Abstract

In a parliamentary democracy, the opposition has a significant role in the parliament. This research article analyzes the role of opposition benches in finance bills presented on the floor of the National Assembly in the PML-N government from 2013-2018. It thoroughly investigates the debates of the members of the opposition benches made on all the budget bills in the period 2013-18. Moreover, the suggestions and amendments put forward by the members of the opposition parties are also critically analyzed. This study has carried out under a qualitative research design. The descriptive-analytical method is adopted for the analysis of data. This research shows that the opposition benches had actively participated in the budget bills through debate and cut motions. It had also criticized those policies of the government which are against the welfare of the common people, particularly the imposition of new taxes. It further finds that the opposition parties did the contrary when they came in power.

Key Words

Opposition, Budget, Debate, Cut Motions, Amendments

Introduction

In a parliamentary democracy, the opposition has a significant role in the parliament. The Modern Politics' thesaurus describes opposition as a political party or loose affiliation of people who desire to replace the government and change its plans (Robertson, 2002). However, Robert Dahl defines opposition as the political parties which are working against the behavior and policies of the ruling parties (Dahl, 1966). To put it more comprehensively, the political parties sitting on the opposition benches of parliament propose alternative policies against the policies of treasury benches. In this research, therefore, opposition means the political parties in Pakistan which had occupied opposition benches in Parliament from 2013 to 2018 and had offered alternative policies against the policies of the ruling parties. This research finds out the role of opposition benches in the finance bills presented in the National Assembly (NA) in the Pakistan Muslim League Nawaz (PML-N) government from 2013 to 2018. In the PML-N government, the major opposition parties were Pakistan People Party (PPP), Pakistan Tehreeki Insaaf (PTI), Jamat-i-Islami (JI), Awami National Party (ANP), Muttahida Qaumi Movement (MQM) and some regional parties.

The finance bills are presented every year in June in the National Assembly of Pakistan by the treasury benches. By tradition, the opposition leader initiated the debate on the bill, and then all the opposition parties, as well as treasury benches, participated in the debate. The opposition benches make objections, propose suggestions and move amendments in the bill. However, the most important tool through which opposition parties show their criticism on the finance bill is cut motion. It is a power granted to the members of the parliament to oppose a demand proposed by the treasury benches in the finance bill. There are three types of cut motion, namely disapproval of policy cut motion, Token cut motion, and Economy cut motion. Disapproval of policy cut motion is moved to reduce the amount demanded to Re. 1, which means the mover is rejecting the government policy. The token cut motion is tabled to reduce the amount demanded to Rs. 100, which means the member has grievances on the policy of the government. The economy cut motion is moved to reduce the amount of demand to a specific amount. It is to be noted that the cut motion should be submitted in the NA one day before the discussion. All these different types of cut motions are significant tools that show the activeness of the opposition. In this article, the role of opposition benches in the budget bills in the PML-N government (2013-18) is critically analyzed.

Finance Bill 2013-14

PML-N government proposed its first Finance bill 2013-14 of 3.59 trillion rupees, comprised of 207 billion rupees in new taxes. The government employees' salaries were increased up to 10 percent. In addition, GST was raised to 17 from 16 percent by amending the Sale Tax Act 1990. It is to be noted that while sitting on the opposition benches in the PPP government (2008-13), PML-N was of the opinion that GST should be brought down to 10 percent. However, in its own government, in the first finance bill, GST was increased from 16 to 17 percent.

Afore starting formal debate on the finance bill, two opposition parties, PTI and JI, staged a walkout from the house. PTI lawmakers protested on the increase of GST rate by FBR before the finance bill was passed from the parliament (Rehman, 2013). Whereas JI staged a walkout against the withdrawal of relief package for the masses of Malakand Division.

Starting the debate on the finance bill, opposition leader Khursheed Shah said that the budgets had no package to redress the problems faced by the poor people of the country (National Assembly, 2013). He labeled the budget as "anti-people". He extended the by only abolishing the discretionary funds would result in benefit for the country. Opposition leaders argued that treasury benches increased salaries only up to 10 percent after strong protest from the opposition political parties and government servants. He further criticized the increase in GST. He also advised the government not to privatize any government institution because it would badly impact the poor labor of Pakistan.

MQM’s Farooq Sattar told the house that the finance bill had no new thing for the common people (National Assembly, 2013). He recommended that GST should be a provincial subject, and the federal government has no right to keep it with itself. He termed the extra tax on petroleum as 'official extortion'. In addition, he proposed a 50 billion rupees reduction in defense spending to control load shedding in the country. Iqbal Qadri of MQM also criticized the amendment in tax and called it unjust and unfair.

Shah Mehmood Qureshi of PTI objected to the imposition of GST from the 13th of June and termed it unconstitutional (National Assembly, 2013). Shireen Mazari argued government servants, and labor class has been ignored in the budget as minimum wages are not enhanced (National Assembly, 2013). She extended that the government concentration is on indirect taxes which is unconstitutional. PTI lawmaker also expressed grievances on the increase in electricity tariff because all the burden would befallen on the poor masses. Shafqat Mehmood of PTI believed that the government has imposed more tax on low-salaried people than high-salaried employees in the finance bill 2013-14, which is an injustice to the lower-grade government's employees.

Sahizada Tariqullah of JI told the house that our party has strong reservations over the increase in GST (National Assembly, 2013). He was of the view that the solution for all the problems of Pakistan was in the imposition of Islamic Law in the country. Moreover, he proposed a 20 percent increase in the salaries of government employees. Ghous Bakhsh Mehar of PML-F also emphasized on the withdrawal of GST as it would result in the rise of inflation (National Assembly, 2013).

In short, the opposition benches main proposals to the government were not to opt for the privatization of national enterprises, withdrawal the rise in GST, and increase the salaries of the government employees. However, all the proposals and objections of the opposition parties in the finance bill 2013-14 were rejected by the treasury benches.

Federal Minister for Finance Ishaq Dar while responding to the opposition benches, argued that the 1931 Act empowered the government to collect any rise in GST instantly with introduction of finance bill (National Assembly, 2013). Furthermore, he said that PPP's government had raised the allowances and salaries of the NA speaker and chairman senate via an amendment in finance bill 2010. Therefore, we changed that amendment as it was irrelevant and against the spirit of the constitution. The treasury benches tried to involve the opposition in other political issues like a national security issue, trial of Musharaff for treason and peace process with Taliban in the limited session for budget (Khan, 2013). The purpose was to keep away opposition parties from debating on the finance bill.

Besides, opposition benches moved two amendments in the finance bill 2013-14 which were opposed by the government. Dr. Nafisa Shah of PPP proposed an amendment in Clause 3 of the bill that the words "which are declared by the Federal Government through a notification in the Official Gazette, to be provincial sales tax for the purpose of input tax" should be removed (National Assembly, 2013). In clause 4, Sahibzada Tariqullah of JI moved an amendment which proposed that after the word “manner” appearing at the end, the words “provide details of those account holders and transactions made in their accounts that are declared as tax evaders or defaulters by the competent authority or any court of law, as directives given by the concerned competent authority or court of law” (National Assembly, 2013). However, both the amendments were rejected by the treasury benches.

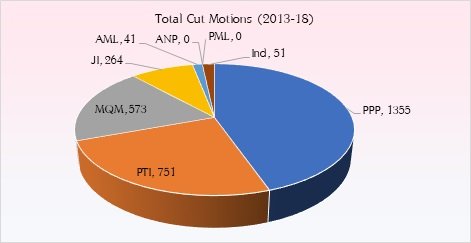

In addition, opposition benches also used a tool of cut motion to scrutinize the financial policies for 2013-14 of the government. Five opposition parties and independent members from opposition benches moved 770 cut motion in the finance bill in which PPP was at the top. PPP moved total 284 cut motions, which included 102 disapproval policy cut motions, 176 token cut motions, and only 06 economy cut motions. PTI tabled a total of 222 cut motions in which 79 were disapproval of policy cut motion, 138 were token cut motions, and only 05 were economy cut motions. Another opposition party, MQM presented a total of 233 cut motions comprised of 42 disapproval of policy cut motions, 188 were token cut motions, and only 03 were economy cut motions. Other smaller opposition parties, JI and AML, moved 04 and 10 disapproval of policy cut motions and 09 and 02 token cut motions, respectively. However, both parties did not move any economy cut motions. Some independent members also moved 04 disapproval of policy cut motions and 02 token cut motions. The data shows PPP had the most active participation in the bill, whereas MQM had fewer members than PTI but performed better then it. The charts of these details are shown in figure 1.

Finance Bill 2014-15

PML-N government passed the finance bill for 2014-15 and approved the federal budget of 4300 billion rupees. The expenditure for the fiscal year 2014-15 was calculated 3937 billion rupees which was 2 percent higher than previous years. The salaries of the government employees were increased up to 10 percent. While all the tax-related amendments moved by the treasury benches were adopted, the amendments proposed by the opposition benches were rejected.

Opposition leader Khursheed Shah proposed to the government to review the whole budget (National Assembly, 2014). He told the house that government must keep the debt to GDP ratio below 60 percent but it had crossed 62 percent. The leader of the opposition used harsh language for the government in his speech. He severely criticized the government plan to privatize the public entities. He informed the government that the opposition strongly resisted on the privatization of any public entity. The opposition leader was also unhappy with the allocation of 28 billion rupees for the Metro Bus project. He was of the opinion that this amount should be spent on the construction of Basha and other dams.

Another member from the opposition benches Asad Umar of PTI, rejected the finance bill 2014-15. He argued the budget would give benefit Indian businessmen because they would pay less tax than our country's businessmen (National Assembly, 2014). He claimed the PML-N government had raised inflation up to 60 percent. He further criticized the purchasing of bulletproof vehicles of 22 crore rupees for the PM house. He emphasized that government should decrease the rates of gas and electricity and raise the wages of laborers. He added that the government has presented a people-enemy budget, and it has no such thing which gives welfare to the poor masses of the country.

While responding to the opposition benches, PML-N’s Danyal Aziz from treasury benches argued that PPP's government had run the affairs of the government without a finance minister (National Assembly, 2014). He extended the privatization of some public entities was approved by the cabinet of the PPP government. So, PPP had no right to make a criticism on the privatization policies of the government. He was of the opinion that inflation were in its highest level in the previous government. He further said the PML-N government had presented a people-friendly budget and would give a boost to the business environment in the country.

Overall in the budget session, there was less discussion on the finance bill and its related issues. Most of the time was spent on issues which were irrelevant to the finance bill. There was no proper debate and discussion on the issues important for the public in the finance bill 2014-15 (Saeed, 2014). The Nation newspaper also reported this session as an "unusual budget session".

Besides debate on the finance bill 2014-15, opposition benches proposed several amendments. Sher Akbar Khan of JI moved an amendment which says that the government has enacted a minimum amount of custom duty on one kind of things which has been withdrawn through this finance bill; therefore, he suggested that it should not be withdrawn because it would affect the poor classes (National Assembly, 2014).

In Clause 3, the government has empowered the FBR to decide area or zones in which the maximum rate of any brand would be imposed, on this JI proposed amendment that the determination of rate should be decided on the quantity as well as the quality of the products(National Assembly, 2014). JI also proposed that 5 percent tax in the electricity bills up to twenty thousand rupees should be abolished because if someone has one or two thousand electricity bills, he would also pay this tax which is injustice with poor masses. Moreover, JI proposed another amendment which says that government should refund money to any individual who made a legal claim for it. Nevertheless, all these amendments in clause 3 by JI was opposed by the treasury benches.

In clause 6, JI proposed that the tax on movable and immovable property should be imposed after assessment, without assessment, imposition of tax would be an injustice (National Assembly, 2014). Another member from opposition benches, PPP's Nafeesa Shah, suggested that federal excise duty should also be imposed on the 1800cc local vehicles (National Assembly, 2014). She further proposed that rural Sindh should be included in tax exemption area for five years, and the horticulture in Southern Punjab should be incentivized. Similarly, Shagufta Jumani of PPP proposed an amendment that the limit of turnover should be increased from 5 million to 100 million rupees for tax imposition. Syed Naveed Qamar of PPP also proposed in Clause 6, in sub-clause 35 in proposed section 235 B, the words “tax on steel melters and re-rollers" should be deleted. He also suggested that in sub-clause 37, the words "five percent" should be replaced with "two percent". However, this time the government accepted the amendments from the opposition benches. Consequently, the house adopted all the three amendments of PPP and one amendment of JI.

Furthermore, the opposition also tabled 978 cut motions to inspect the finance bill. This year the number of cut motions were increased from the previous year. PPP was the most active opposition party and moved 468 cut motions in the finance bill 2014-15, which included 91 disapproval of policy cut motions, 339 token cut motions, and 38 economy cut motions. PTI tabled a total of 242 cut motion which included 68 disapproval of policy cut motions, 151 token cut motion, and 23 economy cut motions. MQM also moved 136 cut motions comprised of 09 disapproval of policy cut motion, 120 token cut motions, and 07 economy cut motions. JI, with only four members in NA, proposed not only amendments but also tabled 95 cut motions. JI cut motions included 25 disapproval of policy, 68 token cut motions, and only 02 economy cut motions. AML, with only one member in the NA tabled 12 disapproval of policy cut motions and 03 token cut motions. Similarly, independent members also 13 disapproval of policy cut motions and 09 tokens cut motions. Like the previous year, PPP was again the most active opposition party as it was also a major opposition party. However, the role of JI and AML were appreciable because of fewer seats in the NA actively contributed in the NA. The charts of these details are shown in figure 1.

Finance Bill 2015-16

While the opposition was boycotting from the budget session, the treasury benches passed hurriedly the Finance Bill 2015-16 with the total amount of 4310 billion rupees. Finance Minister Ishaq Dar revealed the salient features of the bill, including removal or decrease of some taxes, increase in salaries of government servants, and allocation of billion rupees for farm subsidy fund. It was easy for the finance minister to pass the bill due to low attendance and continuous walkouts of the opposition benches from the session.

Opposition leader Syed Khursheed Shah

started the debate on finance bill and termed it anti-people budget. He disapproved the increase in sale tax by arguing it would disturb the poor man in villages as well as in cities. He was of the view that the budget 2014-15 was not people friendly. There was no such thing in the bill which had been formulated for the welfare of the common citizens of Pakistan.

Asad Umar of PTI alleged PML-N government for making policies only for the elite class and ignoring the poor and middle class (National Assembly, 2015). He also demanded that sale tax should be decreased to 15 percent, and in the next two years it should further reduced to 12.5 percent. He strongly condemn the increase of sale tax to 28 percent which would result in the double increase in the rates of electricity and gas. He claimed all the targets were missed due to incompetency of the government, for this reason, five mini budgets had been presented by the government. He further criticized the allocation of 139 billion rupees supplementary grants, which were 65 billion rupees the previous year. Besides, he proposed a 15 percent increase in the salaries of government servants and the imposition of net asset tax to decrease the gap between rich and poor.

Farooq Sattar of MQM argued the finance bill had no practical solutions for the economic problems of Pakistan (National Assembly, 2015). He told the house that the presentation of the budget was only a tradition as it did not propose any permanent solution to improve the economic deterioration of the country. He asked the government to decrease the rate of oil, electricity, urea and gas. He also condemn the government's proposal to raise sale tax by 1 percent. He was of the opinion that sale tax should be decreased from 16 percent to 10 percent, on the contrary, it was raised to 17 percent. He maintained the 1 percent increase in sale tax meant a 5 percent increase in inflation, which would affect the poor class.

However, the opposition parties abstain from the remaining proceeding on the budget in the NA. The opposition leader and his co-benchers decided not to participate in the session because the treasury benches did not wait for the opposition return from a walkout and passed 50 demands for grants (Asghar, 2015). It was considered as an insult by the opposition parties. They also did not move 1500 cut motions of which they had given notice. The opposition parties also called for a nationwide protest across the country against the government’s policies and observed the day as “black day” (Asghar, 2015). The government tried to persuade the opposition benches for participating in the budget session. Speaker of the NA called a meeting of the parliamentary leaders of the opposition parties to change the decision of boycott and participate in the proceeding of the session. In return, the government would carry on the proceeding of NA to debate the energy crisis in the country. As the opposition had staged token walkouts on the issue of energy crisis. Nonetheless, the treasury and opposition benches did not come to an agreement. Ultimately, the opposition continued its boycott from the budget session and the government passed the Finance Bill 2015-16. Numerous amendments from PPP and JI and 1500 cut motions from the opposition parties were also not tabled due to the protest of the opposition parties.

Finance Bill 2016-17

PML-N's government passed its fourth budget from the NA amounting 4400 billion rupees with changing the tax laws and raising the salaries of the parliamentarians. In addition, 261 billion rupees supplementary budget were also passed for the spending which the government had spent beyond the budget in the outgoing financial year.

The debate on the financial bill was opened by the opposition leader Khursheed Shah. He argued the opposition did not understand the budget whether it is pro-public, pro-labor or pro-farmer (National Assembly, 2016). He stated that the economic policy of the government has no direction as it has not focused on a particular area. He reminded the finance minister of the promise to shun energy crisis in one year by constructing new dams. PML-N had also promised in its election manifesto to abolish the energy crisis from the country soon after making government. However, after coming into power, PML-N were telling that the energy crisis would be overcome after 2018. Opposition leader asked the government that where are the different projects like Neelum-Jehlum hydropower and Chasma nuclear plants to fulfill the energy demand of the country.

The parliamentary leader of MQM Farooq Sattar also from opposition benches termed the finance bill anti-poor (National Assembly, 2016). He argued people of Pakistan are deceived by the budget because it has nothing for the welfare of the poor people. He extended MQM has proposed many constructive suggestions for the betterment of the people, however ignored by the treasury benches. MQM parliamentary leader was of the view that the budget would not create any significant impact on the masses of Pakistan. He also rejected the government claims of economic stability by pointing out millions of non-filers of taxes. He stated that the imposition of withholding tax would result in additional burden over the masses of Pakistan, therefore, the government should withdraw this withholding tax. Besides, he proposed that levy and sale tax should also be withdrawn. Another MQM's member Salman Baloch termed the budget as "political announcement" for the election year. He argued only tricky statistics are projected in the budget, as there are no concrete measures for the prosperity of the people.

PTI’s Dawar Kundi from opposition benches labelled the budget directionless and was an expression of criminal negligence (National Assembly, 2016). He asked how the government could assess the distribution of funds to provinces when it did not know the actual figure of the population of the provinces. Another PTI's member Shahriyar Afridi also insisted on this point by questioning that how a family head formulate policies without knowing authentic figures of members of his family. He said that it is not understandable to formulate Vision 2025 and other policies while census has not been conducted since 1998. He claimed the government has failed to accomplish any of its target set in the previous finance bill.

Nonetheless, the treasury benches rejected all the amendments suggested by the opposition parties. In Clause 2 and Clause 3 of the bill, JI from opposition benches proposed a new proviso which states that such INGOs operating under a memorandum of understanding (MoUs) or an agreement with the Government of Pakistan should limit their work to natural calamity and welfare purposes and should not have type of work in any meaning against national security and national economic interests (National Assembly, 2016). JI want to add this sentence in Clause 2 because the government has exempted foreign companies from custom duties and sale tax in the bill. JI was of the opinion that only those companies should be exempted from tax which are not involved in such activities which is against the national interest of Pakistan. However, the amendment was opposed by the finance minister and rejected by the house.

In Clause 3, PPP proposed two amendments, the first amendment was moved by Naveed Qamar from opposition benches which states that paragraph (iii) should be deleted as it is imposing double taxation which is injustice (National Assembly, 2016). The second amendment was moved by Azra Afzal which says that mineral water should not be removed from zero rate tax and stationary items should also not be taxed. PTI, another opposition party, also moved an amendment in Clause 3, section 56B, in sub-section (2), for the word 'shall' the word 'may' should be replaced (National Assembly, 2016). Dr. Arif Alvi explained that the government should have the authority to disclose the information it received in different agreements, therefore, the word 'shall' be replaced by the word 'may'. According to section 56B in Clause 3, the information received by the government shall be confidential, and for this reason PTI wanted to amend the said section. Furthermore, JI also proposed in Clause 3 that stationary item and mineral water should not be taxed, and the tax increased from 5 to 10 percent on poultry in the bill should be revised back. However, the government did not consider any of these amendments, hence all these amendments were also rejected by the house.

In Clause 6 of the bill, Nikhat Shakeel of MQM proposed that every parliamentarian should be given an assistant who would help them in research and legislation making (National Assembly, 2016). In Clause 7 of the bill PPP proposed that service tax on port operator and tribunal services in ports should be removed, as it is provincial subject (National Assembly, 2016). PPP also proposed that in sub-section 12 of section 19 in Federal Excise Act a new proviso should added which states that any person should be given judicious opportunity of hearing and chance to correct the error before imposing penalty. Dr. Arif Alvi of PTI also moved an amendment in Clause 7, section 47B, in sub-section (2), for the word 'shall' the word 'may' should be replaced (National Assembly, 2016). It is the same amendment which is also proposed in Clause 3 of the bill by PTI. Nonetheless, these amendments were also opposed by the government and rejected by the house.

In the Finance Bill 2016-17, opposition benches moved 13 amendments in several clauses of the bill, however, all were opposed by the government. In total amendments, PPP proposed 5, JI 4, PTI 3 and MQM proposed 1 amendment.

Moreover, opposition parties moved 1287 cut motions in the finance bill. PPP tabled the high numbers of cut motions. Out of 603, PPP moved 118 disapproval of policy cut motions, 422 token cut motions and 63 economy cut motions. On the second number, PTI tabled 287 cut motions which included 75 disapproval of policy cut motions, 199 token cut motions and 13 economy cut motions. MQM also tabled 204 cut motions in which 18 were disapproval of policy cut motions, 169 token cut motions and 17 economy cut motions. JI tabled 156 cut motions comprised 59 disapproval of policy cut motions, 96 token cut motions and only 01 economy cut motions. AML with only one member also moved 13 disapproval of policy cut motions and only 01 token cut motion. Independent members from the opposition benches also moved 18 disapproval of policy cut motions, 13 token cut motion and 02 economy cut motions. The charts of these details are shown in the figure 1.

Finance Bill 2017-18

The Finance Bill 2017-18 was passed from the NA by PML-N government with total outlay of 4750 billion rupees. The house also permitted 3450 billion rupees for different ministries and divisions. However, the opposition remained absent from the session due to protest by not telecasting the speeches of the opposition members. It was the first time in the history of Pakistan that finance bill had passed without the presence of the opposition parties in the whole session of the National Assembly.

The government presented the finance bill for general discussion in the NA, nonetheless, opposition benches refused to participate in the debate on the finance bill 2017-18 (Wasim, 2017). The opposition had demanded to live telecast the speeches of the opposition members on national TV which was rejected by the treasury benches. Consequently, the combined opposition parties conducted equivalent assembly in front of the Parliament. They termed the finance bill as anti-people. Some of the government seasoned members with PkMAP chief Mehmood Khan Achakzai tried to persuade the leader of opposition, but he declined the proposal of the treasury benches and maintained the “mock assembly” (Rehman, 2017).

In front of parliament at mock assembly, leader of opposition severely criticized the government’s proposal for the budget 2017-18. Other veteran members of opposition parties comprising PTI, MQM and JI also debated on the finance bill in the mock assembly. Khursheed Shah, the leader of opposition, was of the opinion that the minister for finance has betrayed the whole nation via budgetary proposals (Rehman, 2017). He said the grievances of the poor people are not addressed in the finance bill. Besides, the government has failed to achieve the GDP growth.

Shah Mahmood Quraishi of PTI contended that government has failed to resolve the energy crisis in the country (Wasim, 2017). He further criticized the government for not giving preference to health and education in the finance bill. Asad Umar also from PTI alleged the government for tampering the figures in the finance bill 2017-18. He opined the level of production of electricity is reduced by comparing it with the production of the last government. He also condemned the tax on salaried persons because there was no appropriate package in return of the tax collected from the salaried class.

Sahbizada Tariqullah of JI from opposition benches stated there is nothing in the budgetary proposal for the poor class of the country (Rehman, 2017). He asserted that in return of tax collection, the government is not providing any proper relief to the taxpayer people. Parliamentary leader of MQM Farooq Sattar scolded the treasury benches over unscheduled load shedding in Karachi (Rehman, 2017). He claimed that the government has failed to monitor the K-electric for overcoming the issue of load shedding. He emphasized for the incorporation of the shadow budget prepared by MQM.

The opposition parties neither forwarded any alternative polices nor examined thoroughly the finance bill. They remained absent from such an important legislation because their speeches were not telecasted on PTV. It was unserious attitude of the opposition parties towards an annual fiscal policy of the government. The opposition benches ill-performed in proposing alternative policies for bettering the budgetary proposal (Hoti, 2017). It looked like that all the opposition parties were not prepared to critically analyze the finance bill. The protest staged by the opposition did nothing but provide a safe passage to the government to pass the finance bill without any amendment and objection from the opposite benches.

Figure 1

Figure 2

Discussion

Figures 1 and 2 show the total amount of cut motions presented by the opposition benches against the policies of the government from 2013 to 2018. PPP as a major opposition party presented the most cut motions, in addition, it also tabled several amendments in the finance bills on the floor of the house. Hence, PPP had played the role of the most active opposition party in the Parliament. PTI and MQM also actively examined the financial policies of the government by tabling 751 and 573 cut motions in three finance bills, respectively. JI, one of the smaller opposition parties, moved not only 264 cut motions but also several amendments in the finance bills. I had only four members in the NA, however, it performed significantly well according to its numbers. AML with only one member in NA also tabled 41 cut motions to scrutinize the policies of the government. ANP and PML neither moved any cut motion nor tabled an amendment in the finance bills of PML-N government. In addition, independent members from opposition benches moved 51 cut motions to examine the policies of the government. However, in two finance bills of 2015-16 and 2017-18, the opposition benches staged protest and boycotted from the session. It neither participated in the budget debate nor tabled any cut motion or amendments in the said finance bills. The government had taken advantage of the situation and passed the bills smoothly.

However, when asked from the then opposition member of the parliament that why opposition boycotted from the important budget session. Tahir Mashadi argued that walk out in the budget session occurred when the government double-crossed the opposition benches (T.H. Mashadi, personal communication, August 18, 2020). Double cross means when the finance minister accepts the demands of the opposition benches and do not incorporate in the bill. On the other hand Senator Mushtaq Ahmed of JI responded that budgets are always made on the wishes of IMF. It has nothing for the interest of the common people (M. Ahmed, personal communication, August 10, 2020). It is only a formality to pass it from the parliament. He said that JI always emphasized to abolish foreign dependency and make our own policies irrespective of the conditions of international organizations. PTI’s MNA Saleem-ur-Rehman claimed that in the PML-N government, Finance Minister Ishaq Dar had designed a budget only for mafias like sugar mafia, petrol mafia etc. and showed fake figures in the budget (S. Rehman, personal communication, April 06, 2020). He extended that there was nothing for the welfare of the common people in the finance bill passed in PML-N's government.

Correspondingly, a political anomaly is observed in the finance bills passed by the parliament from 2008 to 2018. While sitting on the opposition benches, PML-N was of the opinion that GST should be brought down to 12 percent (National Assembly, 2010). However in its own government, in the first finance bill, GST was increased from 16 to 17 percent. In addition, PML-N had strongly criticized the government for increase in defense budget (National Assembly, 2011), but it did not decrease the defense budget in its own government. Similarly in the finance bills during PML-N government, PPP severely criticized the policy of privatization. However, this policy was approved by the cabinet in PPP's government. PPP had strong reservations over the increase in taxes and petroleum levies, even though it was also increased by PPP's government itself. In the same way, in PML-N's government, PTI lawmakers were of the opinion that GST should be brought down to 12.5 percent. Nonetheless, after three years of government they did not act upon its own proposal. It shows that the opposition parties did the contrary when they came in power. They do not fulfill what is expected from them by the common masses. The data also shows that opposition had mainly focused on tax laws and the salaries of the government employees. It criticizes the imposition of new taxes and demands to increase the salaries of the government's employees.

Conclusion

To sum up, the opposition responsibility is not only to examine the policies of the government but also to propose alternative policies against the policies of government. The above description shows that PML-N government from 2013 to 2018 opposition benches have performed their duties. They have pointed out those policies of the government which were against the public aspirations and had proposed alternative policies in this regard. Furthermore, in PML-N's government, opposition benches have tabled 3035 cut motions and more than 20 amendments. They boycotted from two budget sessions and did not move any cut motions or amendments. In both governments, the opposition's objections are almost the same. They had made strong reservation over the increase in taxes and had emphasized on the salaries of the government servants. It is also worth mentioning that every finance bill from 2013 to 2018 was termed 'unfriendly' by the opposition benches. Every time the government was being accused of for making the budget only for the elite class and not for poor class by the opposition parties. This research also implies that what the opposition had demanded in the finance bills from the governments, mostly those demands were ignored when the opposition parties had taken charge of the treasury benches.

References

- Asghar, R. (2015, June 24). Budget rushed through NA after boycott by opposition. Dawn.

- Dahl, R. (1966). Political opposition in western democracies. Yale University Press.

- Hoti, I. (2017, June 12). Opposition looks unprepared to make 'hostile' analysis of budget. The Express Tribune,

- Khan, M. Z. (2013, June 27). Finance bill 2013- 14: The Accountant's budget. Dawn.

- Pakistan. Parliamentary Debates. National Assembly. 15 June 2013. 2.

- Pakistan. Parliamentary Debates. National Assembly. 18 June 2013. 2

- Pakistan. Parliamentary Debates. National Assembly. 20 June 2013. 2.

- Pakistan. Parliamentary Debates. National Assembly. 27 June 2013. 2.

- Pakistan. Parliamentary Debates. National Assembly. 06 June 2014. 12.

Cite this article

-

APA : Adil, M., & Afridi, M. K. (2021). The Politics of Opposition: A Critical Analysis of Financial Legislation in Pakistan (2013-18). Global Social Sciences Review, VI(IV), 174 ‒ 183. https://doi.org/10.31703/gssr.2021(VI-IV).17

-

CHICAGO : Adil, Muhammad, and Manzoor Khan Afridi. 2021. "The Politics of Opposition: A Critical Analysis of Financial Legislation in Pakistan (2013-18)." Global Social Sciences Review, VI (IV): 174 ‒ 183 doi: 10.31703/gssr.2021(VI-IV).17

-

HARVARD : ADIL, M. & AFRIDI, M. K. 2021. The Politics of Opposition: A Critical Analysis of Financial Legislation in Pakistan (2013-18). Global Social Sciences Review, VI, 174 ‒ 183.

-

MHRA : Adil, Muhammad, and Manzoor Khan Afridi. 2021. "The Politics of Opposition: A Critical Analysis of Financial Legislation in Pakistan (2013-18)." Global Social Sciences Review, VI: 174 ‒ 183

-

MLA : Adil, Muhammad, and Manzoor Khan Afridi. "The Politics of Opposition: A Critical Analysis of Financial Legislation in Pakistan (2013-18)." Global Social Sciences Review, VI.IV (2021): 174 ‒ 183 Print.

-

OXFORD : Adil, Muhammad and Afridi, Manzoor Khan (2021), "The Politics of Opposition: A Critical Analysis of Financial Legislation in Pakistan (2013-18)", Global Social Sciences Review, VI (IV), 174 ‒ 183

-

TURABIAN : Adil, Muhammad, and Manzoor Khan Afridi. "The Politics of Opposition: A Critical Analysis of Financial Legislation in Pakistan (2013-18)." Global Social Sciences Review VI, no. IV (2021): 174 ‒ 183. https://doi.org/10.31703/gssr.2021(VI-IV).17