Abstract

In this study, the researchers observed the impact of Brexit on the Pound and its spillover to other European countries, likely to be affected during that period. The intraday high-frequency hourly return data of chief monies as Great Britain Pound (GBP), Euro (EUR), Danish Krone (DDK), Hungarian Forint (HUF), Turkish Lira (TRY), Swiss Franc (CHF), Swedish Krona (SEK), and Polish Zloty (PLN), for two months and one day, was utilized. The Intraday volatility spillover index approach and a further rolling window technique applied. The analysis of high-frequency data revealed that four currency pairs as TRY/USD, DKK/USD, PLN/USD, and HUF/USD, are highly volatile currencies. However, three pair currencies as GBP/USD, EUR/USD, and SEK/USD, are comparatively lesser volatile. The results and managerial implications reflect preparedness dynamics and proactiveness for a new continuum project that regional transmission effects of volatility spread from one currency to other currencies in the EU during Brexit.

Key Words

Brexit, Forex Market, Volatility Spillovers

Introduction

Brexit (or Britain exit) is Britain leaving the European Union (EU) is also developing as an event of the great impact of modern time. This event occurred because of the referendum in the UK, where 51.9 % of people voted to leave the European Union EU (Electoral Commission, 2016). The circumstances of Brexit are highlighted by (Baker et al., 2016) that this event is not a simple withdrawal of one country from the Union and termed this event as a large scale event having socio-economic implication, which eventually going to change the structure of European economies. As a result of this historic political event, financial market decline cause chaos in the forex market (Foreign Exchange Market) and the global stock market. Immediately after the result of the referendum, it was observed that in the forex market, the GBP (Great Britain Pound) had declined sharply against USD (United State Dollar) and Euro due to intervention on June 23, 2016 (Etuk & Amadi, 2016; Breinlich et al., 2017). It was the largest movement in the history of pound sterling from $1.50 to $1.37 in the two hours, and it dropped 10% and 7% against USD and Euro, respectively (Aristeidis & Elias, 2018). Subsequently, sterling declined 10% from its pre-referendum value by November 2017 (Breinlich et al., 2017).

This declining position of the pound sterling downgraded the expectation of market participants about the performance of the UK economy due to the likelihood of growing uncertainty that expected to occur in future, such as the UK will be less open to trade with the EU. Some previous event investigation like Black Monday of October 1987 is made where volatility caused by an event in one market transmit its spillover to other markets (King & Wadhwani, 1990; Hoang & Trinh, 2021).

In addition to this, Babak et al. (2011) studied the dynamics of volatility transmission between intraday exchange rate volatility of forex markets as the world economies are interconnected, trade and markets are interlinked. This volatility is transmitted to regional markets; Lai and Pan (2018) critically reviewed that Asian markets are also affected by the consequences of Brexit. Inflation, interest rates, public debts, current account deficit, and terms of trade etc., are the economic factors that affect and affected by currency exchange rates (Barbosa et al., 2018). The decline in the pound sterling has also endorsed economic problems for local investors, domestic markets and states’ import and exports.

The impact of this event has major economic and political aspects, which consequently have affected the exchange rate as well (Plakandaras et al., 2017). UK was the active trading participant in the EU; a study has mentioned its bilateral IIT (Intra Industry Trade) with EU countries, North, OECD countries, developing countries and with all other countries (Greenaway et al., 1999), which show that decline in pound sterling has effected all other currencies in the EU and outside the EU, as mentioned before an example of Asian countries (Lai & Pan, 2018).

Therefore, to investigate this scenario, numerous studies have investigated the possible impact of a withdrawal of the UK from the EU. However, these were based on different weekly, monthly investigations (as well as probably different intentions), and the authors come to rather different conclusions. Besides it, the research in this area does not meet the challenging demands of the present complex scenarios, especially when a sudden event/disaster in forex markets like Brexit is discussed. Hence, high-frequency trading in the forex market is the target area of this research. This allows us to investigate deeper to find out what the true ramifications might be. The exploration of focus in this study is the volatility spillover effect during Brexit based on hourly patterns in intraday among European markets.

Related Work

Brexit has created chaos in the global forex market and disrupted exchange rates. This event put pressure on the British Pound and resulted in a depreciation of 15% in the following days of this decision. As exchange rates become more volatile, this triggered alarm among traders about possible currency collapse (Plakandaras et al., 2017) and volatility persistence (Adesina, 2017). Firms having the international nature of expanded operations were less likely to have an abnormal stock returns effect, as due to their expanded operation and market efficiency, stock prices adjusted rapidly (Oehler et al., 2017). Not only the forex market but other sectors like manufacturing, services, logistics and others were troubled due to the result of this vote; EU and UK both suffered from this but suffering for the UK has been more than EU (Tielmann & Schiereck, 2017). To analyses and interpret the impact of this referendum in more detail (Ramiah et al., 2017), investigated different sectors after Brexit by using daily data and found the key impact on stock returns.

Considering the significance of the impact of spillovers (Hoang & Trinh, 2021) on forex markets, economists still have no consent on the existence of spillovers during the financial crisis. Dooley and Hutchison (2009) explored large statistical and financial effect (homogenous movements) among forex markets of emerging countries. Syllignakis and Kouretas (2011) explored that forex markets of central and eastern European economies are moderately integrated, with the US and Germany having strong contagion effects among currencies. Dungey and Gajurel (2014) presented that forex markets of both emerging and developed nations have strong contagion effects. Dungey and Gajurel (2014) measured volatility spillover by using high-frequency data through intraday volatility spillover index technique for five European stock markets; this study analyzed five minutes returns data pre and post-Brexit for six months and observed a speedy increase in volatility spillover in the short-run right after the vote, however, in the long run, it recovered. Aristeidis and Elias (2018) investigation on the impact of Article 50 used the periodic subset categorized into pre-vote, during vote and post-vote for 43 economies including developed and emerging and found that volatility increase pre and during vote period of activation of article 50.

The extension of the scholarly work done by Diebold and Yilmaz (2012, 2014), based on the high-frequency field, has been carried out in this study. The suggestions of the two proficient scholars suggest that the outcome of the VAR modelling in the shape of forecasting anomalies are utilized by the spillover index. Therefore, the explanation for the anomalies shock is explained by the corresponding variance-decay and “it can be used to measure the spillovers in returns or return volatilities across individual assets, asset portfolios, asset markets, etc., both within and across countries” (Diebold & Yilmaz, 2012). This study deeply discusses the literary underpinning of the high-frequency monies intraday-periodicity volatility.

Theoretical Underpinning

According to the theoretical background, two main views explain the relationship between these two markets: the flow-oriented Model and the Stock oriented Model. Flow oriented model proposed by Dornbusch and Fischer (1980) tells us that trade balance performance and the current account of the company are considered as two important elements of the determination of exchange rate. On the other hand, Stock Oriented Model suggest by Branson (1983) and Frankel (1983) that suppose demand and supply of financial securities as equities and bonds are helped to determine the exchange rate.

Objective

The main has been to gauge (i) estimates the volatility spillover among currencies EU due to BREXIT, and to (ii)estimate the Intermarket volatility spillover of British forex market in Asian forex markets due to BREXIT.

Problem Statement

Therefore, to investigate this scenario, numerous studies have investigated the possible impact of a withdrawal of the UK from the EU; however, these were based on different methods and assumptions based on weekly, monthly investigations (as well as probably different intentions), and the authors come to rather different conclusions. Besides it, the research in this area does not meet the challenging demands of the present complex scenarios, especially when we talk about a sudden event/disaster in forex markets like Brexit. Hence the high-frequency trading in the forex market is the target area of this research. This will allow us to investigate deeper in order to find out what the true ramifications might be. Our exploration of focus in this study is the volatility spillover effect during Brexit based on hourly patterns in intraday among European markets. Moreover, investigating this volatility spillover in Intermarket beyond the European Forex markets and extending observation in Asian Forex markets.

Significance

This study will not only help the policymakers, federal reserve banks, risk managers and key decision-makers of exchange control but will also help in devising the macro and microeconomic policies. High-frequency data in the forex market is not used earlier, and the intraday approach within the currencies has not been investigated before. The volatility spillover effect spread to different time zones of the connected forex markets. The context of this study cannot be bracketed or surrounded by any boundaries. Since the currency and forex market analysis of focused areas, i.e. European Union and Asia, indirectly reflect the overall scenario of upcoming misfortunes like Brexit. So, we assume to say that this study is a readymade prescription throughout the world to get benefitted and timely prepared for events like Brexit. This study will help us to understand the importance of financial links of the UK forex market with European forex markets and Asian forex markets. The minute up to date information by the result of this study will enable the individuals, organizations, governments and all other related entities to uplift regarding policymaking, efficient decision making, estimation, risk mitigation, budgeting, forecasting and on top of that, the damage control which usually occurs due to the tsunami-like Brexit.

Method

This paper has been extracted from the PhD work of the first author, supervised by the second author, as the researchers have observed in the literature that different investigators used diverse techniques and methods to find the movement in stocks and forex. Therefore, the IVSI technique (Intraday Volatility Spillover Index) that has been used in the study by Nishimura and Sun (2018) was utilized for the extension of the Diebold model using high-frequency data of foreign exchange rates of European and Asian countries. The researchers will also apply this methodology in three steps. The first is to remove the intraday periodic pattern by using FFF regression. In the second step, intraday volatility by using ARCH- type model was calculated. In the final step, the spillover index by using the VAR model was measured.

A. Intraday-Volatility Estimation

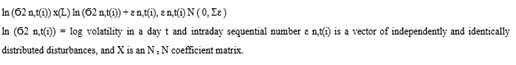

As per the impactful research of Andersen and Bollerslev (1998), the long memory high-frequency interday-volatility and periodicity needs to be calculated. The spillover index is affected up to some degree as the estimates of volatility is not anomaly free. This observation steered the researcher from the FIGARCH model to adapt the high-frequency long memory volatilities model.

The following auto regressed FIGARCH model:

The auto-regression was applied to the process to get the lag order of p, q and k. The four pairs of p and q were made. Afterwards, the standardized residual and take the square of residuals were computed. Moreover, the serial correlation and ARCH effect was gauged.

B. Intraday Spill Over Index

By using AR- FIGARCH, the upper natural log of volatility is calculated, spillover index was measured through the VAR model.

The VAR framework (generalized) breakdown variance projects the spillover index, and error

matrix (forecast) is defined as:

In the above formulae, as per the standard assumptions and understanding:

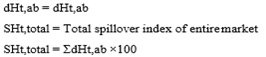

The normalization of the elements for dHt for

different markets’ magnitude comparison was

done through:

In detail as:

The spillover index (unidirectional), being estimated through the element (normalization) of the generalized variance decomposition matrix:

In the above formulae, SHt, reflects the effect of spillover from one market to the other, and its negative figure means that it's smaller. Data of eight major EU currencies which were offering intraday high-frequency hourly returns were taken. The base currency to show the value of other currencies was ‘USD’ or ‘$’. Every currency in the sample was paired with USD, e.g. EUR_USD, GBP_USD, and CHF_USD etc. The sample size is hourly returns of the day of the referendum (on June 23, 2016) and 1-month before the referendum (from May 22, 2016, to June 22, 2016) and 1-month after the referendum (from June 24, 2016, to July 24, 2016). The total sample was 51 days, 25 days from each month and one day of the referendum. Each day of the sample contained 24 hourly returns, and the total number of 1,224 observations per currency is taken in the sample. This study used hourly data of high-frequency returns instead of daily or weekly because when we use daily or weekly data to calculate spillover index based on the VAR framework, this made unrealistic results. If we convert daily or weekly data by taking logs, it will be nearly normal.

Results

The analysis shows

that the mean and standard

deviation value of eight

currencies from the EU with intra-daily time series data of time zone

surrounding the June 23, 2016, the day of Brexit referendum, i.e. data from 1st Apr 2016 (2nd Qtr 2016).

Tabe1. Descriptive

Analysis of Eight Currencies from March 22, 2016 to Jan 2020

|

|

x |

s |

|

EUR (Euro) |

-0.00673142 |

0.0029142 |

|

GBP (Great British Pound) |

-0.0042509 |

0.0030058 |

|

CHF (Swiss Franc) |

0.00013934 |

0.00108846 |

|

DKK (Danish Krone) |

0.00285986 |

0.0013784 |

|

HUF (Hungary Forint) |

-0.00095877 |

0.0020057 |

|

PLN (Polish Zloty) |

0.00081888 |

0.0020567 |

|

SEK (Swedish Krona) |

0.00038613 |

0.001945 |

|

TRY (Turkish Lira) |

-0.00005851 |

0.002387 |

Among all

currency’s EUR, GBP, HUF, and TRY to

have a negative mean return, while the remaining currencies have positive mean returns. The mean return of

EUR is highly negative, and GBP and TRY are negative next to it. This resulted

that EUR is at a high-risk position,

as shown in the Mean-Return table, where

GBP and TRY are followed by EUR. Danish Krone (DKK),

Polish Zloty (PLN) and Swedish Krona (SEK) are showing positive mean

returns. Whereas the mean return of the Swiss Franc (CHF) is the smallest. Euro

(EUR) has to mean the return of -0.00673142, and

Pound Sterling (GBP) has the highly negative mean return of - 0.0042509,

Hungarian Forint (HUF) has to mean the return of - 0.00095877

and Turkish Lira (TRY) has meant the return of - 0.00005851, whereas positive mean returns are seen in Polish Zloty (PLN) having a mean return of

0.00081888, Swedish Krone (SEK) with 0.00038613, Danish Krone with 0.00285986 and CHF (Swiss Franc)

with 0.00013934. Moreover, the standard deviation is greatest for GBP, which is 0.0030058, followed by Euro 0.0029142, TYR 0.002387, PLN 0.0020567, HUF 0.0020057.

SEK, CHF and DKK are the lowest among

all currencies, with a standard deviation of 0.001945, 0.00108846,

0.0013784, respectively.

Volatility Spillover Index

Table 2 is showing

intraday volatility spillover indexes

of currencies, representing volatility spillovers

among Swiss Franc, Danish Krone, Euro, Pound Sterling,

Hungarian Forint, Polish

Zloty, Swedish Krone and Turkish Lira, and showing spillover contribution to others and from others. In the beginning, currencies in the first

row are explaining the spillover effect

to others, vertically downward, and the last column

(named ‘From others’) is showing the collective

spillover effect. However,

currencies in the first column are showing spillover effect from others, left to right. The last

two rows, ‘Contribution to others’ and

‘Contribution including own’ are explaining the contribution of currencies of the

first row in spillover and their contribution in spillover including their own, respectively.

|

|

EU R |

GB P |

CH F |

DK K |

HU F |

PL N |

SE K |

TR Y |

From others |

|

EUR |

25.56 |

26.685 |

7.642 |

2.457 |

1.062 |

1.019 |

35.563 |

0.007 |

74.435 |

|

GBP |

28.18 |

23.364 |

11.096 |

4.253 |

2.054 |

0.026 |

31.015 |

0.006 |

76.636 |

|

CHF |

10.725 |

21.429 |

55.389 |

3.958 |

3.032 |

0.009 |

5.444 |

0.015 |

44.612 |

|

DKK |

15.125 |

17.45 |

3.466 |

57.982 |

2.018 |

2.026 |

1.925 |

0.009 |

42.019 |

|

HUF |

8.008 |

17.004 |

2.068 |

1.017 |

70.889 |

0.001 |

1.012 |

0.002 |

29.112 |

|

PLN |

2.076 |

11.018 |

1.015 |

0.007 |

0.003 |

85.868 |

0.007 |

0.007 |

14.133 |

|

SEK |

5.659 |

18.299 |

9.677 |

0.289 |

0.049 |

0.01 |

66.01 |

0.007 |

33.99 |

|

TRY |

2.005 |

5.002 |

1.013 |

0.014 |

0.002 |

0.004 |

0.006 |

91.954 |

8.046 |

|

Contribution to others |

71.784 |

116.887 |

35.977 |

11.995 |

8.22 |

3.095 |

74.972 |

0.053 |

322.983 |

|

Contribution including own |

97.349 |

140.251 |

91.366 |

69.977 |

79.109 |

88.963 |

140.982 |

92.007 |

800.004 |

Table 2. Sustainability of Volatility Spillover Index of Currencies

These currencies are paired with USD, as EUR_USD, GBP_USD, CHF_USD, DKK_USD, HUF_USD, PLN_USD, SEK_USD, and TRY_USD. As inference from the results of the volatility spillover table, pairs of EUR_USD and GBP_USD are highly volatile (unattractive) during the period of Brexit. EUR_USD has volatility spillover translated from others is 74.43% while 25.56% is explained by itself. GBP_USD has volatility spillover translated from others is 76.636 % while 23.36 % is explained by itself. These results are representing that both are majorly affected by exogenous disturbances and less affected by endogenous disturbances. After them, CHF _USD also need some attention because it has volatility spillover translated from others is 55.389 % while 44.612 % is explained by itself, comparatively, it is better than EUR and GBP because it is less affected by exogenous disturbances but still not attractive (same with CHF_USD). DKK _USD has volatility spillover translated from others is 42.019 % while 57.982 % is explained by itself. HUF _USD has volatility spillover translated from others is 29.112 % while 70.889 % is explained by itself. These results are representing that both are majorly affected by exogenous disturbances and less affected by endogenous disturbances. PLN _USD has volatility spillover translated from others is 14.133% while 85.868 % is explained by itself. SEK _USD has volatility spillover translated from others is 33.99 % while 66.01% is explained by itself. These results are representing that both are majorly affected by exogenous disturbances and less affected by endogenous disturbances. Volatility spillover index of the Euro is contributing spillover of 71.784 % while it has spillover from others is 74.435 % and from GBP is 26.685% and to GBP is 28.186 %. Volatility spillover index of Swiss Franc is contributing spillover of 35.977 % while it has spillover from others is 44 % and from GBP is 11.096 % and to GBP is 21.429 %. Volatility spillover index of Danish Krone is contributing spillover of 11.995 % while it has spillover from others is 42.019 % and from GBP is 4.253 % and to GBP is 17.45%. Volatility spillover index of Hungarian Forint is contributing spillover of 8.22 % while it has spillover from other is 29.112 % and from GBP is 2.054 % and to GBP is 17.004 %. Similarly, the volatility spillover index of Polish Zloty is contributing spillover of 3.095% while it has spillover from others is 14.133 % and from GBP is 0.026 and to GBP is 11.018 %. Volatility spillover index of Swedish Krona is contributing spillover of 74.972 % while it has spillover from others is 33.99% and from GBP is 31.015 % and to GBP is 18.299 %. Finally, the volatility spillover index of Turkish Lira is contributing spillover of 0.053 % while it has spillover from others is 8.046 % and from GBP is 0.006 % and to GBP is 5.002 %. Total Volatility spillover index has been calculated by dividing ‘Contribution to others’ with ‘Contribution including own’ expressed as,

Putting value in the above formula,

The total volatility spillover index is representing the spillover of volatility shock observed because of the referendum on BREXIT. Here, a 40.34% volatility spillover on overall currencies was noted. There only 76.63% volatility spillover on GBP, which is the highest spillover among all currencies.

Rolling Window Analysis- Total Spillover

Rolling analysis is a tool usually used to measure the constancy of the model over time by following the statistical model, especially for financial time series data. Coefficients of the model are assumed to be invariant over time, while everything has been changed considerably in economic settings. Therefore, it is unpractical to assume coefficients constancy in a model. Here, we have a technique named ‘rolling-window analysis’ in which we can assess coefficients’ constancy of model by estimating coefficients through the sample of fixed size over rolling-window analysis. Now, there are two cases, one is the constancy of coefficients over the period of the sample, and the second is the change in coefficients during the time period of the sample. If coefficients are invariant along the entire period, then the estimate will not be too different, and if coefficients are changing at some points, it means the rolling window have detected instability of coefficients over time.

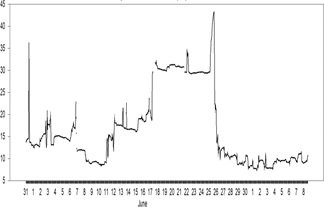

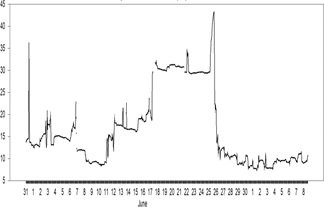

Figure 1

Rolling Window Graph

The above graph is an output of rolling window analysis, which is showing the change in overall coefficients over time. In June, analysis is showing boom from 17th June 2016 to 27th June 2016, thus showing that volatility spillover was prevailing for ten days. We have discussed the volatility spillover index table; total volatility spillover was 40.34%, while here it is 30% on average, and one peak is touching over 40%. The major difference between the rolling window analysis and volatility table is that the rolling window is showing total spillover on an hourly basis, and the table of spillover is showing results on the basis of single values used in the total volatility spillover formula. If we only observe the effect of volatility shock due to BREXIT, it is showing that all parameters of the model were unstable during that period.

Conclusion

Pound Sterling was the fourth most traded currency of the world, after the Euro, Japanese Yen, and US Dollar. The origin of the British Pound was continental Europe in the Roman era. British Pound (also known as Pound Sterling) was possessing worth as most reliable currency and one of the oldest reserve currencies to store wealth, and now it was the third reserve currency of the world. It was observed that in the Forex market, Great Britain Pound dropped sharply against the US Dollar and Euro due to the referendum results of June 23, 2016. There are two main objectives of this study, first is to estimate the volatility spillover index of the Pound with other major eight European currencies due to BREXIT, and the second is to develop a rolling window analysis. Results of this high-frequency data showed currency pairs TRY/USD, DKK/USD, PLN/USD, and HUF/USD are highly volatile currencies, whereas EUR/USD, GBP/USD and SEK/USD are fewer volatile currencies. Consequently, it caused regional transmission effects of volatility spread from one currency to other currencies in the EU during Brexit. This study helped us to understand the strength of the British Pound in the European Union and the economic connectivity of the UK in European countries and EU; it is also helpful for investors and policymakers to understand the strength of BREXIT event impact, which will enable them to make counter-strategy in future if they face similar event like Brexit again.

Future Research

For future research, a much deeper analysis should be done. Instead of a 5min interval, one can go for 1 min interval to know about the deep-instantaneous fluctuations in forex market. Other models and theories’ intersections can be applied to check the multi-layered volatilities effects and track all the sources/triggers and outcomes/observations in a much-detailed manner.

References

- Adesina, T. (2017). Estimating volatility persistence under a Brexit-vote structural break. Finance Research Letters, 23, 65-68.

- Andersen, T. G., & Bollerslev, T. (1998). Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. International economic review, 885-905.

- Aristeidis, S., & Elias, K. (2018). Empirical analysis of market reactions to the UK's referendum results-How strong will Brexit be?. Journal of International Financial Markets, Institutions and Money, 53, 263- 286.

- Baker, S. R., Bloom, N., & Davis, S. J. (2016). Policy uncertainty: Trying to estimate the uncertainty impact of Brexit. Presentation, September, 2.

- Barbosa, L. O. S., Jayme Jr, F. G., & Missio, F. J. (2018). Determinants of the real exchange rate in the long-run for developing and emerging countries: a theoretical and empirical approach. International Review of Applied Economics, 32(1), 62-83.

- Branson, W. H. (1983). A model of exchange- rate determination with policy reaction: evidence from monthly data. NBER Working Paper, (w1135).

- Breinlich, H., Leromain, E., Novy, D., & Sampson, T. (2017). The Brexit vote, inflation and UK living standards. CEP Brexit Analysis, 11, 2-15.

- Diebold, F. X., & Yilmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal, 119(534), 158-171.

- Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57-66.

- Dooley, M., & Hutchison, M. (2009). Transmission of the US subprime crisis to emerging markets: Evidence on the decoupling-recoupling hypothesis. Journal of International Money and Finance, 28(8), 1331-1349.

- Dornbusch, R., & Fischer, S. (1980). Exchange rates and the current account. The American Economic Review, 70(5), 960- 971.

- Dungey, M., & Gajurel, D. (2014). Equity market contagion during the global financial crisis: Evidence from the world's eight largest economies. Economic Systems, 38(2), 161- 177.

Cite this article

-

APA : Satti, J., & Abbas, Z. (2021). New Continuum of High Volatile Currency Spillover During EU-BREXIT. Global Social Sciences Review, VI(II), 77-86. https://doi.org/10.31703/gssr.2021(VI-II).08

-

CHICAGO : Satti, Javed, and Zaheer Abbas. 2021. "New Continuum of High Volatile Currency Spillover During EU-BREXIT." Global Social Sciences Review, VI (II): 77-86 doi: 10.31703/gssr.2021(VI-II).08

-

HARVARD : SATTI, J. & ABBAS, Z. 2021. New Continuum of High Volatile Currency Spillover During EU-BREXIT. Global Social Sciences Review, VI, 77-86.

-

MHRA : Satti, Javed, and Zaheer Abbas. 2021. "New Continuum of High Volatile Currency Spillover During EU-BREXIT." Global Social Sciences Review, VI: 77-86

-

MLA : Satti, Javed, and Zaheer Abbas. "New Continuum of High Volatile Currency Spillover During EU-BREXIT." Global Social Sciences Review, VI.II (2021): 77-86 Print.

-

OXFORD : Satti, Javed and Abbas, Zaheer (2021), "New Continuum of High Volatile Currency Spillover During EU-BREXIT", Global Social Sciences Review, VI (II), 77-86

-

TURABIAN : Satti, Javed, and Zaheer Abbas. "New Continuum of High Volatile Currency Spillover During EU-BREXIT." Global Social Sciences Review VI, no. II (2021): 77-86. https://doi.org/10.31703/gssr.2021(VI-II).08