outcomes show that there exists

bidirectional causality between Pakistan and Bombay stock exchange, America to

Japan and America to Hong Kong. Unidirectional linkage found from Pakistan and the

American stock market to Hong Kong, Hong Kong to China and India to America. Overall,

the results suggest a significant relationship between emerging and developed

stock markets due to incorporation.

Table 6. VECM Test Results

|

Error

Correction |

D(HTKSER) |

D(HTBSSR) |

D(HTSSESR) |

D(HTHISR) |

D(HTN225R) |

D(HTGSPR) |

|

CointEq1 |

-0.417 |

-7.241 |

-4.531 |

-2.461 |

-1.771 |

1.4611 |

|

|

(0.072) |

(9.122) |

(2.512) |

(8.122) |

(5.222) |

(3.712) |

|

|

[-5.74] |

[-7.973] |

[-0.185] |

[-3.036] |

[-3.413] |

[ 3.902] |

|

D (HTKSER

(-1)) |

-0.289 |

4.551 |

3.152 |

1.351 |

8.932 |

-5.712 |

|

|

(0.067) |

(8.412) |

(2.311) |

(7.532) |

(4.822) |

(3.512) |

|

|

[-4.301] |

[ 5.417] |

[ 0.138] |

[ 1.796] |

[ 1.857] |

[-1.663] |

|

D (HTBSSSR

(-1)) |

1.621 |

-0.081 |

0.295 |

0.033 |

0.024 |

-0.086 |

|

|

(6.521) |

(0.081) |

(0.219) |

(0.072) |

(0.046) |

(0.034) |

|

|

[ 2.508] |

[-0.991] |

[ 1.342] |

[ 0.424] |

[ 0.607] |

[-2.593] |

|

D (HTSSESR

(-1)) |

-2.032 |

-0.027 |

-0.785 |

-0.001 |

0.006 |

0.001 |

|

|

(1.312) |

(0.016) |

(0.045) |

(0.014) |

(0.009) |

(0.006) |

|

|

[-1.531] |

[-1.651] |

[-17.442] |

[-0.068] |

[ 0.661] |

[ 0.028] |

|

D (HTHISR

(-1)) |

-3.978 |

0.251 |

-0.582 |

-0.178 |

0.029 |

0.273 |

|

|

(8.808) |

(0.112) |

(0.299) |

(0.098) |

(0.063) |

(0.045) |

|

|

[-0.443] |

[ 2.281] |

[-1.944] |

[-1.807] |

[ 0.466] |

[ 6.014] |

|

D (HTN225R

(-1)) |

1.779 |

0.369 |

0.441 |

0.135 |

-0.138 |

0.367 |

|

|

(1.309) |

(0.157) |

(0.429) |

(0.141) |

(0.0905) |

(0.066) |

|

|

[ 1.398] |

[ 2.337] |

[ 1.026] |

[ 0.959] |

[-1.531] |

[ 5.637] |

|

D

(HTGSPR (-1)) |

3.888 |

-0.181 |

-0.366 |

-0.224 |

-0.228 |

0.169 |

|

|

(1.019) |

(0.126) |

(0.342) |

(0.112) |

(0.072) |

(0.058) |

|

|

[ 0.384] |

[-1.433] |

[-1.072] |

[-1.996] |

[-3.168] |

[ 3.184] |

|

C |

451.38 |

-3.596 |

-3.943 |

-7.663 |

-1.192 |

-1.456 |

|

|

(97.531) |

(0.002) |

(0.033) |

(0.001) |

(6.925) |

(5.005) |

|

F-statistic |

15.184 |

19.591 |

47.518 |

3.579 |

5.723 |

33.302 |

|

R-squared |

0.358 |

0.419 |

0.636 |

0.116 |

0.172 |

0.553 |

|

Adj.R-squared |

0.335 |

0.397 |

0.623 |

0.083 |

0.1436 |

0.534

|

Table 7. Wald Test Results

|

Dep. variable |

D(HTPSX) |

D(HTBSE) |

D(HTSSE) |

D(HTSEHK) |

D(HTNSE) |

D(HTTSE) |

|

Excluded |

Chi-sq(Prob.) |

Chi-sq(Prob.)

|

Chi-sq(Prob.)

|

Chi-sq(Prob.) |

Chi-sq(Prob.) |

Chi-sq(Prob.) |

|

D(HTPSX) |

|

29.352( 0.00)*

|

0.019(0.89)

|

3.22(0.07)**

|

3.453(0.06) |

2.768(0.09)** |

|

D(HTBSE)

|

6.290( 0.01)* |

|

1.813(0.17)

|

0.181(0.67) |

0.369(0.54)

|

6.722(0.00)* |

|

D(HTSSE) |

2.345(0.12) |

2.724(0. 09)** |

|

0.004( 0.94)

|

0.437( 0.50) |

0.001(0.97) |

|

D(HTSEHK) |

0.201(0.65) |

|

5.219(0.02)* |

3.781(0.05)* |

|

0.218(0.64)

|

|

36.14( 0.00)* |

|

|

|

|

|

|

|

D(HTNSE)

|

1.955(0.16) |

5.462(0.01)* |

1.054(0.30)

|

0.921(0.33) |

|

31.77( 0.00)* |

|

D(HTTSE)

|

0.147(0.7) |

2.053(0.15 |

1.145(0.28) |

3.986(0.04)* |

10.037( 0.00)* |

|

|

All |

11.356(0.04) |

63.54(0.00)* |

5.396(0.36) |

9.088(0.10)

|

18.345(0.00)*

|

166.00( 0.00)* |

Conclusion and Implications

Improbability in stock markets direct towards adverse circumstances for financiers of capital markets. The concern of stock’s volatilities has got an adequate position in the emergent and advanced nations. Consequently, the current investigation is an effort to consider volatility spillover among emerging and advanced equity markets. The study is a pioneer to analyze the impact of the European debt crisis by employing an extended version of EGARCH representation.

Outcomes designate that volatility spillover differs commencing usually to disordered periods. This research provides imperative suggestions for depositors and strategy makers. Stock markets turned to more incorporate in the crisis situation. Financial adversity spread from one to further marketplace which leads to influence on the performance of capital markets. So, volatility spillover involving financial markets propose little prospective diversi?cation chances for financiers. Furthermore, the strategies should be designed to protect the financial zone from global financial upsets.

References

- Bangash, R., Khan, F., and Jabeen, Z. (2018). Size, value and momentum in Pakistan equity market: Size and liquidity exposures. Global social Sciences Review, 3(1), 376-394.

- Bhunia, A., & Yaman, D. (2017). Is there a causal relationship between financial markets in Asia and the US? The Lahore Journal of Economics, 22, 71-90.

- Baele, L. (2005). Volatility spillover effects in European equity markets. Journal of Financial and Quantitative Analysis, 40, 373-401.

- Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307-327.

- Bhar, R. (2001). Return and volatility dynamics in the spot and futures markets in Australia: an intervention analysis in a bivariate EGARCH-X framework. Journal of Futures Markets, 21, 833-850.

- Bekaert, G., & Harvey, C.R. (1997). Emerging equity market volatility. Journal of Financial Economics, 43, 29-77.

- Engle, R.F., & Susmel, R. (1993). Common volatility in international equity markets. Journal of Business & Economic Statistics, 11, 167-176.

- Eun, C.S., & Shim, S. (1989). International transmission of stock market movements. Journal of Financial and Quantitative Analysis, 24, 241-256

- Engle, R. F., & Granger, C. W. J. (1987). Cointegration and error correction: representation, estimation and testing. Econometrica, 55, 251-276.

- Engle, R. (1982). Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50, 987-1008.

- Hamao, Y., Masulis, R.W., & Ng, V. (1990). Correlations in price changes and volatility across international stock markets. Review of Financial Studies, 3, 281-307.

- Hassan, T., Nassir, B.N., & Mohamad, S. (2006). The heat waves or meteor showers hypothesis: Test on selected Asian emerging and developed stock markets. Investment Management and Financial Innovations, 3(1), 120-131.

- Issam, C., Achraf, G., & Boujelbene, Y. (2013). Volatility spillover and channels transmission during subprime crisis: empirical study of USA stock market and other developed stock markets. Journal of Applied Economic Sciences, 1, 7-21.

- Jebran, K., & Iqbal, A. (2016). Examining volatility spillover between Asian countries' stock markets. China Finance and Economic Review, 4, 1-13.

- Jebran, K. (2014). Dynamic Linkages between Asian Countries Stock Markets: Evidence from Karachi Stock Exchange. Research Journal of Management Sciences, 3(5), 6-13.

Cite this article

-

APA : Hussain, M., Awan, R. U., & Hassan, H. (2020). Eurozone Crisis and Asymmetric Volatility Spillover between the Stock Markets of Selected Emerging Asian and Developed Economies. Global Social Sciences Review, V(I), 399 ‒ 409. https://doi.org/10.31703/gssr.2020(V-I).41

-

CHICAGO : Hussain, Muzammil, Rehmat Ullah Awan, and Hammad Hassan. 2020. "Eurozone Crisis and Asymmetric Volatility Spillover between the Stock Markets of Selected Emerging Asian and Developed Economies." Global Social Sciences Review, V (I): 399 ‒ 409 doi: 10.31703/gssr.2020(V-I).41

-

HARVARD : HUSSAIN, M., AWAN, R. U. & HASSAN, H. 2020. Eurozone Crisis and Asymmetric Volatility Spillover between the Stock Markets of Selected Emerging Asian and Developed Economies. Global Social Sciences Review, V, 399 ‒ 409.

-

MHRA : Hussain, Muzammil, Rehmat Ullah Awan, and Hammad Hassan. 2020. "Eurozone Crisis and Asymmetric Volatility Spillover between the Stock Markets of Selected Emerging Asian and Developed Economies." Global Social Sciences Review, V: 399 ‒ 409

-

MLA : Hussain, Muzammil, Rehmat Ullah Awan, and Hammad Hassan. "Eurozone Crisis and Asymmetric Volatility Spillover between the Stock Markets of Selected Emerging Asian and Developed Economies." Global Social Sciences Review, V.I (2020): 399 ‒ 409 Print.

-

OXFORD : Hussain, Muzammil, Awan, Rehmat Ullah, and Hassan, Hammad (2020), "Eurozone Crisis and Asymmetric Volatility Spillover between the Stock Markets of Selected Emerging Asian and Developed Economies", Global Social Sciences Review, V (I), 399 ‒ 409

-

TURABIAN : Hussain, Muzammil, Rehmat Ullah Awan, and Hammad Hassan. "Eurozone Crisis and Asymmetric Volatility Spillover between the Stock Markets of Selected Emerging Asian and Developed Economies." Global Social Sciences Review V, no. I (2020): 399 ‒ 409. https://doi.org/10.31703/gssr.2020(V-I).41