Abstract

This study is aimed to examine the impact of US News and exchange rate exposure on emerging economies of Pakistan, China, Turkey and Iran. Daily exchange rates have been used for the period Jan 1, 2003 to Dec 31, 2018 to identify the volatility in exchange rate exposure due to news effect. US News is modeled with variance equation respectively for each country exchange rate. GARCH (1,1) by Bollerslev (1986), and EGARCH (1,1) by Nelson (1991) models have been used to estimate the volatility of exchange rate dynamics. Results indicate that impact of US News is significantly positive on the exchange rate of Pakistan and China and the results of US news impact on Turkey and Iran are insignificant. Present study is helpful for investors, financial analysts and economic decision makers for understanding the changing dynamics of exchange rate volatility.

Key Words

Exchange rate, EGARCH, US News Impact Curve, Volatility.

Introduction

Due to modern developments in financial markets the liquidity and volatility has been increased in foreign exchange markets. Therefore, the debate on influx of foreign exchange in emerging economies has got focus due to volatile nature of these economies. The US dollar flow is the main driving force in managing the liquidity and foreign exchange reserves of various developing economies. However, the volatility in exchange rate has significant practical implications in the field of finance. In the context of new world economic order and increasing globalization, the developing economies are sensitive to the effects of unexpected fluctuation in exchange rates prices. The exchange rate shocks can substantially destabilize the firms, capital markets and macro economies. In global financial management volatility in exchange rate and its risk exposures towards the information has drastically made this element an essential part of international finance. With exchange rate fluctuations every person suffers while in the conduct of business activity. The decisions of firms operating locally or internationally, the environment is influenced directly or indirectly due to the ups and downs in exchange rate. So for survival in international competing environment, exchange rate variation should be focused.

Bretton Wood system encouraged the adoption of fixed exchange rate system. In this system changes and volatility in exchange rate remained normal and predictable. News impact in a so-called fair game model retaliate the basic finance theory. The collapse of Bretton Wood system led the regime of flexible exchange rate regime. Due to an end of Bretten Wood era the exchange system flourished in a dynamic manner. The changes and volatilities came into the exchange rate. The estimation and prediction of these changes and volatilities is hardly needed because the unexpected fluctuations affect the life setting of every individual, business, company, government, policy maker and decision maker. The failure in estimation of exchange rate exposure leads to the financial losses of the all above mentioned stakeholders. The inflows or outflows of funds of importers and exporters may vary due to the non-predictability of exchange rate exposure. The positive cash flows of multinational companies may change into negative by translating statements from foreign currency to local currency. The debts of the Governments may increase if there are depreciation in exchange rates. To avoid the financial losses of these stakeholders we should estimate the exchange exposure. The timely prediction and reasonable determinants identification can reduce these losses. A number of studies were conducted on developed markets but they found small statistical impact of exchange rate risk on stock returns (Bartram & Bodnar 2007 and Bhuiya, Ahmed and Haque 2015). The importance of exchange rate has been explained in all types of economies as it is a primary tool to boost up the economic progress of any country. Similarly the economic health of any economy can also be determined from the stability of exchange rate in an economy. Therefore, several author emphases on the vital role of exchange rate in developing and developed economies. Considering this vital importance many researchers contributed in this subject and some researchers explored that exchange rate exposure is low due to the hedging strategies (Bartram, Brown & Minton 2010). A few researchers focused on the methodology used. They stated that sampling and selection of methodologies are reasons of poor evidence of the exchange rate exposure. They also stated that we consider only linear part of exchange rate exposure. By estimating the non linear part of exposure the results may improve (Koutmos & Martin 2003). Some studies provided that results on monthly data are significant rather than daily data. Some researchers explored that there are multiple asymmetries in developed markets like Japan (Jayasinghe and Premaratne 2004). Earlier studies do not provide general determinants of exchange rate exposure. There is no consensus on facets of exchange rate exposure. Some researchers concluded that GRACH type modeling is reasonable to find out significant results instead of common coefficients (Ahmadi et al 2012). ). In this study, volatility of exchange rate is measured and US News estimation through the GARCH (1, 1) process (Bollerslev, 1986) and EGARCH (1, 1) process (Nelson, 1991) are being used in mean and variance equation. Purpose of this study is to examine the volatility of exchange rates and effect of US News on emerging economies exchange rate. In the first segment we have briefly introduced the exchange rate exposure and its relevancy to the news and volatility dynamics. Second segment of the study contains the review of literature. Similarly the third part of the study contains research methodology and data, whereas fourth contains the result and discussion, last part is conclusion.

Literature Review

In this part, explains the literature about the volatility of exchange rate exposure. Palia and Thomas (1997) documented a research on exchange rate exposure and firm valuation with reference to market efficiency. They stated that the earlier studies made a puzzle in the area of sensitivity of exchange rates. They discussed that the stock returns only weekly linked with contemporaneous exchange rate changes but they are associated with the lagged exchange rate variations. So this is related to inefficiency of stock market. This study was conducted to re-examine the Bartove and Bodnar (1995),s research. The net exporters and net importers with perfect negative (positive) correlation between abnormal returns and contemporaneous exchange rate changes. The data was taken for previous twenty quarters. The claims of results are on the basis of subset of firms and sample period and this was not examined before this study. The same methodology which was used by the Bartove & Bodnar, s (1995) research. They found strong association between abnormal returns and contemporaneous exchange rate variation. The lagged exchange rate relation of earlier studies. Nydahl (1999) examined the exchange rate exposure in Swedish about to examine foreign involvement and currency hedging. This study was conducted in small open economy while the most of previous studies were performed in open economy. The more percentage of firms are exposed in this study than study of US and Japan. Bartram, Brown and Fehle (2003) used the financial derivatives for the extensive sample. It is explored that the firm specific facets of derivatives as financial distress cost and taxes, underinvestment, and management incentives. Macroeconomic variables are common. It is also stated that the size of local derivative market is very important determinant of the use of derivatives and national level factors are inconsistent. Finally, It is found that using interest rate derivative have positive effect on firm value. This is a good study but they did not give an appropriate road map to use the financial derivatives. Bartram, Dufey and Frankel (2005) documented an examination on the primer of the exchange rate exposure of non financial corporations to foreign exchange rate risk. In their study the investigation of literature and practices of firms were evaluated. They made a comparison of selection of financial and operative hedges. They concluded that there should be clear focus on cash flows, the effects of price and quantity of exchange rate changes should be considered, denominations and determination currencies should be focused. They indicated that these things are critical for either hedging decision.

Aggarwal and Harper (2010) determined domestic corporations and the foreign exchange exposure. He stated that earlier studies were on multinational companies and this study is purely on local companies. Fama and French three factor model was used to perform the study. According to them the domestic exchange rate exposure of firms is as like the multinational firms. Moreover, authors indicated negative relationship of firms exposure and asset turnover, size, MTB ratio and financial leverage. Empirical analysis shows that there is smaller exposure for liquid currencies. Bhuiya, Ahmed and Haque (2015) elaborated a study on corporate international diversification and exchange rate exposure. The study was conducted on U.K based multinational firms listed on FTSE-250 for a period from 2005 to 2010. Only 6% multinational firms significantly exposed and could not find the significant results. The results are insignificant due to only linear exposure estimate and left the non-linear part of exposure. Ramzan et al. (2012) explored the dynamics of exchange rate using ARCH models. The GARCH results are found best as compared to EGARCH in the period 1981 to 2010. Riman et al. (2013) concluded that the shocks of oil prices due to exchange rate volatility have negative effect on domestic investment and industrial development. Kobersy et al. (2016) concluded that floating exchange rate does not protect from shocks at global level and serious challenges occurred due to currency risk i.e. global financial crises. Gencer and Musoglu (2014) explained the volatility dynamics of exchange rates that investors and portfolio managers must consider the news impact and information asymmetry reactions.

Hamid and Hasan (2016) used macroeconomic variables as well to model the volatility and identified that various proxies can be added in mean and variance equation to identify the direction of news impact curve.

Hamid, Akash and Ghafoor (2018) identified that long run persistency in volatility exist due to leverage effect during an evaluation of impact of US News on the stock returns of regional sharia compliance indices and volatility. However, EGARCH (1,1) model identified that bad news has increased more volatility than good news on sharia compliance returns due to leverage effect.

Naimy and Hayek (2018) use d GARCH (1,1) , EWMA and EGARCH (1,1) to model the volatility of Bitcoin /USD exchange rate and identified that the nature of Bitcoin matters and behaves differently than traditional currencies. However, its early-stage behavior News impact curve EGARCH (1,1) results might be changed in the future.

Data and Methodology

To achieve the objectives and to respond the research questions we examined the data of exchange rates empirically of the selected emerging economies. For an appropriate examination, we used data for US news, exchange rate data from www.oanda.com and evaluated in EView 11 software.

Data

In this particular study monthly data of exchange rates in term of US Dollar is used of major five emerging economies including Pakistan, China, Iran and Turkey and Iran. The sample period is taken from January 2003 to December 2018.

Methodology

Focus of the study is to identify the valid and appropriate models for measuring the US news impact curve and volatility in exchange rate. For this purpose we have to consider the basic features and estimation methods of exchange rate exposure.

Exchange Rates

For empirical analysis the percentage change of the exchange rate is calculated as

?xr?_it=[?(x?_t-x_(t-1))/x_(t-1)] *100

Where xrit is denoted as percentage change of the exchange rate, xt is denoted as the exchange rate at present time t and xt-1 is denoted as the exchange rate at preceding time t-1. The exchange rate (Xt) on may also be the following model is also used. The GARCH (1,1) model (Bollerslev, 1986) for volatility is also used and proceeds to conditional variance of historic exchange rates at lag values. The following GARCH (1, 1) model is employed to examine the volatility:

Xrt = ?_(0 ) + ?_(i=1)^r??_(i ) Xr_(t-1)+ µ_t -------------------------------(1)

µ_t? Xr_(t-1) ~ ? (0, ht)

ht = ?_(0 ) + ?_(i=1)^p??_(i ) µ_(t-1) + ?_(i=1)^p??_(i ) h_(t-1) --------------------(2)

Where hi,t represents the conditional variance of residuals, ?_(0 ), ?_(i ) and ?_(i ) denotes the unknown parameters and ?t denotes the white noise error term.

The autoregressive process is used to capture the behavior of conditional mean and estimate that residuals (µ_t) have no serial correlation in equation 1. The equation 2 is used to capture the behavior of conditional variance. The ht conditional variance is based on lagged conditional variances and lagged squared errors. In the GARCH model, the non-negative coefficients and their sum is less than one are used to measure the significance of the results. The US News impact can be captured by adding in the variance equation. Nelson (1991) explored the exponential GARCH (EGARCH) model to analyze the persistence of long run volatility and impact of good and bad news on exchange rates in term of US dollars. EGARCH (1,1) model can be expressed in the following manner:

log (?Xr?_(t )^2)= ? + ?_(i=1)^p??_(j ) |µ_(t-j)/?Xr?_(t-j) |+ ?_(i=1)^q???_i log?(? X_(rt )^2) + ?_(i=1)^k??_(k ) µ_(t-k)/?Xr?_(t-k) --- (3)

? ?_i ? are the coefficients to calculate the conditional variance. ?_i describes the impact of the prior period exchange rates on conditional variance. ?_(j ) parameters to calculate the effect of information for previous period of time. The ?_(k ) is the term of being used for calculation of the impact of good and bad news on exchange rates in term of US dollars.

Results and Discussion

Table

2. GARCH (1, 1) model

for Pakistan

|

Dep. Variable: Pakistan |

||||||

|

ML - ARCH |

||||||

|

Equation (Mean) |

||||||

|

Vari. |

Coef |

St. Err |

Z-Stat |

Prob. |

||

|

C |

23.24327 |

1.362862 |

17.05475 |

0 |

||

|

Pakistan

(-1) |

0.77683 |

0.015878 |

48.92424 |

0 |

||

|

Variance Equation |

||||||

|

C |

-0.21869 |

0.226627 |

-0.96499 |

0.3346 |

||

|

RESID(-1)^2 |

-0.08098 |

0.028951 |

-2.79727 |

0.0052 |

||

|

GARCH(-1) |

0.220783 |

0.044123 |

5.003848 |

0 |

||

|

US

News(-1) |

0.454686 |

0.100152 |

4.539945 |

0 |

||

|

R-square 0.461420 D.W.

stat 2.313613 |

||||||

Table 2 elaborates that ARCH and GARCH terms are significant at

p<0.01 and the US news proxy has positive impact on the exchange rate

volatility of Pakistan. There exist leverage Effect.

Table 3. GARCH (1, 1) model for China

|

Dep. Variable: China |

||||

|

ML

- ARCH |

||||

|

Equation (Mean) |

||||

|

Vari |

Coef |

St. Err |

Z-Stat |

Prob. |

|

C |

0.040037 |

0.000539 |

74.30602 |

0 |

|

China(-1) |

0.736311 |

0.000687 |

1071.46 |

0 |

|

Variance Equation |

||||

|

C |

4.070700 |

2.340600 |

0.173535 |

0.8622 |

|

RESID(-1)^2 |

-0.103760 |

0.018454 |

-5.622500 |

0 |

|

GARCH(-1) |

0.755730 |

0.121568 |

6.216498 |

0 |

|

US

News(-1) |

0.232158 |

0.056182 |

4.132252 |

0 |

|

R-squared |

0.491166 |

|

|

|

|

D.Watson

stat |

1.572040 |

|||

Table 3 indicate that ARCH and GARCH

terms are statistically significant at p<0.01 and the US news has

significant positive impact on the volatility of exchange rate of China at

p<0.01 and hence shows that there exist leverage effect. The lagged the

residual square elaborating a negative direction but the lagged variance has

positive impact.

Table 4. GARCH (1,

1) model for Iran

|

Dep Variable: Iran |

|||||||

|

ML

- ARCH |

|||||||

|

Equation (Mean) |

|||||||

|

Vari |

Coef |

St. Err |

Z-Stat |

Prob. |

|||

|

C |

1236.607 |

2948.742 |

0.419368 |

0.6749 |

|||

|

Iran(-1) |

1.112594 |

0.118473 |

9.391145 |

0 |

|||

|

Variance Equation |

|||||||

|

C |

32504205 |

8285555 |

3.922997 |

0.0001 |

|||

|

RESID(-1)^2 |

-0.16259 |

0.026952 |

-6.03257 |

0 |

|||

|

GARCH(-1) |

0.191031 |

0.040649 |

4.699531 |

0 |

|||

|

US News(-1) |

0.108944 |

0.091023 |

1.19689 |

0.2313 |

|||

|

R-square 0.707576 D.Watson stat 2.402906 |

|||||||

Table 4 also indicate that lagged

residual square (ARCH term) and the lagged variance (GARCH term) are

statistically significant at p<0.01 but the US news has no significant

impact on the volatility of exchange rate of Iran.

Table 5. GARCH (1, 1) model for Turkey

|

Dep Variable: Turkey |

||||

|

ML

- ARCH |

||||

|

Mean Equation |

||||

|

Vari |

Coef |

St. Err |

Z-Stat |

Prob. |

|

C |

0.745309 |

0.073829 |

10.09504 |

0 |

|

Turkey (-1) |

0.574988 |

0.047053 |

12.22001 |

0 |

|

Variance Equation |

||||

|

C |

-7.40E-05 |

0.000349 |

-0.21236 |

0.8318 |

|

RESID(-1)^2 |

-0.00146 |

0.004868 |

-0.30003 |

0.7642 |

|

GARCH(-1) |

0.00285 |

0.008519 |

0.3346 |

0.7379 |

|

US

News(-1) |

1.080468 |

1.035577 |

1.043349 |

0.2968 |

|

R-square 0.050021 D.W

stat 2.138264 |

||||

The results of Table 5

report that past exchange rate of Turkey significantly influence the present

exchange rate. However, the ARCH and GARCH terms are insignificant and the US

news impact is also insignificant for Turkey as well.

Table 6 report the results of EGARCH (1, 1) model for the exchange

rate of Pakistan, China, Iran and Turkey. The EGARCH (1,1) model is used to

explain the level of persistency of

volatility and the news impact on exchange rates. The results indicate

that ?1 is significant at p<0.01 for Pakistan,

China and Iran. However this parameter is not statistically significant for

Turkey. The term

Table 6. Egarch

(1,1) Model For Pakistan, China, Iran, Turkey and Malaysia of Exchange Rates

and Us News Stock Index

|

Mean Equation |

|||||

|

Parameters |

Pakistan |

China |

Iran |

Turkey |

|

|

|

0.7768 |

0.7363 |

1.1125 |

0.5749 |

|

|

P-values |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

|

|

|

0.0054 |

7.7041 |

0.0000 |

0.0000 |

|

|

P-values |

0.0258 |

0.2007 |

-0.0000 |

0.1836 |

|

|

Variance Equation |

|||||

|

Parameters |

Pakistan |

China |

Iran |

Turkey |

|

|

|

-0.2187 |

0.0000 |

0.3250 |

-0.0000 |

|

|

P-values |

0.3346 |

0.8622 |

0.0001 |

0.8318 |

|

|

|

-0.0810 |

-0.1038 |

-0.1626 |

-0.0015 |

|

|

P-values |

0.0052 |

0.0000 |

0.0000 |

0.7642 |

|

|

|

0.2208 |

0.7557 |

0.1910 |

0.0029 |

|

|

P-values |

0.0000 |

0.0000 |

0.0000 |

0.7379 |

|

|

|

0.4547 |

0.2322 |

0.1089 |

1.0805 |

|

|

P-values |

0.0000 |

0.0000 |

0.2313 |

0.2968 |

|

|

R-Square |

0.4614 |

0.4912 |

0.0500 |

0.7075 |

|

|

DW-Statistics |

2.3136 |

2.5700 |

2.1383 |

2.4029 |

|

Fig 1

Volatility of Pakistan, China, Iran, Turkey and Malaysia and us News

Exchange Rates

Fig.1 shows the volatility behavior of exchange rate in Pakistan, China, Iran and Turkey. Pakistani and Chinese exchange rate remain highly volatile during the period 2003 to 2018 the exchange rates volatility is relatively high than other period in case of Pakistan exchange. The exchange rate of Iran is remained lesser volatile and the volatility behavior of Turkish exchange rate is mean reverting along with the impact of US News proxy.

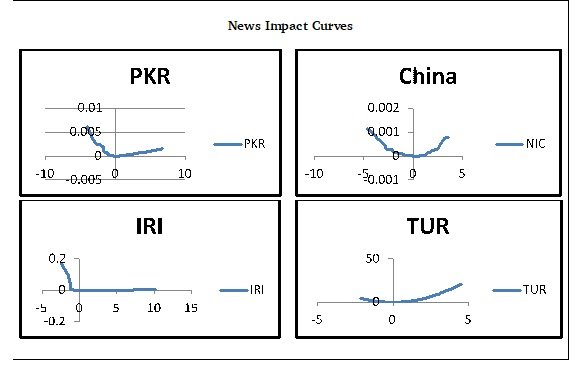

Fig 2.

EGARCH (1, 1) News Impact Curves for Pakistan, China, Iran, Turkey and Malaysia Exchange rates in term of US Dollars

Fig.2 indicates the News Impact Curves for Pakistan, China, Iran and Turkey and US News exchange rates. This figure shows that bad news impact is also high than good news in all above said exchange rates series. This bad news impact increases high volatility due to the significant leverage effect during the whole sample period.

Conclusion

This study has examined that both US news and volatility in exchange rate exposure matter in emerging economies or not. The changing dynamics of exchange rates has dire need to analyze the involved risk or volatility in determining the exchange rates and impact of US News on exchange rates. For this study the exchange rate of Pakistan, China, Iran and Turkey has been examined to determine the impact of this macroeconomic financial indicator and to draw its performing role with US news. Results indicate that the exchange rate of Pakistan and China are more influenced by the US news than Iran and Turkey. The logical reasoning of these results are very clear that US has not well bilateral relationships with Iran and Turkey. The result of News Impact Curves indicates that bad news is generating more volatility than good news and it is an indicator of leverage effect. The Exchange rates are very important for flow of trade and foreign investments of economies and the US economy has strong influence on the world business. However the China is leading in near future in the world of business and trade towards other developing countries. The foreign trade and investments has strongly increased the GDP and per capita income of China from the last once decade tremendously. The exchange rate dynamics indicate that Pakistan and China will co-jointly overcome the issues of global economy regarding to the monopolistic control through the adventure of CPEC. There are many countries in modern world which pay a special attention to control the sustainability in the foreign exchange rate. Considering the importance of exchange rate stability in developing countries, few countries remain unable to gain sustainability in exchange rate due to poor political administrative structure and instable corporate governance in countries. These specific issues badly effect the financial performance of the economies which does not allow to retain the exchange rate stable over a long period of time. Hence, several investors and businesses remain reluctant in putting their investment in any grey area. In such cases the flow of funds does not meet the economic requirement in countries and many business ventures get disturb and overall economy suffers. By taking into account all these facts, it was the need of the hour to examine the different factors of different economies to know the real cause of exchange rate performance. This study provides guiding implications regarding to the contagion effect of developed world economic, financial, geopolitical news on the Asian economies and provides a policy guideline for investors, financial decision makers and economist to understand the risk behavior and investment designs for better portfolio management.

References

- Abbes, M. B., & Abdelhédi-Zouch, M. (2015). Does hajj pilgrimage affect the Islamic investor sentiment? Research in International Business and Finance, 35, 138-152.

- Al-Khazali, O. (2014). Revisiting fast profit investor sentiment and stock returns during Ramadan. International Review of Financial Analysis, 33, 158-170.

- Aggarwal, R. and Harper, Jt., (2010). Foreign exchange rate exposure in domestic corporation. Journal of International Money and Finance, 29, 1619-1636

- Ahmadi R., Rezayi M. and Zakeri M. (2012). Effect of exchange rate exposure on stock market: Evidence from Iran. Middle-East Journal of Scientific Research, 11(5), 610-616.

- Adler, M. and Dumas, B. (1984). Exposure to currency risk: definition and measurement, Financial Management, 13(2), 41-50.

- Bartov, E., & Bodnar, G. M. (1994). Firm valuation, earnings expectations, and the exchange-rate exposure effect. Journal of Finance, 49(5), 1755-1785.

- Bartov, E. and Bodnar, G.M. (1995). Foreign currency translation reporting and the exchange rate exposure effect. Journal of International Financial Management and Accounting, 6 (2), 93- 115.

- Bartram, S.M., Brown, G.W. and Fehle, F. (2003). International evidence on financial derivatives usage. University of Lancaster, University of North Carolina and University of South Carolina Working Paper.

- Bhuiya, M., Ahmed, E., and Haque, M. E. (2015). Corporate international diversification, exchange rate exposure, and firm value' an analysis on United Kingdom multinationals. International Journal of Economics, Commerce and Management, 3(3), March 2015

- Bartram, S.M., Frenkel, M. and Dufey, G. (2005). A primer on the exchange rate exposure of nonfinancial firms to foreign exchange rate risk. Journal of Multinational Financial Management, 15 (4/5), 394-413.

- Bartram, M. S., & Bodnar, M. G. (2007). The exchange rate exposure puzzle, Managerial FinancE, 33(9) - August 2007

- Bartram M, S., Brown, W. G., & Minton, A. B. (2010). Resolving the exposure puzzle: the many facets of exchange rate exposure. Journal of Financial Economics. 95, 148-173

- Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307-327.

- Choi, J.J. and Prasad, A.M. (1995). Exchange risk sensitivity and its determinants: a firm and industry analysis of U.S. multinationals. Financial Management, 24(3), 77-88.

- De Jong, A., Ligterink, J., & Macrae, V. (2006). A firm-specific analysis of the exchange-rate exposure of Dutch firms. Journal of International Financial Management and Accounting, 17(1), 1-28.

- Dominguez, K.M.E. and Tesar, L.L. (2001a). A reexamination of exchange-rate exposure. American Economic Review, 91 (2), 396-400.

- Dumas, B. 1978. The theory of the trading firm revisited. Journal of Finance, 33(3), 1019-1030.

Cite this article

-

APA : Akash, R. S. I., Hamid, K., & Mahmood, I. (2020). Do US News and Volatility in Exchange Rate Exposure Matter (Empirical Evidence from Emerging Economies). Global Social Sciences Review, V(I), 198-208. https://doi.org/10.31703/gssr.2020(V-I).21

-

CHICAGO : Akash, Rana Shahid Imdad, Kashif Hamid, and Iqbal Mahmood. 2020. "Do US News and Volatility in Exchange Rate Exposure Matter (Empirical Evidence from Emerging Economies)." Global Social Sciences Review, V (I): 198-208 doi: 10.31703/gssr.2020(V-I).21

-

HARVARD : AKASH, R. S. I., HAMID, K. & MAHMOOD, I. 2020. Do US News and Volatility in Exchange Rate Exposure Matter (Empirical Evidence from Emerging Economies). Global Social Sciences Review, V, 198-208.

-

MHRA : Akash, Rana Shahid Imdad, Kashif Hamid, and Iqbal Mahmood. 2020. "Do US News and Volatility in Exchange Rate Exposure Matter (Empirical Evidence from Emerging Economies)." Global Social Sciences Review, V: 198-208

-

MLA : Akash, Rana Shahid Imdad, Kashif Hamid, and Iqbal Mahmood. "Do US News and Volatility in Exchange Rate Exposure Matter (Empirical Evidence from Emerging Economies)." Global Social Sciences Review, V.I (2020): 198-208 Print.

-

OXFORD : Akash, Rana Shahid Imdad, Hamid, Kashif, and Mahmood, Iqbal (2020), "Do US News and Volatility in Exchange Rate Exposure Matter (Empirical Evidence from Emerging Economies)", Global Social Sciences Review, V (I), 198-208

-

TURABIAN : Akash, Rana Shahid Imdad, Kashif Hamid, and Iqbal Mahmood. "Do US News and Volatility in Exchange Rate Exposure Matter (Empirical Evidence from Emerging Economies)." Global Social Sciences Review V, no. I (2020): 198-208. https://doi.org/10.31703/gssr.2020(V-I).21